GDPR RegTech solution providers saw a spike in funding leading up to the May deadline

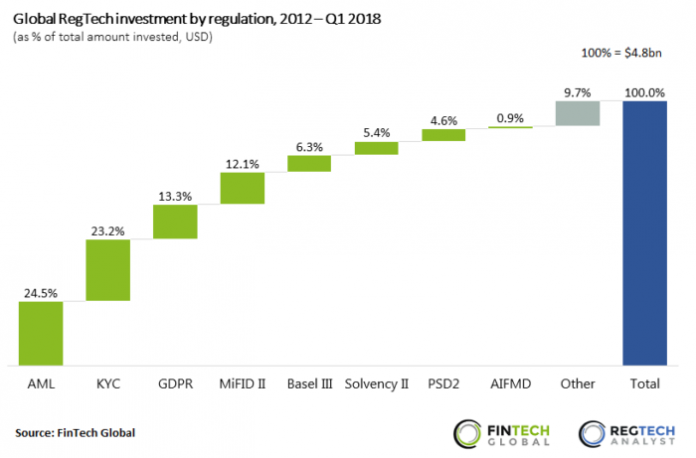

- Over $4.8bn has been invested in RegTech companies globally since 2012, with 47.7% of this going to companies addressing AML and KYC.

- The dominance of these two regulations is understandable, given the increasingly complex requirements placed and heavy fines imposed for inadequate compliance by regulatory authorities.

- More than a quarter ($1.2bn) of the total capital raised by RegTech companies globally has been invested in GDPR and MiFID II solution providers. MiFID II has been one of the most significant pieces of legislation to impact financial markets in recent times and, consequently, companies addressing the regulatory framework are heavily backed by RegTech investors.

- Almost $640m has been invested in companies addressing GDPR with nearly a third of this invested in the last three quarters, in the run up to the GDPR implementation deadline.

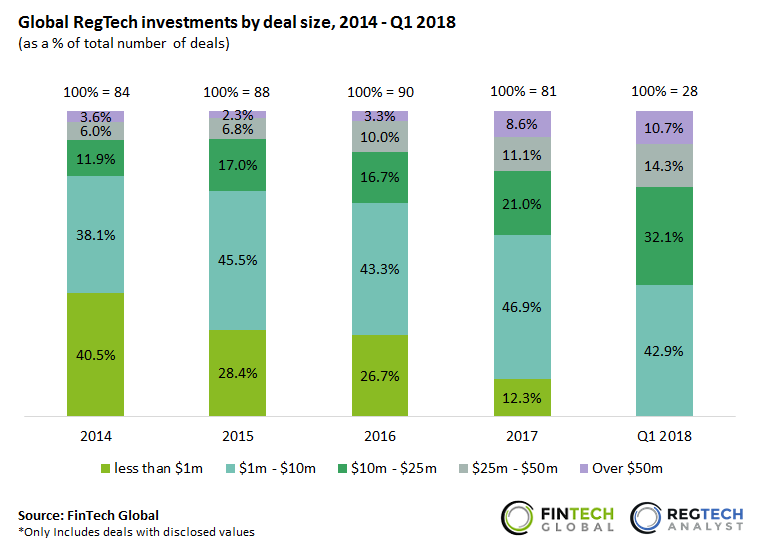

RegTech deal sizes have increased year on year since 2014

- The share of sub-$1m RegTech deals declined globally from 40% in 2014 to just above 12% last year, with no deals of this size recorded in Q1 2018.

- Concurrently, the share of deals valued between $10m and $25m almost doubled during the same period, before reaching almost a third of deals in Q1 2018, as the RegTech funding landscape shows continued signs of maturity.

- The proportion of large deals valued above $50m has grown considerably from 2.3% in 2015, to 10.7% in Q1 2018, as RegTech investors engage in more later-stage transactions. Avalara, a US tax compliance solution provider, raised $100m in private equity funding from Warburg Pincus in Q4 2014. This was one of the largest RegTech investments to date and has helped the company to fund international growth and strategic acquisitions.

Cybersecurity companies’ share of RegTech investment has experienced rapid growth since 2012

- Compliance Management companies’ share of RegTech investment dipped from just under 40% in 2014 to 16.9% last year. However, 2018 might bring a reversal in this trend with nearly half of the RegTech funding in Q1 2018 going to companies in the subsector. Digital Reasoning, a compliance automation solution provider, raised $30m in venture funding led by BNP Paribas in one of the largest RegTech deals last quarter.

- Risk Management solution providers’ share of total RegTech investment jumped above 20% in 2017 as solutions providers look to address fraud and trading risks for financial institutions. Riskified, a Tel-Aviv based fraud prevention solution provider, raised $33m in series C funding in Q2 2017. This was led by Pitango Venture Capital and is the largest RegTech investment outside of North America and Europe so far.

- The proportion of RegTech investment going to Cybersecurity companies has risen sharply from 2.7% in 2012 to 17.8%, in preparation for GDPR implementation and due to increased threat of cyber attacks. Anomali, a real-time network threat detection company, raised $40m in series D funding in Q1 2018. This was led by Lumia Capital and was the largest Cybersecurity/Information Security deal last quarter.

RegTech companies are successfully attracting investment capital from across the investor spectrum

- Techstars Barclays Accelerator has been the most active RegTech investor, making 10 RegTech investments since 2014. It’s most recent investment was a $2.5m seed investment in Liveoak Technologies, a remote onboarding and identity verification solution provider, in Q3 2017.

- Palo Alto-based venture firm, Accel Partners, has also been active, participating in eight transactions since 2014. Accel invested in XebiaLabs’ $100m series B funding round in Q1 2018. The company provides compliance automation software and the transaction was the largest RegTech investment in Q1 2018.

- Goldman Sachs has been the most active financial institution in the RegTech space having participated in six transactions since 2014. The investment bank’s most recent RegTech deal was a $30m venture investment in Digital Reasoning, a big data and compliance automation platform, in Q1 2018.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2018 FinTech Global