Tag: Insurers

UAE group pensions: designing digital-first savings

Insurers, employers and technology providers across the UAE are moving quickly from discussing workplace savings to building real programmes that can compete for talent...

AI drives accuracy in insurance AML

For years, insurance firms have accepted false positives in anti-money laundering (AML) monitoring as an unavoidable cost of compliance.

SymphonyAI, which offers an AI solution...

Ortec Finance and M&G pioneer 3D portfolio optimisation

Ortec Finance has unveiled a new case study in partnership with M&G Investments, demonstrating how its Scenario-Based Machine Learning (SBML) approach can redefine strategic...

Previsico expands AI flood forecasting to Ireland, enhancing insurer resilience to...

Previsico has unveiled its innovative live flood forecasting service in the Republic of Ireland.

Arise invests $7.5m in Omnisient to advance financial services in Africa

South African FinTech, Omnisient, has recently secured a substantial $7.5m investment from Arise.

McKenzie Intelligence Services unveils AI damage classifier to revolutionise insurance assessments

McKenzie Intelligence Services (MIS) has announced the launch of a cutting-edge AI damage classifier to enhance its human intelligence-led damage assessments for insurers following catastrophic events.

How the world’s top banks and insurers are adopting GenAI tools

In recent years, the integration of generative artificial intelligence (GenAI) tools within the financial sector has seen remarkable growth. A study conducted by ORX, a leading operational risk association, reveals that 75% of the world’s major banks and insurers are now utilizing external GenAI applications in their operations.

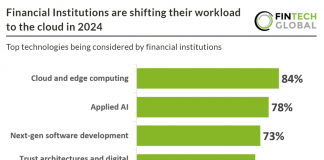

Financial Institutions are shifting their workload to the cloud in 2024

This research was derived from a 2023 survey conducted by McKinsey and The Institute of International Finance of 37 financial services companies around the...

Hyperexponential’s guide to pricing decision intelligence

In the realm of insurance, the most vital determinant of success lies in pricing strategies. Yet, a dramatic shift in how insurers formulate these crucial decisions remains elusive for many. Which leads us to the pivotal question: How can decision intelligence revolutionise the insurance landscape? Award-winning insurance pricing software provider, Hyperexponential investigates.

The insurance evolution: How delegated authority relies on fast data exchange

There's been a noteworthy shift within the insurance sector. The catalyst for this shift? The ever-growing importance and sheer volume of data.