From InsurTech to RegTech, the last week showed that some sectors may be able to benefit from the coronavirus crisis.

InsurTech Hippo raised a massive $150m round last week that pushed its valuation past the $1.5bn mark. In isolation, the round is impressive in itself. Yet, putting it into context of some of the bigger news to hit the InsurTech industry could provide reason for some optimism for the sector.

After all, American InsurTech unicorn Lemonade had a hugely successful initial public offering in early July and rumour has it that Policybazaar is also vying the prospect of going public in 2021.

Additionally, this week saw a peppering of smaller rounds such as Branch, Claim Genius, BestDoctor and Angle Health.

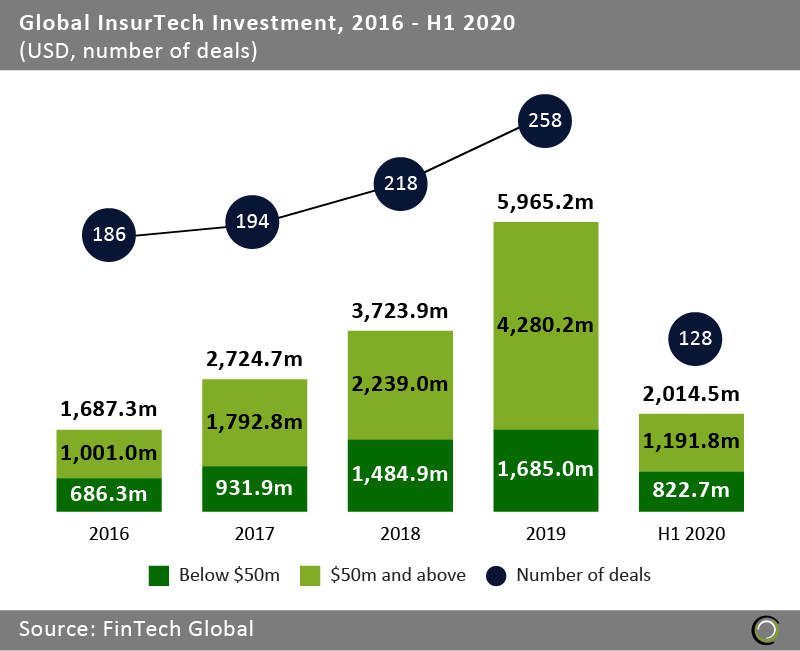

This comes after a period of tremendous growth of the sector. FinTech Global’s data shows that investors have increased their investment into the sector from $1.68bn in 2016 to reach $5.96bn in 2019. There seems to have been a slight slowdown in the first half of 2020, with the sector only attracting $2.01bn in investment during that period.

Nevertheless, all these factors combined could prove the people suggesting that the coronavirus could be the moment the InsurTech industry has been waiting for right as several businesses have been reaped successes during the pandemic.

Nevertheless, all these factors combined could prove the people suggesting that the coronavirus could be the moment the InsurTech industry has been waiting for right as several businesses have been reaped successes during the pandemic.

However, it should also be mentioned that the sector has seen setbacks. Just last week, UK-based InsurTech Coverly was forced to shut down operations. So while there’s reason to be optimistic, there’s also reason to be cautious.

Speaking about how the coronavirus could affect different segments of the FinTech industry, we would be amiss if we neglected to talk a bit about RegTech, especially given Quantexa bagged $64.7m last week.

As we have discussed in the past, the RegTech sector as a whole could benefit from the health crisis in several ways. Firstly, it has created extra pressure for financial firms to ensure they remain compliant even through these trialling times. This is not easy, given many people are now working from home, meaning more people may become lenient in their regular due diligence.

Similarly, the crisis has emboldened cyber criminals. As a consequence, the demand for cybersecurity solutions has skyrocketed. The notion that this could benefit the cybersecurity segment of the RegTech sector only have to look at the rounds raised by CyCognito, CalypsoAI, Sotero and Quorum Cyber this week for some slight confirmation.

That being said, the cybersecurity boom may not last. A recent study from research company Canalys suggested that the global cybersecurity market increased by 9.7% in the first three months of 2020 compared with the same period in 2019. However, the researchers also warned that the boom may not last as financial services firms could soon become more cautious in how they spend their money.

With all that in mind, let’s take a closer look at the rounds FinTech Global covered in the past seven days.

Hippo raises $150m Series E round at $1.5bn valuation

InsurTech Hippo has cemented its place in the coveted unicorn club by raising a $150m round at a $1.5bn valuation. The company will use the money to expand its services, recruit new team members and support a proposed acquisition of insurance carrier Spinnaker Insurance Company. Hippo has the goal of reaching 95% of US homeowners in the next year.

Revolut adds another $80m to its Series D round

Revolut has added another $80m to its Series D round, bringing the total raised in it to $580m. It originally closed the round at $500m in February. Despite the extra dough from investor TSG Consumer Partners, the UK challenger bank’s valuation will remain at $5.5bn. It will use the money to keep expanding its operations in Europe and to roll out new features in the US.

InCred said to raise $66.9m in debt funding

Online lending platform InCred has reportedly bagged $66.9m in a debt funding line. The company received the funds from a number of unnamed public sector banks and public financial institutions. With the fresh line of equity, the FinTech will boost lending across select segments in consumer, education and MSME markets, the article states.

RegTech platform Quantexa scored $64.7m in its Series C round

Quantexa, a contextual intelligence software company, has bagged $64.7m in its Series C round, which will help it move into new markets. Evolution Equity Partners served as the lead investor, with contributions also coming from previous Quantexa backers Dawn Capital, Accenture Ventures, AlbionVC and HSBC. British Patient Capital and ABN AMRO Ventures also joined the round, making their first investment into Quantexa. Capital from the round will be used to accelerate its product innovation roadmap and further its growth across Europe, North America, Asia and more.

Scalable Capital said to reach $460m valuation after new investment

Digital wealth management company Scalable Capital has reportedly raised $58m in a funding round, which values the WealthTech at $460m. The Series D round was supported by a mixture of new and existing investors, according to a report from TechCrunch. Investors included BlackRock, HV Holtzbrinck Ventures and Tengelmann Ventures.

Ava Labs’ Avalanche project picks up $42m in initial coin offering

Blockchain FinTech Avalanche has picked up $42m in an initial coin offering of AVAX tokens which took a little more than four hours. The project is developed by AVA Labs and is set up to create a unified global digital market for equities, commodities and alternative assets.

Selina Finance bags £42m in new round to strengthen its loan capabilities for SMEs

SME loan FinTech Selina Finance has raised £42m in a new round to grow the business. The round was supported by Picus Capital and Global Founders Capital among ofter investors. The UK-based FinTech’s new round made up of £12m and £30m in debt to distribute as loans.

Cybersecurity company CyCognito closes its Series B on $30m

CyCognito, a cybersecurity solution that can uncover and prioritise risk from attacker-exposed systems, has closed its Series B round on $30m. The round was led by Accel, with commitments also coming from Lightspeed Venture Partners, Sorenson Ventures and UpWest. With the new equity, the company plans to enhance its platform to “take advantage of its lead and unique position in identifying the externally-exposed systems,” it claims.

Home and auto InsurTech Branch looks to bolster US expansion with fresh equity injection

Home and auto insurance platform Branch is continuing its expansion efforts having netted $24m in its Series A round. The investment was co-led by Greycroft and HSCM Bermuda, with additional support coming from existing backers American Family Ventures and Revolution’s Rise of the Rest Seed Fund. Joining the round were a handful of first-time Branch investors, including SignalFire, SCOR Global P&C, Elefund, Foundation Capital, and individuals from Stone Point Capital.

AwanTunai scores $20m in new round

Indonesian lending platform AwanTunai has picked up $20m in a new raise led by Accial Capital.

AwanTunai is the startup behind a point-of-sale financing services and mobile-based consumer credits to small businesses such as merchants and stores.

The company is set up to help underserved micro-businesses in Indonesia find affordable finaincing alternatives.

By utilising merchants’ transaction data, AwanTunai is able to estimate and offer credit for its users.

MANTL brings total of Series A round to $19m with additional investment

Account opening software MANTL has reportedly extended its Series A to close the round on $19m. The company has secured an additional $11m from investors including Point72 Ventures and Clocktower Technology Ventures.

METACO collects $17m in its oversubscribed Series A

METACO, a technology solution developer for digital assets, has collected $17m in its oversubscribed Series A round. Giesecke+Devrient, a Germany-based security technology company, led the raise. Standard Chartered Bank, Zürcher Kantonalbank, Investiere, Swisscom, SICPA, Avaloq Ventures and Swiss Post also participated in the raise. METACO will use the money to grow its presence in the US, South East Asia and Europe.

CalypsoAI bags $13m in its Series A round led by Paladin Capital

CalypsoAI, a validation, security and monitoring software solution for AI technology, has bagged $13m in its Series A funding round. Paladin Capital Group led the raise. Martin Ventures, 8VC, Frontline Ventures, Lightspeed Venture Partners, Manta Ray Ventures, Pallas Ventures and other unnamed backers also participated in the raise. With the fresh equity boost, the cybersecurity company is preparing for global expansion, increasing its adoption within enterprises and accelerating innovation.

Plum bags $10m in new funding round

European money management app Plum has raised $10m to fund the company’s international expansion in Spain and France. Previous investor the European Bank for Research and Development returned to co-lead the raise together with Global Brain. The bank had previously joined Plum for its $4.5m round back in May 2019.

Meemo said to raise $10m in funding as it launches from stealth

Mobile FinTech app Meemo has reportedly raised $10m in a funding round, as it comes out of stealth mode. The capital injection was led by Saama Capital, Greycroft, Monashees and Sierra Ventures, with participation also coming from a number of angel backers. This investment was actually raised across two rounds, the first being a $5m investment in early 2019 and a $5m extension at the end of 2019, the article claims.

Hummingbird soars to $8.2m Series A close

Anti-money laundering compliance technology developer Hummingbird RegTech has scored $8.2m in its Series A round. The capital infusion was led by Flourish Ventures, with commitments also coming from Homebrew, Designer Fund, TTV Capital and a handful of angel investors. Hummingbird will use the money to expand its team and develop its solutions further.

Payments software developer Episode Six secures $7m in its Series A

Episode Six, which designs financial and payment products, has secured $7m in its Series A round, which was led by HSBC. Contributions also came from Mastercard and SBI Investment. Part of the capital will be used to expand its product roadmap across other markets. It will also look to grow internationally and enhance its technology.

The Helper Bees said to bag $6m Series A investment

The Helper Bees, which aims to improve the way homecare is offered, has reportedly secured a $6m Series A investment. Silverton Partners acted as the lead investors, with contributions also coming from Austin Impact Capital, Techstars and unnamed angel investors.

Digital investment platform Propel(x) scores $5.5m in a new funding round

Online investment platform Propel(x) has scored $5.5m in a new investment round to help it build new services. The round was supported by Franklin Templeton, FreeS Venture Capital, Sky Saga, Capital, ZhenFund, MIT Alumni Angels of Northern California and other unnamed family offices an angel investors.

Propel (x) hopes to create new features to help investors make informed decisions. It also plans to grow its operations and increase marketing.

InsurTech startup Claim Genius bags $5.5m in its Series A round

Claim Genius, a vehicle damage assessment solution, has bagged $5.5m in its Series A funding round. The investment was supported by Financial Link, a digital insurance automation services in Asia, and SIRI Info Solutions, a global technology solution provider. Claim Genius will use the money to scale its sales and development efforts, as well as support the launch of new products for the auto claims market.

Data protection company Sotero bags $5m in its funding round

Data protection platform Sotero has scored a $5m funding round, which was led by Gutbrain Ventures. Additional support came from Boston Seed Capital and PBJ Capital.

BestDoctor closes $4.5m round

Russian online medical insurance platform BestDoctor has bagged $4.5m in a round led by Addventure and Target Global. LVL1 also participated in the raise. BestDoctor plans to use the money to expand and develop its services.

Cambrian Asset Management bags $4.2m in its seed round

Quantitative investment firm for digital assets Cambrian Asset Management has bagged $4.2m in its oversubscribed seed round. The company managed to beat its initial target for the round, which had been set at $3m.

A number of angel investors led the round, including Renaissance Technologies co-founder Howard Morgan, IVP general partner Dennis Phelps and Business Insider co-founder Kevin Ryan. Tano Capital, which is the family office of the founding family of Franklin Templeton Investments, was also a lead investor.

Other contributions to the round came from Airbnb, BNP Paribas, The Carlyle Group, DRW & RGM Advisors, Fastly, First Round Capital, Founders Circle Capital, Goldman Sachs, Google, Instagram, Microsoft, Pinterest, SAC Capital, Standard Pacific Capital, Tata Capital, UBS, Winton Capital, as well as other angel investors.

Health insurance startup Angle Health nets $4m in its seed round

Health insurance company Angle Health has netted $4m in its seed round, which was led by Blumberg Capital. Additional contributions came from Y Combinator, Correlation Ventures, TSVC, Liquid 2 Ventures and a number of unnamed angels. Capital from the round will be used to complete the regulatory filing process and launch its mobile application. Furthermore, the company will integrate infrastructure to support greater accessibility to medical services, including primary and urgent care, mental health, chronic disease management and reproductive health.

South Africa-based Valr said to raise $3.4m in funding

South Africa-based Valr has reportedly raised $3.4m to help build new products for its cryptocurrency exchange. The investment was led by 100x Group, which is the parent company of cryptocurrency exchange Bitmex, according to a report from Bitcoin.com. Additional support came from 4Di Capital.

Quorum Cyber secures $2.7m in a funding round

Quorum Cyber, a cybersecurity solution, has received a $2.7m funding round led by Maven Capital Partners. Scottish Investment Bank (SIB) also contributed to the round. With this capital injection, the company will boost its growth and innovation of the platform. Funds will also be used to accelerate the internationalisation of the platform.

FLX Distribution scores $2.5m in seed round

WealthTech startup FLX Distribution has collected $2.5 in new round. The company is developing a platform for asset management firms and independent distribution professionals.

Tax app Coconut bags £2.4m in a crowdfunding platform

Invoicing and tax app Coconut has bagged £2.4m in its crowdfunding campaign, after achieving three-times growth over the past 12 months. The FinTech app secured the capital on the Crowdcube platform, with support coming from around 3,003 individual investors.

Coconut stormed past its initial goal, which had been set at just £700,000 and shares were priced at £0.02 apiece. A total of 16.78% of Coconut’s equity was sold through the crowdfunding campaign.

Lendistry receives funding from Comerica Bank

Lendistry, a small business loan platform, has scored a $1.5m investment from Comerica Bank, which will help it increase its loan balance.

Teller closes $1m in its seed round

Teller, a blockchain infrastructure for distributed lending, has secured $1m in its seed round, which was led by Framework Ventures. Capital was also supplied by Parafi Capital and Maven11 Capital. With this financial support, Teller aims to build the first-ever algorithmic credit risk protocol for decentralised finance. The protocol will be a bridge between the traditional finance and decentralised finance spaces by aggregating data from legacy credit scoring systems into decentralised lending markets.

Morocco-based OnePay secures $417,000 funding round

Moroccan FinTech company OnePay has reportedly bagged $417,000 in funding from MITC Capital’s Maroc Numeric Fund II, which is targeting startups in Morocco. The startup is using the capital to invest into its technical, marketing and commercial development to help it increase its customer base, according to an article from Disrupt Africa.

India-based banking app Finin said to raises pre-Series A round

India-based banking app Finin has reportedly closed a pre-Series A round to support the expansion of its product and team. Unicorn India led the investment round, with contributions also coming from PointOne Capital and Astir Ventures, according to a report from BW Disrupt. The value of the deal was not disclosed.

Copyright © 2020 FinTech Global