Tag: financial education

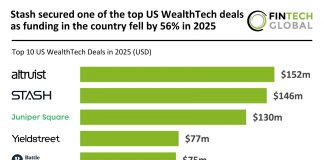

Stash secured one of the top US WealthTech deals as funding...

Key US WealthTech investment stats in 2025: US WealthTech funding fell by 56% YoY in 2025

New York continued to dominate the US WealthTech...

UAE group pensions: designing digital-first savings

Insurers, employers and technology providers across the UAE are moving quickly from discussing workplace savings to building real programmes that can compete for talent...

New York emerged as the main US WealthTech hub as deal...

Key US WealthTech investment stats in Q1 - Q3 2025: US WealthTech deal activity fell by 47% YoY

New York emerged as the main...

Survey shows women thrive in investing despite stereotypes

Fifty years after the Sex Discrimination Act transformed women’s financial rights in the UK, new data from Revolut indicates that stubborn perceptions about women’s...

Attara launches AI-powered hedging tools for SMEs

Commodity hedging FinTech Attara has launched its new AI-powered Explore Zone platform, designed to help businesses of all sizes navigate volatile markets.

The Explore Zone...

Prospero.ai and Finimize unite to empower retail investors

Prospero.ai, an award-winning AI-powered investing platform designed to help retail investors trade like professionals, has announced its third partnership with Finimize, a global retail...

GoHenry empowers kids with new financial literacy board

GoHenry has launched its new Kids Financial Education Advisory Board to give young people a voice in shaping the future of financial education in...

Horizon Utah Credit Union partners InvestiFi on digital investing

Horizon Utah Federal Credit Union has announced a partnership with InvestiFi to provide members with direct access to a wide range of digital investing services through its online and mobile platforms.

German FinTech investments maintained growth trajectory with 4.3x YoY funding boost...

Key German FinTech investment stats in Q2 2025: German FinTech had a funding boost of 4.3x YoY in Q2

German FinTech market maintained growth...

Global WealthTech funding projected to fall by 46% in 2025 as...

Key Global WealthTech investment stats in H1 2025: Global WealthTech funding fell by 66% YoY in H1

At current investment pace, funding is projected...