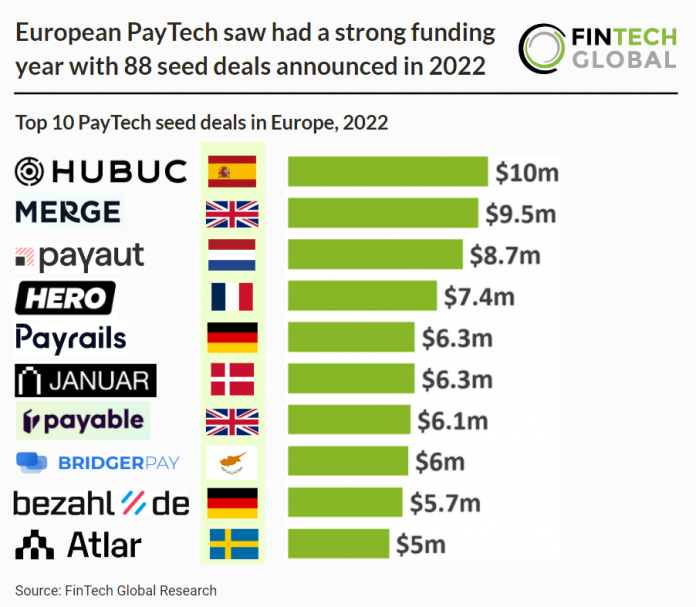

Key European PayTech seed statistics in 2022:

• European PayTech companies raised 88 seed deals in 2022, a 14.8% share of total FinTech deals in the region

• The UK was the most active PayTech seed country in Europe with 27 deals, a 30% share

• The average European PayTech seed deal raised $6.5m in 2022

The PayTech sector was the third most active European FinTech subsector for seed deals in 2022. Only behind WealthTech and Blockchain & Crypto. European PayTech companies raised 88 seed deals in total during 2022, a 14.8% share of total European seed deals. The UK was the most active PayTech seed country in Europe with 27 deals, a 30% share of total European PayTech seed deals. France was the second most active with eight deals, a 9% share and Germany was third with eight deals.

HUBUC, an embedded payments API, was the largest PayTech seed deal in Europe in 2022 raising a considerable $10m in their seed round which was led by Runa Capital and WndrCo and included 19 other investors. HUBUC will use the funds to build a compliance team and expand its current presence in Europe. The additional capital will also help further product development, streamline customer implementation processes and focus on boosting the go-to-market strategy.

The total transaction value for European digital payments is projected to reach $1,722bn in 2023. It is also estimated to grow at rate of 14.12% (CAGR 2023-2027), 2.33 percentage points higher than the global average projection.

Other PayTech research here

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2023 FinTech Global