Zopa might have secured a last-minute capital injection needed to ensure the peer-to-peer lender can become a challenger bank.

The company clinched the £130m deal with an entity connected to IAG Capital Partners, an American investment firm, and its UK vehicle Silverstripe, and is planning to finalize the deal early this week, according to sources familiar with the matter who shared the news with Sky News.

If true, that would mean Zopa has been able to get the money needed to fulfil the regulatory requirements from regulators to become a challenger bank. The money is needed for Zopa to keep its provisional banking licence.

The deal would reportedly make IAG Capital Partners a majority stakeholder, according to Sky News’ sources. The investor is already a small stakeholder in Zopa.

Zopa first announced its plans to become the UK’s next challenger bank back in 2018 when it raised £60m in its largest funding round to date.

At the time, Zopa CEO Jaidev Janardana said, “This new funding takes us a step closer to realising our vision of being the best place for money in the UK.

“Having served half a million customers to date, Zopa is set to redefine the finance industry once again through our next generation bank to meet a broader set of UK customers’ financial needs.â€

The news is another example of how the UK challenger banking space is heating up. The country has seen the fastest growth rate of challenger banks across Europe thanks to early adoptions of digital banking and an unsaturated banking sector.

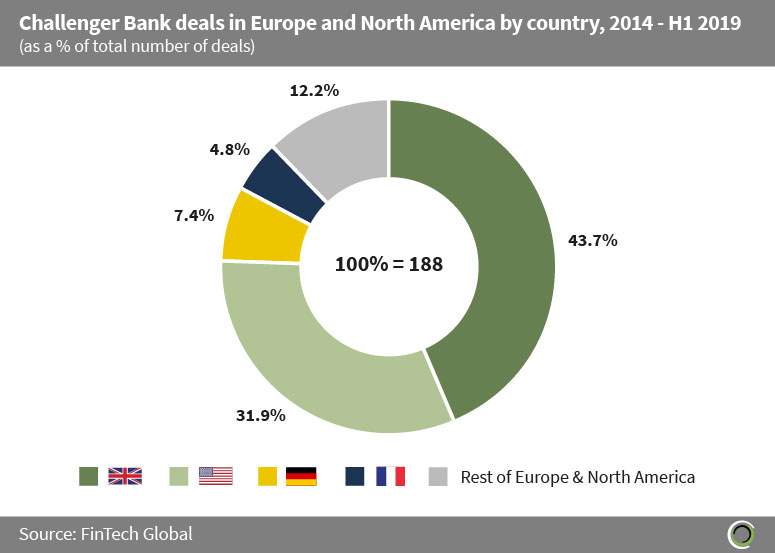

The country received 43.7% of the total challenger bank deals in Europe and North America between 2014 and the first six months of this year, according to FinTech Global’s data.

Startups challenging the old order are not confined to Britain. The global challenger bank sector is expected to scale to be worth $394.64bn by 2025.

There are FinTech initiatives popping up in places like the US and Australia. Singapore recently put five digital banking licences up for grabs. In Brazil, Pride Bank recently recently launched to provide banking services to underbanked and discriminated LGBT people in the Latin American country.

Copyright © 2019 FinTech Global