The UK’s RegTech sector has nearly grown eight-fold since 2015. 2020 has been a weird year for everyone, but it could prove beneficial for the RegTech space and help it continue to grow in the UK.

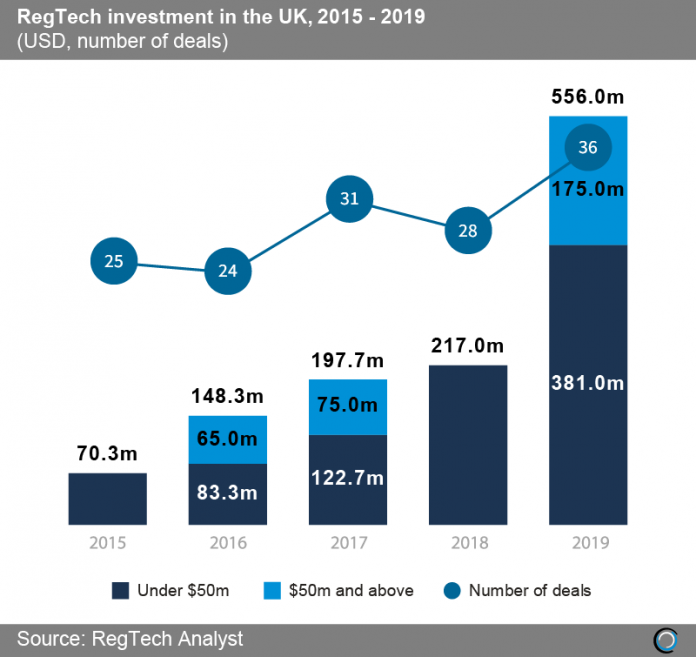

In 2015, a total of $70.3m was invested across 25 RegTech companies, with none of these deals being larger than $50m. Fast-forward to 2019, and there was a total of $556m invested through 36 deals, with a couple of deals being greater than $50m. The largest deal in the UK in 2019 was the $70m Series C of cybersecurity company Snyk. Funding into the UKs RegTech sector has seen a year-on-year growth since 2015. Further proof of the UK’s success in the RegTech market is that it represents 52.9% of the total capital invested into the sector in the whole of Europe between 2015 and 2019. Germany holds the second largest proportion of funding, but this is just 10.4%.

The question is, why is the UK such a hotbed for all of this activity. Europe is full of strong financial markets and many have established sizable FinTech markets. One of the drivers of the FinTech sector’s growth in the UK, and RegTech by extension, could be due to George Osborne in 2015. At the time Osborne was the UK’s Chancellor of the Exchequer and in numerous public addresses he expressed the importance of the UK pursuing and fostering the growth of the FinTech space. Talking at a Bank of England forum he even stated that he wanted London to become the global centre for FinTech.

The question is, why is the UK such a hotbed for all of this activity. Europe is full of strong financial markets and many have established sizable FinTech markets. One of the drivers of the FinTech sector’s growth in the UK, and RegTech by extension, could be due to George Osborne in 2015. At the time Osborne was the UK’s Chancellor of the Exchequer and in numerous public addresses he expressed the importance of the UK pursuing and fostering the growth of the FinTech space. Talking at a Bank of England forum he even stated that he wanted London to become the global centre for FinTech.

In one of his budget speeches in 2015, Osborne went even further to support RegTech specifically. He called upon the Financial Conduct Authority (FCA) and the Prudential Regulation Authority (PRA) to collaborate and build a regulatory sandbox for financial services innovators. Furthermore, he asked them to identify ways in which they can support the adoption of new RegTech solutions. The FCA managed to establish its regulatory sandbox in 2016 and has helped around 89 companies, according to a report from Deloitte. It’s this type of support which has helped nurture the UK’s RegTech space. There have been a number of countries to establish or are in the process of building a regulatory sandbox. Those which have created one, have also seen strong RegTech and FinTech growth.

But it’s this mix of regulatory support and its strong financial market that has undoubtedly contributed to the success of the RegTech market in the UK. John Lee, president of compliance-as-a-service provider CSS said, “As a RegTech provider serving the financial services sector, the UK market retains the natural advantages of being home to some of the world’s largest financial institutions. Brexit or not, it is still at the epicentre of new regulation emanating from Brussels that drives the business and as RegTech firms scale they have access to a ready pool of corporate finance. These factors combine to make it a centre of excellence for RegTech and an environment where it flourishes.â€

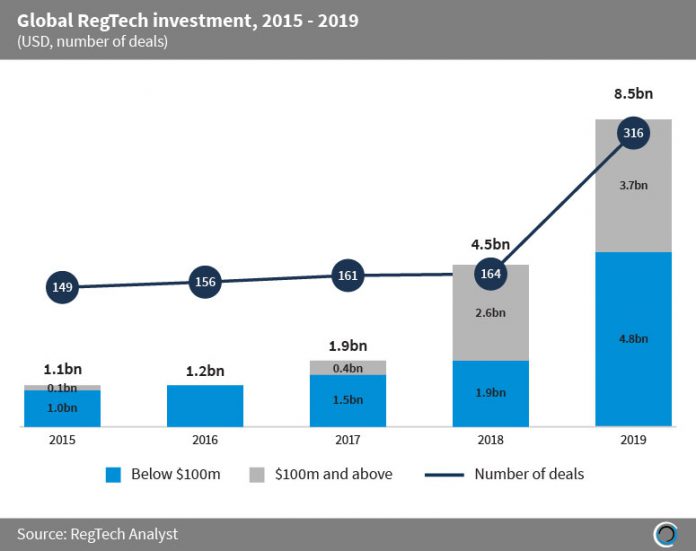

RegTech has become a major industry around the world as companies begin to realise the true benefits the tools can have for their operations. As more regulations are implemented and become more stringent, companies will need to leverage technology to streamline and improve the efficiency of their process or fear wasting more and more resources and manpower. In 2019, a total of $8.5bn was invested globally into the RegTech space, with the capital spread across 316 deals. Showing how far the sector has come in a relatively short period, in 2015 total global investment was $1.1bn via 149 deals and in 2018 it was $4.5bn through 164 transactions.

There is clearly a worldwide appetite for RegTech, but the question is how 2020 will impact it. The UK is facing both the coronavirus pandemic and Brexit, which raises questions of whether it can continue to see funding levels increase or if it will start to decline.

There is clearly a worldwide appetite for RegTech, but the question is how 2020 will impact it. The UK is facing both the coronavirus pandemic and Brexit, which raises questions of whether it can continue to see funding levels increase or if it will start to decline.

The impact of the coronavirus and Brexit

2020 will go down in the history books as that one weird year. Its hard to predict just how the financial market will be impacted and what areas will be hurt. Commercial businesses like restaurants and shops will obviously be hit hard, but other companies will be hit equally hard and it is difficult to really understand what the ripple effects will be. However, David Clee, the CEO of web archiving and monitoring solution MirrorWeb said, “I’m optimistic this will further heighten the need for such solutions.â€

When looking at the fundraising market at first glance, Q1 2020 makes it look like the pandemic has not impacted the ability for companies to raise capital. In the opening quarter of the year, there were 96 RegTech deals around the world, pulling in a total of $1.3bn. The trouble is, most of these deals would have been underway long before the pandemic started. It won’t be until the second, third and fourth quarters where we will be able to truly tell if companies have been able to sail through the pandemic. But there have still been numerous RegTech deals closing this year, putting some optimism behind the resilience of the sector.

A number of UK RegTech companies have been closing funding rounds throughout the year, including the past couple of months. In June, data privacy platform Privitar extended its $80m Series C, which closed in April 2020, with an additional $7m to support international expansion. H4, which creates and analyses documents, also closed an investment in June. The RegTech platform netted $27m to grow its product and reach more customers.

One of the sectors looking to be doing well out of the pandemic is cybersecurity. A study from research company Canalys, claims the global cybersecurity market increased by 9.7% in the first three months of 2020 compared with the same period in 2019. This increase comes after businesses spent $10.4bn to enhance their online security as they let their staff work from home during the pandemic.

Clee added, “Obviously, there could still be impacts – some firms may decide to reign back on their RegTech spending as a way of cutting back costs and protecting cash. However, from personal experience at MirrorWeb we’ve actually been pleasantly surprised by the amount of interest and new business we’ve experienced during this crisis. Don’t get me wrong, this is a fast-changing situation and who knows where the virus will be this time next year, but right now things look ok for the best RegTech solutions out there. And as with every sector, the strongest will survive.â€

Fears around the ability to raise capital are justified. Most notably, the UK’s challenger bank giant Monzo recently suffered a down round that resulted in its valuation drop by an eye-watering 40% – it went from $2bn to $1.24bn. A study from Finch Capital claimed this pandemic would see down rounds a common sight. It claimed that those companies unfortunate enough to need a funding round during the pandemic were likely to see valuations drop. Whether this is a bad thing, due to the overinflated valuations of many FinTechs, is to be decided, but the Finch Capital report also stated that venture firms are likely to be more interested in their existing portfolio rather than new opportunities.

Anthony Quinn, founder and CEO of financial crime audit, risk and compliance services provider Arctic Intelligence, said, “It is probably too early to tell, but in the short-term many venture capital firms are focused on supporting their existing portfolio companies rather than looking for new companies to invest in, but broadly the thematic around RegTech being complex, costly, ripe for disruption and innovation is a good one and many well capitalised corporate venture funds, venture capital firms and private equity firms see the opportunities.â€

The coronavirus could even see the further growth of the RegTech sector, but encouraging private equity firms to engage in the market to complete more mergers and acquisitions.

CSS’ John Lee said, “Tech start-ups are experiencing difficulties in raising early series financing. However, in the larger-in-scale end of the market where private equity firms are typically prevalent, many see this as an opportunity to progress M&A. The reason is they see this segment of the software market as particularly resilient with its recurring revenue model and the obligations that exist around regulatory compliance. The client roster of RegTech firms serving the financial vertical also happen to be amongst the most well-capitalised enterprises on the planet. It’s a good business for PE firms to be in.â€

Opportunities in the pandemic

While the pandemic has been a terrible curse on the world, there could still be a few positives to come out of it. Businesses have got used to a new normal and it is highly probable that when business goes back to “normal†it will not look the same as it did before the lockdown began. Businesses have seen that many of their staff can work efficiently from home and how technology has helped them stay connected while apart. Remote working has put a spotlight on manual and document-heavy workloads, showing how inefficient they can be for compliance or any number of processes.

Arctic Intelligence’s Quinn stated that traditionally risk and compliance assessments are manual heavy between the regulated entities and consultants. They often involve employees going back and forth with hundreds of spreadsheets via email, which is “a recipe for disaster.†The pandemic has shown the benefit of a centralised platform for structured workflow, audit trail and enterprise-wide analytics.

He added, “It is evident that the pandemic has disrupted business as usual, changing the way firms interact with their customers, having to update or adapt the products and services they provide, where their business is active and many more. These kind of changes to the business can mean a change to the Businesses AML Risk exposure, and so it is important to have technology that not only supports the annual Risk Assessment, but easily updated and can be utilised for an internal view of what impact any changes may have, and also shows best practice to the regulator.â€

Another opportunity Covid-19 has presented RegTech could be the consolidation of the market. RegTech has been maturing over the years, with the number of larger investments increasing since 2015. In 2019, 17.3% of RegTech deals were valued at $50m or above, whereas, this figure was just 3.4% in 2015. As the world goes through this turbulent period, businesses could see the real value of their RegTech solutions.

Lee said, “Business continuity is now at a premium and those larger RegTech firms that have proven their resilience throughout the crisis and supported their customers throughout will undoubtedly forge closer relationships with their clients. This is likely to see an acceleration of the trend – that had already begun – toward vendor consolidation, to improve the use of data, reduce vendor interfaces and work more closely with trusted partners of size and breadth in terms of the scope of regulations they cover.â€

He went on to state that the RegTech sector is no longer seen as the “Wild West†and just exploiting the aftermath of the 2008 financial crisis. Financial institutions are taking the tools seriously and are either integrating or building their own array of tools to improve compliance. As with any sector, not everyone can win. This will mean there are likely to be numerous RegTech platforms that start to fail.

He said, “The growth trajectory of RegTech is driven by the scale and breath of the regulatory burden facing financial firms. It is unabated and that, coupled with growing confidence in RegTech providers, will see double-digit year-on-year growth in the sector for the next five years and beyond. But the success of a few RegTech providers will come at the expense of smaller vendors, who will either be consumed in RegTech ‘roll ups’ or go out of business as compliance-at-scale becomes the mantra of the industry.â€

RegTech could really begin to see numerous companies shutting up shop and not due to the coronavirus but simply because the market is mature and establishing itself. Quinn concluded, “RegTech firms need to be able to achieve scale in order to build a sustainable and high-growth business and that requires regulated entities to adopt innovative solutions at-scale rather than being a fringe player, RegTech needs to move in to the mainstream. In many ways, RegTech firms are building a market that has not previously existed. For firms in heavily competitive spaces, like digital on-boarding and transaction monitoring, we expect there to be some consolidation as there are an abundance of players in this space at the moment.â€

Copyright © 2020 FinTech Global