Key Singaporean FinTech investment stats in Q2 2023:

• Singaporean FinTech deal activity reached 45 transactions in Q2 2023, a 40% drop from Q2 2022

• Singaporean FinTech fudning totalled at $384m, a 5% increase YoY

• Blockchain & Crypto remains the most active Singaporean FinTech subsector with a 31% share of deals

Singaporean FinTech has seen a positive Q2 with deal activity increasing 15% from Q1 2023. In Q2 2023, the number of FinTech deals in Singaporean reached 45, reflecting a significant decline of 40% compared to the figures recorded in Q2 2022. The total investment in Singaporean FinTech companies reached $384m, marking a YoY increase of 5%. Singapore had a record-breaking year in 2022 for deal activity at 232 deals and 40% of these were Blockchain & Crypto. The decline in global FinTech deal activity due to rising interest rates along the drop in bitcoin hype and price are the major reasons we will unlikely see this record re-broken in 2023.

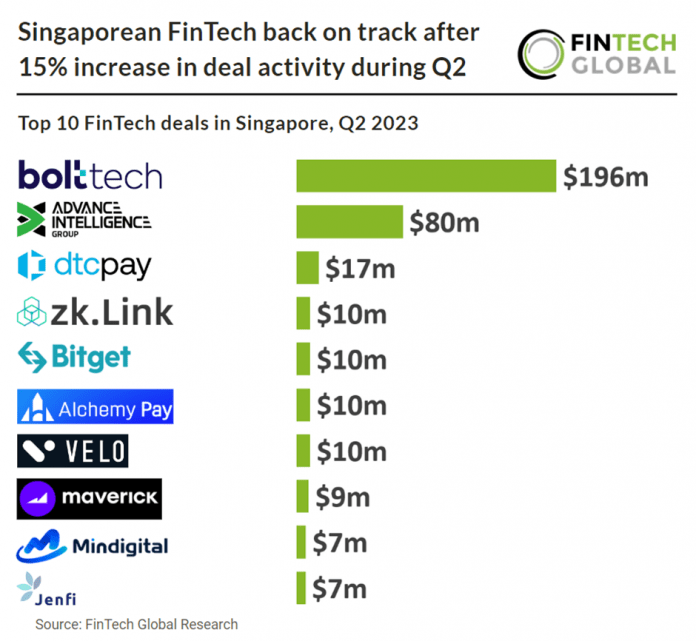

bolttech, an international InsurTech, raised the largest Singaporean FinTech deal in Q2 2023, raising $196m in their latest Series B extension funding round, led by Tokio Marine. The fresh capital sets bolttech’s valuation at $1.6bn. bolttech will use the proceeds of Series B to further fuel its organic growth, including investments in proprietary technology, digital capabilities for business partners and end consumers as well as talent across bolttech’s 30+ markets. In addition, the funds will be used to explore inorganic opportunities to accelerate international growth. Rob Schimek, bolttech’s Group Chief Executive Officer, said, “Having just celebrated our third anniversary since our launch in 2020, we are incredibly proud of what we have achieved so far on our mission to build the world’s leading, technology-enabled insurance ecosystem. We are now one of the fastest growing InsurTechs in the world, enabling our partners to find new revenue streams, accelerate their digital transformation, and deepen their customer relationships. We thank all our Series B investors for their support, and we are excited to welcome our new investors, reputable leaders in their respective spaces, and look forward to strong partnerships that will fuel bolttech’s continued growth on our path to profitability in 2024.”

Blockchain & Crypto remained the most active Singaporean FinTech subsector with 14 deals in the second quarter, a 31% share of all transactions during the period . WealthTech was the second most active with seven deals, a 16% share and PayTech was third with five deals.

In response to the increasing relevance of ESG issues, the Monetary Authority of Singapore (MAS) launched its ESG Impact Hub on 5 October 2022, to foster co-location and collaboration between ESG fintech startups and solution providers, financial institutions and real economy stakeholders. This Hub seeks to capitalise on the strong industry interest in Project Greenprint launched in 2020 and accelerate the growth of Singapore’s ESG ecosystem. MAS has also introduced disclosure and reporting requirements for ESG funds. As of 1 January 2023, the funds will now be required to disclose information on an ongoing basis, and investors will receive yearly updates on the progress of the ESG goals that the funds have specifically set.