Crowdcube, iwoca and Lendinvest’s are among the 50 FinTech founders who have called for the British government to “not be complacent” about the country’s position ahead of Brexit.

While 63 per cent believe the country is a global leader in the sector, only 33 per cent trust that this will be the case within the next five years, according to the survey from Digital Finance Forum, a network for investors and others FinTech stakeholders.

Of the people polled, 69 per cent were concerned about the impact of Brexit and more than half of them called for the government appoint a Secretary of State for Technology to maintain Britain’s reputation as a FinTech leader.

Christian Faes, chair of the Digital Finance Forum and co-founder of Lendinvest, was among the people polled. “The UK must not be complacent about being the world leader in FinTech – and there’s definitely a feeling from FinTech founders, as revealed through this survey that this threatens to be the case,” he told City A.M.

As the Brexit date on Thursday October 31 creeps closer, many voices have been raised regarding what the UK’s divorce from the EU will mean for both Britain and the overall industry’s future.

Last week, RegTech Analyst looked into how people in the RegTech space think their sector will be affected by Brexit. Even though there was some optimism, several of the interviewees believed the conscious uncoupling would mean more complicated regulations for financial institutions to adjust to moving forward.

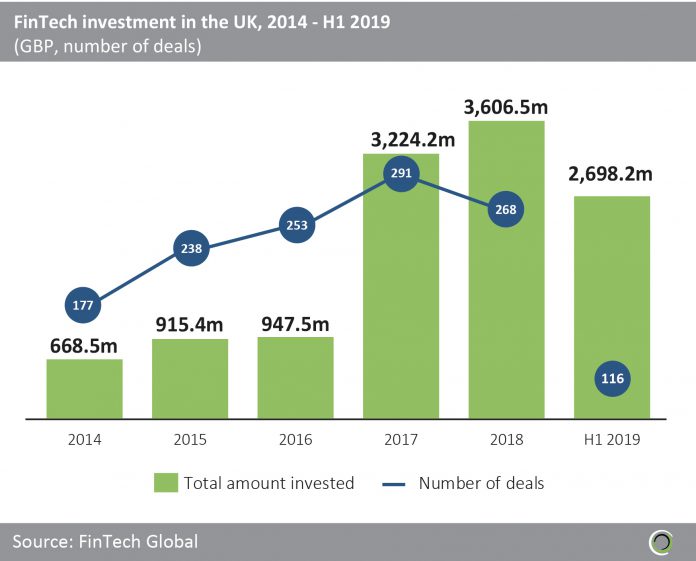

In total, the UK FinTech space has received over £12bn since 2014, according to FinTech Global’s own research. That year, investors poured £668.5m into the sector. That number jumped to £3.6bn in 2018 and reached a smashing £2.69bn in the first six months of 2019 alone.

Copyright © 2019 FinTech Global