Baymarkets, a Swedish financial markets software solutions provider, is splitting its business into two.

The Nordic FinTech firm will split, with one half of the business focusing on RegTech and the other pushing a clearing platform.

The new RegTech Solutions business is being set up by three Baymarkets founders, along with CEO Per Andersson, and will focus on legal and regulatory compliance technology for the FS industry. Reg&Tech will leverage Big Data automation to address the regulatory challenges facing financial institutions around the globe.

“The financial markets are rapidly becoming fully electronic, driven by regulations and new enabling technologies. There is a strong demand for solutions and platforms that automate and streamline the business processes to comply with these new regulations as well as to increase operational efficiency,” said Andersson.

Baymarkets will continue to focus on providing clearing solutions, particularly through its Clara platform. It will be led by Tore Klevenberg, as CEO, and Peter Fredriksson as chairman.

Klevenberg added: “I’m looking forward to this new phase in the development of Baymarkets’ clearing and marketplace offering. The Clara platform has proven to be very efficient at addressing all the demands of a modern clearing solution.”

Clara provides real time margining, corporate action management for stock and derivatives, calculations of daily cash settlement for stock and index futures, calculation of trading, clearing and settlement fees, and cash settlement for derivatives and securities lending, among other features.

Last year, DPOrganizer, a Stockholm-based RegTech company, closed its Series A funding round on €3m to help businesses comply with GDPR. The company’s round was led by Nordic venture capital firm Industrifonden, with participation from Creades and existing investors. DPOrganizer offers a Saas tool that helps businesses map, visualize, report on and manage their personal data processing.

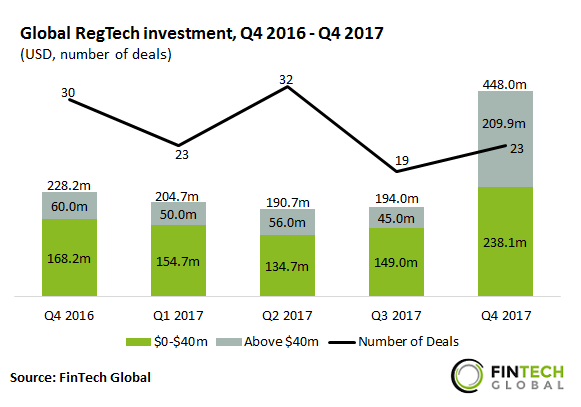

According to FinTech Global data, RegTech investment saw a strong end to the year in 2017, as funding more than doubled QoQ. With nearly $0.5bn, the last quarter of 2017 accounted for 43.2% of the total amount invested in the whole year.

The RegTech industry saw $448m invested in Q4 2017 – more than double the value of the previous quarter – making it the strongest funding quarter to date. This surge is partially due to a rise in the funding raised from deals valued above $40m which increased by 4.7x.

Copyright © 2018 FinTech Global