Key European FinTech seed deals stats in Q1 2024:

• European FinTech seed deal activity reached 161 deals in Q1 2024, a 49% drop YoY

• European FinTech seed companies raised a combined $237m during the first three months of 2024, a 51% reduction from the previous year

• Digital Assets saw the most European seed deal activity in Q1 2024 with a 21% share of total deals

In the first quarter of 2024, European FinTech seed deal activity experienced a significant decline, with the number of deals reaching 161, marking a 49% drop compared to the previous year. Additionally, the combined amount raised by these seed-stage FinTech companies totalled $237m, reflecting a 51% decrease from the year prior. This downturn indicates a worrying outlook for the coming years as less seed deals means investors are discounting the future prospects of the FinTech sector on the continent.

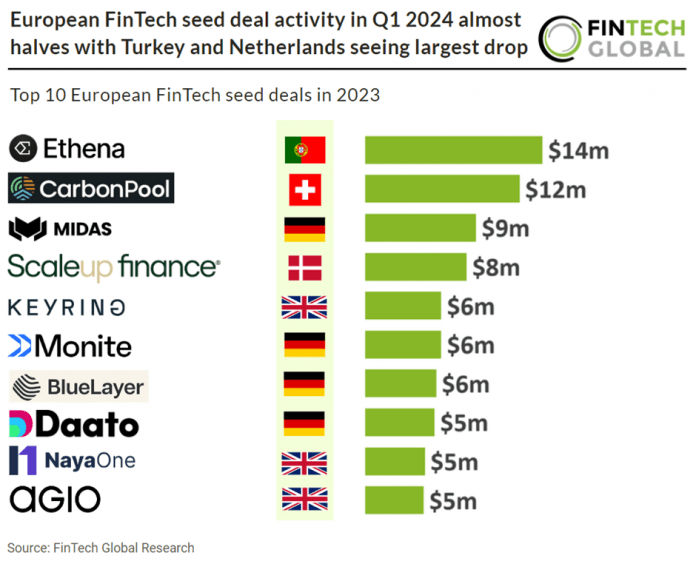

Ethena, a cryptocurrency transforming Ethereum into the first crypto-native yield bearing stablecoin, had the largest European FinTech seed deal in Q1 2024, after raising $14m in their seed round. Currently, USDE (Ethena’s stable coin) holds the position as the ninth-largest dollar-pegged stablecoin by market cap. In the last month, this fiat-aligned token’s supply surged by 85.6%, as reported by coingecko.com. The token, issued by Ethena Labs, serves as a synthetic version of the dollar that is issued on top of the Ethereum blockchain network. It uses delta hedging and derivatives anchored in Ethereum-based assets, alongside a mechanism for minting and redeeming to ensure its stability. The framework behind USDE introduces a novel dollar-indexed asset, providing the digital currency space with a ‘bond’ that aims to sustain dollar parity beyond the confines of conventional banking systems.

The UK remained the most active European FinTech seed deal country in Q1 2024 with 46 deals a 29% share of total deals. This was followed by Germany with 18 deals and France with 14 deals. The Netherlands and Turkey saw the biggest drops in Q1 2024 with The Netherlands seeing a 77% drop and Turkey seeing a 85% reduction.

Digital Assets saw the most European seed deal activity in Q1 2024 with 35 deals, a 21% share of total deals. RegTech was second with 26 deals, a 15% share and Banking Infrastructure had 13 deals, an 8% share.