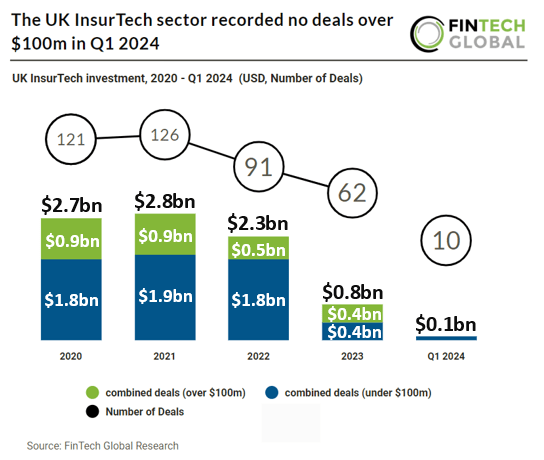

Key UK InsurTech investment stats in Q1 2024:

• UK InsurTech deal activity reached 10 deals in Q1 2024, a 58% drop from Q1 2023

• UK InsurTech companies raised a combined $93m in Q1 2024, a 74% reduction from Q1 2023

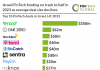

• InsurTech Gateway was the most active investor in UK InsurTech, taking part in three funding rounds

The UK saw a lack of large deals over $100m in Q1 2024 as the investment decline in the sector continues. Large deals typically indicate VCs jumping on companies with high growth, increased revenue or ground breaking innovation but this result indicates an absence of this. This being said the USA, the largest global InsurTech market, also saw no deals over $100m in the same period. In the first quarter of 2024, the UK InsurTech sector experienced a notable decline in deal activity, with only 10 deals recorded, marking a significant 58% drop from the same period in 2023. This puts deal activity for the entire year to reach 40 deals, a 35% drop YoY and the lowest level since 2020. UK InsurTech companies collectively secured $93m in funding during Q1 2024, indicating a substantial 74% reduction compared to Q1 2023. Based on Q1 results InsurTech investment will total at $372m, a 49% drop YoY.

Hyperexponential, a pricing decision intelligence (PDI) software provider, had the largest UK InsurTech deal in Q1 2024 after raising $73m in their latest Series B funding round, led by Battery Ventures. The funds are set to fuel the expansion of the company’s mission-critical insurance pricing platform, and support its strategic expansion into the United States, as it looks to open a New York office later this year.

InsurTech Gateway, a specialist InurTech Incubator, was the most active investor in UK InsurTech, taking part in three funding rounds, a 30% share of all transactions in the first quarter of 2024.