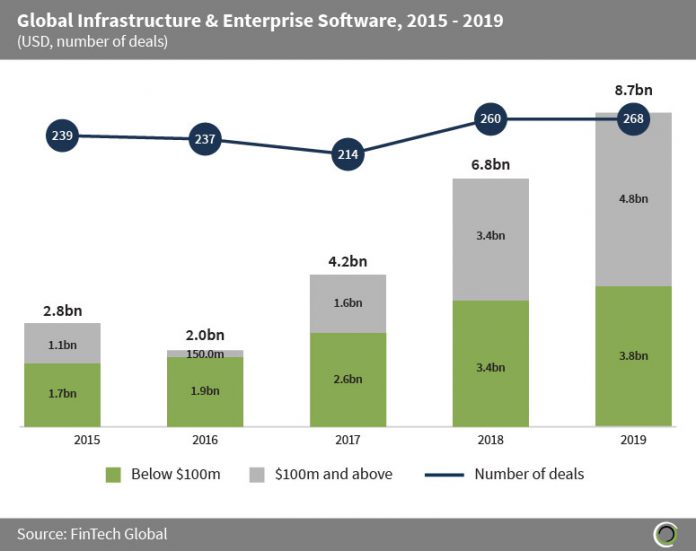

Infrastructure & Enterprise Software companies raised over $24.4bn globally since 2015

- Investment in the subsector hit $24.4bn across 1,218 transactions since 2015. Infrastructure & Enterprise Software funding increased at a CAGR of 25.0% between 2015 and 2019.

- Deals valued at $100m and over account for 45.3% of the capital raised by Infrastructure & Enterprise Software companies globally since 2015. The record high of $8.7bn in 2019 was mostly driven by a combination of large deals of $100m and above, and a record level of 268 deals that year.

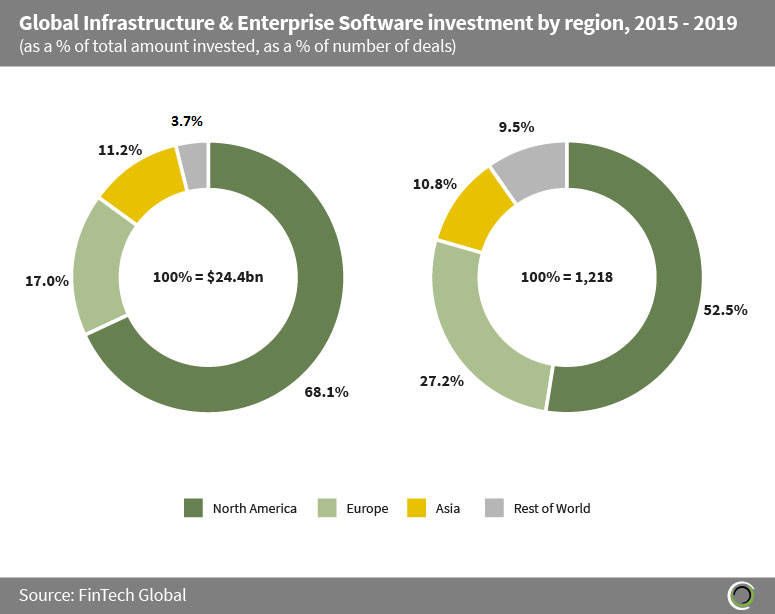

- North American companies in the subsector captured 89.1% of investments valued at $100m and higher. Indicating that North American companies in Infrastructure & Enterprise Software subsector are more mature compared to companies in other regions operating in the subsector.

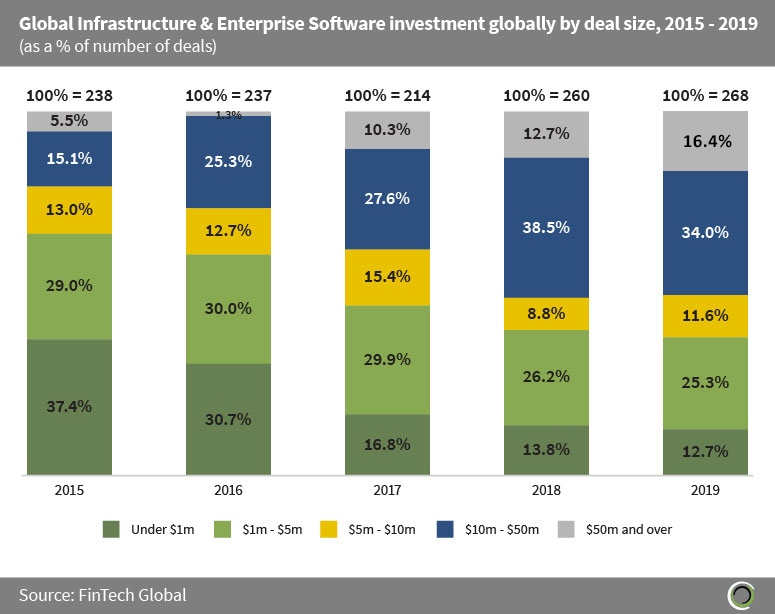

Investors are increasingly backing later stage deals valued over $50m

- The transactions under $10m are gradually becoming less common as the Infrastructure & Enterprise Software subsector matures. The “under $1m” category shows this most notably decreasing its share of deal activity by 24.7 percentage points (pp) since 2015.

- Transactions valued at $10m and over account for 50.4% of total deals in 2019. The later stage transactions are significantly increasing in volume, which shows that companies in the subsector are looking for increasing amount of capital to expand their operations.

- The average deal size has increased by almost 2.7x from $11.9m in 2015 to $32.1m in 2019. This increase in average deal size is mostly driven by the North American region since it captured over 68% of global funding in the Infrastructure & Enterprise Software subsector.

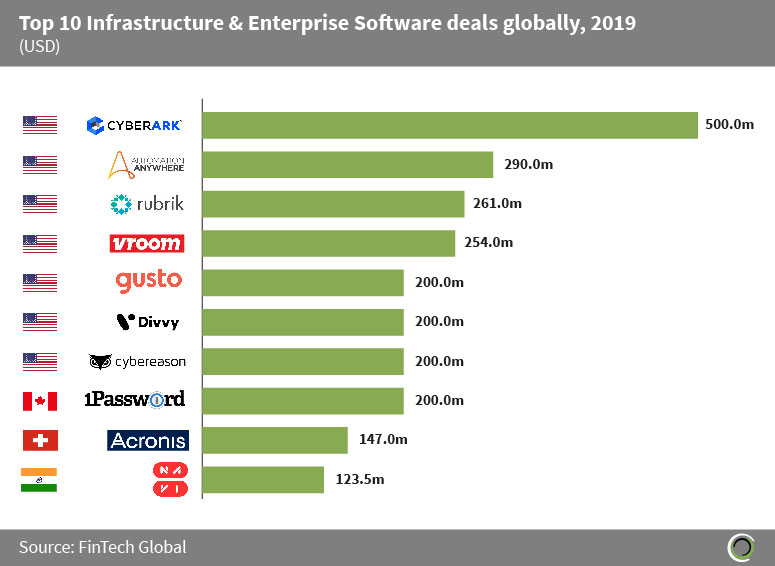

The top 10 global Infrastructure & Enterprise Software deals raised over $2.4bn in 2019

- The top 10 companies in the subsector collectively raised over $2.4bn in 2019, unsurprisingly seven of these deals were raised by US companies, further supporting earlier findings that the Infrastructure & Enterprise Software subsector is most developed in the US.

- CyberARK Software, a United States cybersecurity company, raised $500m in a Post IPO Debt round in November 2019. The company intends to use the funding on operating working capital and to acquire other companies, services, and products.

- Automation Anywhere, a US leader in Robotic Process Automation, raised $290m in a Series B round led by Salesforce Ventures in November 2019. The company stated that the funding will be used to continue improvements into human and robot’s collaboration in the workplace.

North American companies drive global Infrastructure & Enterprise investment to over $24.4bn since 2015

- North American companies in the Infrastructure & Enterprise Software subsector raised 68.1% of global investment amounting to over $16.6bn across 640 transactions. The region’s average deal size is $13.4m larger in comparison to Europe’s average deal size in the subsector, suggesting that companies in the subsector are more mature in the United States and need more funding to grow.

- In second place, European companies raised 17% of global funding amounting to almost $4.2bn. Acronis, a Swedish data recovery company, raised $147m in a Venture round lead by Goldman Sachs in September 2019. The CEO Serguei Beloussov stated that the company will be using the funding to grow the engineering team, pursuing acquisitions, expand in North America, and building more datacentres. Acronis’s venture round is the largest recorded European deal in the subsector to date.

- The Asian Infrastructure & Enterprise Software subsector captured 11.2% of global investment amounting to over $2.7bn. OneConnect, a Chinese AI and Blockchain technology company, raised $650m in a series A round lead by SoftBank Vision Fund.

- The Rest of World category contains Australasia, Middle East & Israel, Latin America, and Africa collectively raising 3.7% of global funding in the subsector.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2020 FinTech Global