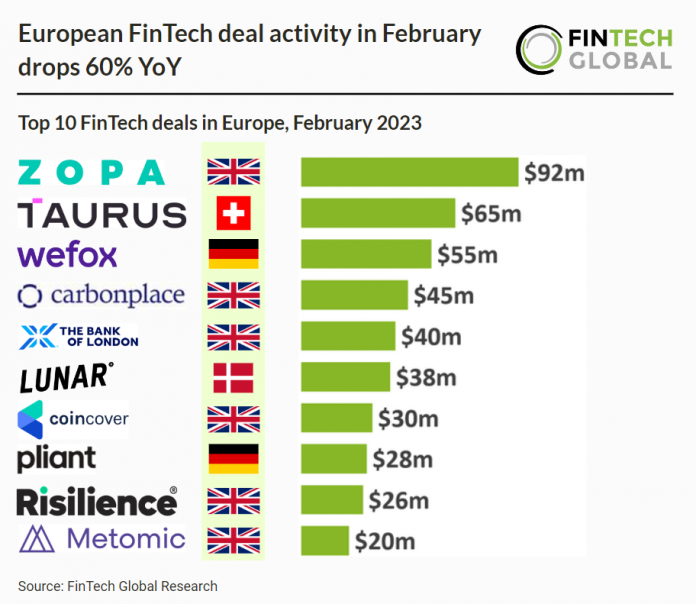

Key European FinTech investment stats in February 2023:

• 82 European FinTech companies raised funding in February 2023, a 60% drop from the previous year

• The UK was the most active FinTech country in Europe during February accounting for 46% of total deals.

• Blockchain & Crypto was the most active FinTech subsector in Europe during the month with a 21% share of deals

European FinTech deal activity in February has significantly declined from the previous year. Overall, 82 FinTech companies raised funding during the month, a 60% drop from February 2022. FinTech investment in the region has seen even a more dramatic reduction, dropping 89% from the previous year.

Zopa, a UK based digital bank, completed the largest FinTech deal in Europe during February 2023, raising $92m (£75m) in their latest Venture funding round, led by IAG Silverstripe. The company intends to use the funds to meet the capital requirements of its balance sheet, and to support M&A dealmaking. Zopa is set to snap up buy-now pay-later firm DivideBuy as it kicks off a dealmaking push following the funding round. Zopa did not disclose a price tag for the funding round but said it “cements” its unicorn status. A source close to the deal said Zopa’s post-money valuation increased through the round.

The UK was the most active European FinTech country in February 2023, with companies raising 38 deals, a 46% share of total deals. Germany was second with a 13.4% share of deals and France was third with an 8.5% share.

Blockchain and Crypto was the most active FinTech subsector in Europe during February 2023 despite the global drop in Cryptocurrencies which saw Bitcoin declining 70% from its peak in November 2021. This shows that VCs still have faith in the disruptive technology going forward.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2023 FinTech Global