From: RegTech Analyst

Aussie customer identity verification company Kyckr is looking to leverage the tightening of anti-money laundering rules and grow on the back of a new funding round.

The venture is looking to raise AUS$8m ($5.4m) before costs via a new share placement to institutional and sophisticated investors.

Moreover, Kyckr will also conduct a share purchase plan for an additional AUS$2m ($1.35m) to allow eligible existing shareholders an opportunity to participate in the raising at the same price as the institutional offer.

Kyckr, not to be confused with musician platform Kycker, plans to leverage both the tightening of regulations against money laundering and how the COVID-19 pandemic has resulted in accelerated adoption of online financial services, which has heightened the need for robust digital customer verification solutions.

“The need for strengthened know your customer practices for online business verification in the financial services sector is now more important than ever in the current COVID-19 environment,” said Ian Henderson, CEO of Kyckr. “Automated customer and business verification will continue to rapidly grow as we have experienced with our contract growth and record revenue in the last few months.

“Our strategy is focused on building our enterprise channel and partnership model, and the additional funds will be used to ensure Kyckr has the financial flexibility to pursue growth as the need for increased digitisation for KYC data increases, and will place us in a stronger financial position to take advantage of emerging opportunities ahead. We are grateful for the strong support from existing shareholders, and we are pleased to welcome new investors to the company.”

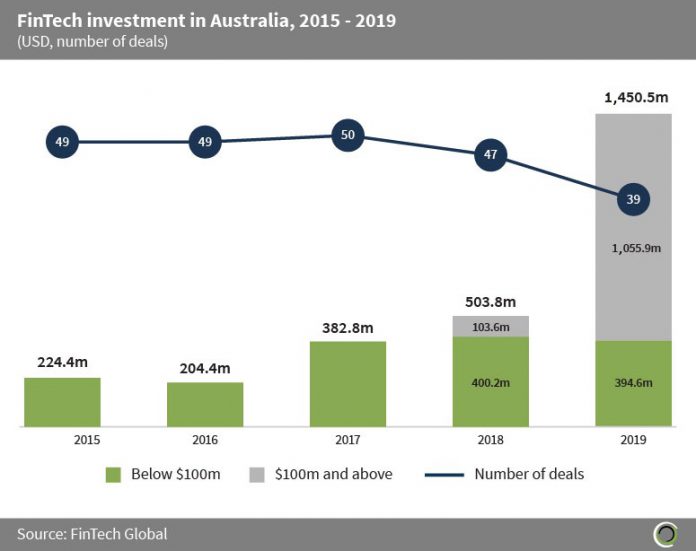

The Australian FinTech space has grown tremendously in recent years. In 2015, there were $224.4m invested into the nation’s FinTech companies, according to FinTech Global’s research. In 2019, that figure had skyrocketed to $1.45bn.

Copyright © 2020 FinTech Global

Copyright © 2020 FinTech Global