Tag: regulatory compliance

Investment companies and shell companies: The hidden tools of money laundering

Money laundering is the process of disguising the proceeds of criminal activity as legitimate funds in an effort to conceal their illicit origin.

How KYB regulations shape the future of banking and FinTech

Know Your Business (KYB) is a crucial process for verifying business entities during the onboarding phase, aimed at understanding risk factors, financial health, creditworthiness, and beneficial ownership.

Insights from a data scientist: Implementing AI in financial crime compliance

The financial services industry is undergoing a transformation driven by artificial intelligence (AI) technologies, particularly machine learning (ML). These advancements are significantly enhancing anti-money laundering (AML), counter-financing of terrorism (CFT), and sanctions screening as part of customer lifecycle management (CLM).

How Napier AI leads the charge in compliance-first transaction monitoring

The financial sector, including banks, payment firms, FinTechs, and wealth and asset managers, faces significant challenges in interpreting regulatory guidance and converting it into...

Position Green aids Fasadgruppen in achieving CSRD compliance

As the Nordic leader in building exterior services, Fasadgruppen is significantly enhancing building energy efficiency. With over 50 subsidiaries, the organisation has faced the daunting task of meeting the Corporate Sustainability Reporting Directive (CSRD) and European Sustainability Reporting Standards (ESRS). Adrian Westman, Head of Sustainability, offers insights into their approach.

Revolutionising client lifecycle management with embedded customer outreach

In the age of enhanced due diligence, knowing your customer has evolved from a simple onboarding task to the lifeblood of a compliant, modern...

Aeropay secures $20m in Series B funding for A2A payments expansion

Aeropay, a leading provider of Pay-By-Bank solutions for businesses, announced $20m in Series B financing.

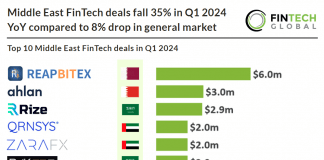

Middle East FinTech deals fall 35% in Q1 2024 YoY compared...

Key Middle East FinTech investment stats in Q1 2024:

• FinTech deal activity in the Middle East reached 24 funding rounds in Q1 2024, a...

Enhancing compliance: The rise of automation in consumer risk management

In the ever-evolving landscape of regulatory requirements, businesses are compelled to reassess how they manage compliance and conduct risks. A proactive approach is necessary, not only to understand the regulations but to anticipate their impacts on operations. Implementing a standardized methodology supported by AI allows businesses to prepare for regulatory changes effectively, ensuring compliance is both consistent and scalable.

Linnovate Partners secures $40m from SeaTown to boost alternative investment tech

Linnovate Partners, an innovative leader in asset servicing and FinTech for the alternative investment sector, has successfully closed a $40m investment commitment from SeaTown Private Capital Master Fund.