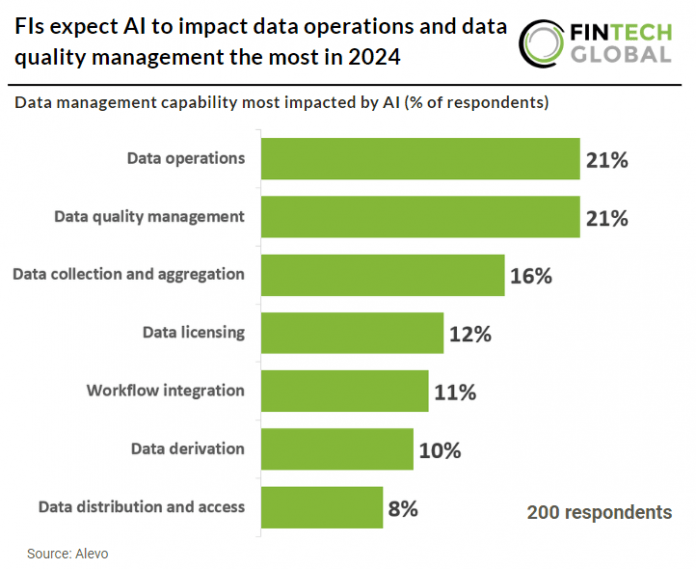

In a report published March 2024, Alveo polled 200 firms about leveraging AI in data management. The respondents were split over the US, the UK and the DACH region (consisting of Germany, Austria and Switzerland). The sample was composed of asset owners, asset managers and banks but also contained brokers, hedge funds and central banks.

Artificial intelligence is significantly transforming the data management landscape across various sectors. AI streamlines primary data collection with 21% of respondents saying AI will be the most impactful in this area. By automating the extraction of information from the web, prospectuses, public databases, and annual reports, thereby enhancing the construction of enterprise data products. AI also serves as an essential tool in market data management, facilitating the discovery and quality assessment of information through data catalogs, dictionaries, and inventories. The integration of AI also brings to the forefront legal considerations about content licensing and the use of derived data within AI applications, potentially reigniting debates over data ownership and usage rights.

Furthermore, generative AI’s ability to create synthetic data opens new avenues for general model testing, scenario management, and stress testing, accelerating the development and validation processes in fields like pricing and risk management.