The UK is a hotbed for FinTech innovation and investment. However, as Brexit draws closer, some fear that will no longer be the case.

Brexit is drawing nearer. Boris Johnson, the new prime minister of the UK, has pledged that the country will leave the EU on October 31 “do or die”. In the last week of August, the stakes became even higher as the leader of the country declared that parliament would be shut down for five weeks from mid-September, leaving very little space to debate the divorce with the EU. Following these latest developments, the sterling, which never truly recovered after the 2016 referendum, dropped again to £1 being worth $1.21.

Moreover, businesses are looking to safeguard themselves against any potential fallout by betting on different countries. Corporates are moving £61bn from Britain to other European financial centres, according to a Bloomberg report.

It is against this backdrop that the UK’s FinTech businesses have to manoeuvre in order to ensure their survival.

Britain has long established itself as a FinTech leader. “I still think UK is the FinTech capital of the world,” says Jeremy Sosabowski, CEO and founder of AlgoDynamix, the financial risk forecasting and analytics startup. He tells FinTech Global that there is no secret to why Britain has asserted itself as a leader in the FinTech space, with it being “in the middle of the time zones” and therefore able to cover both Asia and US. And of course, the City’s financial district has had a long and prosperous history for decades.

If you look at investment so far, the British FinTech scene seems to be booming. “By and large, the overall fundamentals of London’s FinTech sector are very good and very strong,” says Russ Shaw, founder of Tech London Advocates, the network championing tech entrepreneurship. “We are seeing a lot of unicorns emerge and some great exits.”

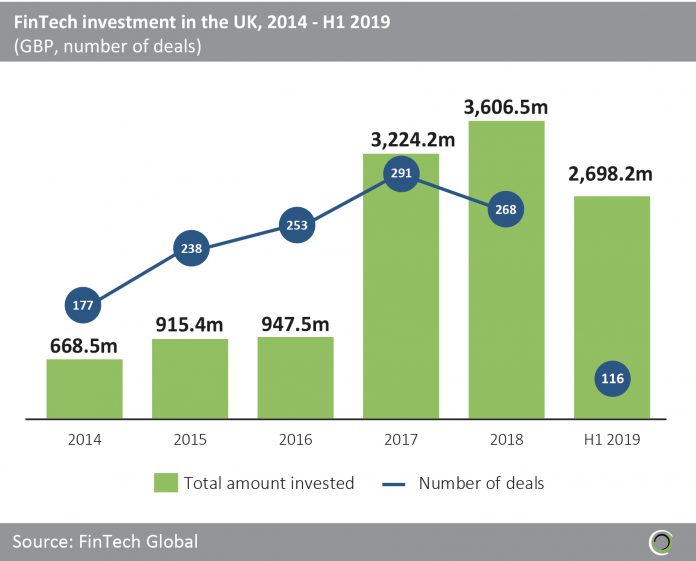

Indeed, according to FinTech Global’s own research, investment in UK FinTech businesses skyrocketed from £668.5m in 2014 to £3.6bn in 2018. Moreover, the country’s enterprises attracted investments worth £2.69bn in the first six months of 2019. Still, when taking a closer look, it is worth noting that the number of transactions declined by 7.9% from 291 deals in 2017 to 268 in 2018.

Moreover, from 2016 to 2017, the average deal size saw the most sizable increase, almost trebling from £3.8m to £11.1m. In other words, the investment rounds are bigger, symptomatic with them going into bigger and more established businesses. And that is where Shaw sees one of the risks as to how Brexit will affect the UK FinTech space. “[New startups] will probably be impacted more adversely than your more FinTech businesses that have raised subsequent rounds of funding,” suggests Shaw.

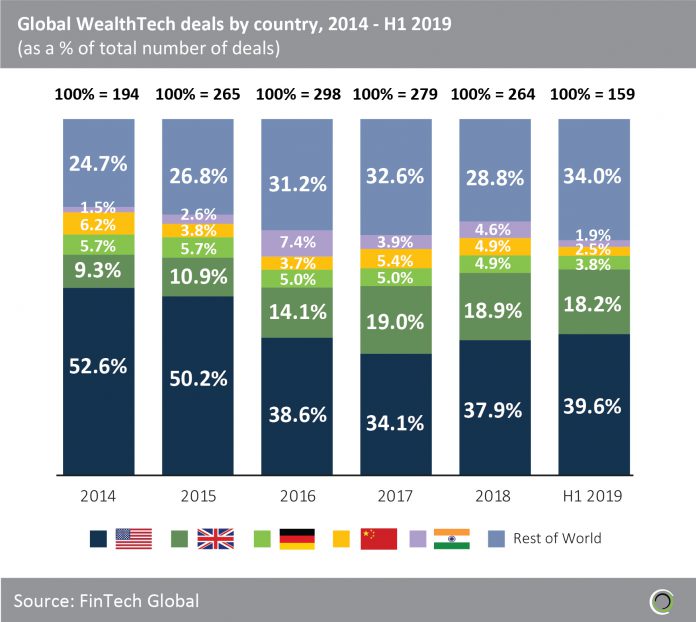

Moreover, Sosabowski suggests that some areas could be more immune to the risks of crashing out of the EU than others. For instance, he believes WealthTech is particularly well-placed. “It’s much more robust is much more bulletproof,” he says. “It’s, dare I say, it’s a safe area.” He points towards FinTech Global’s research suggesting that the global proportion of WealthTech investment going into the UK jumped from 9.3% in 2014 to 18.9% in 2018. Given the rise of cash getting invested in the UK WealthTech sector, Sosabowski argues there is little to suggest that part of the sector will falter any time soon.

Other sectors might not be as lucky. For instance, businesses like challenger banks relying on the EU’s passporting rights might be in for a more challenging time if the Johnson government delivers a no-deal Brexit. The passporting rights essentially means that if a company has license to operate in one member state, then it can also set up shop in another EU or EEA nation without having to apply to a new license.

A no-deal Brexit could also see an end to freedom of movement. “Talent is the number one issue,” Sam Gormley, founder of Osaka Labs, a data-driven creative agency, tells FinTech Global. “The UK has been able to lead the pack in FinTech because we have access to the top talent across Europe and the desirability of London. But due to the level of uncertainty around Brexit, Berlin looks like a much more attractive place for top tech and creative talent to set up camp.”

That, of course, points to another issue: with the UK and London’s position as a FinTech leader having been put into question, other hubs around Europe are angling to claim the top spot. That includes cities like Berlin and Paris.

FinTech investments in France has grown almost ten-fold in the past five years, jumping from $62.5m in 2014 to $595.2m in the first half of 2019, according to FinTech Global’s research. During that same period, FinTech investments in Germany grew from $158.4m to $2.07bn.

Although, Philip Salter, founder of The Entrepreneurs Network, is not too concerned about this prospect for now. “The UK is likely to remain the best place in Europe for FinTech, but the real concern is our ability post-Brexit to compete with the likes of Singapore, Hong Kong, San Francisco, New York, or Beijing, Shanghai, Hangzhou and Shenzhen,” he tells FinTech Global. “In this context, a no-deal Brexit is a senseless act of economic self-harm.”

The big concerns outlined above are dependent on what type of conscious uncoupling from the EU Johnson’s government will deliver. “But we still don’t know [what kind of Brexit we will have] when we wake up on the first of November,” says Shaw. He notes that businesses have been living with this “uncertainty for two years since the referendum” and that this has given enterprises an opportunity to prepare.

Several of them have seized upon this chance by trying to ensure their passporting rights by setting up offices in other countries. In February 2019, the central bank of Lithuania reported that over 100 financial companies had applied for banking licenses in the country. A similar surge had been noted in Ireland, according to Reuters.

Nevertheless, Shaw states that at the end of the day no one know how how Brexit will look like. “And no business is probably fully prepared for that,” he concludes.

Copyright © 2019 FinTech Global