The coronavirus crisis has put a lot of strain on the WealthTech sector, but maybe there are some things it can do to survive the pandemic.

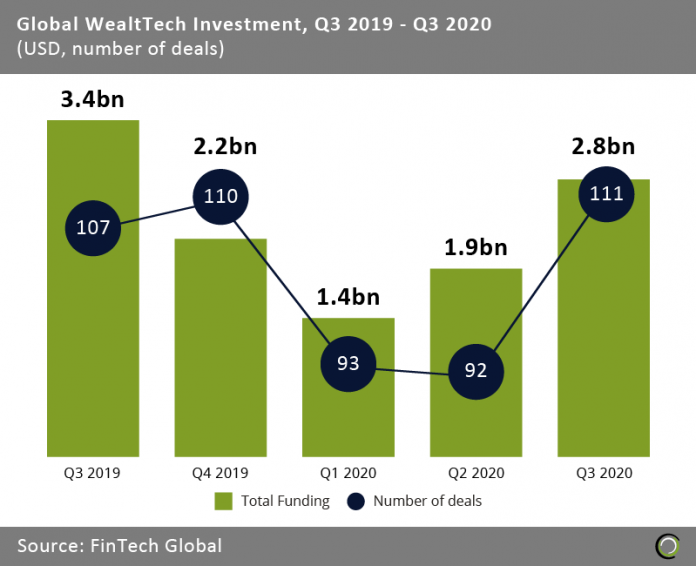

For a while it looked like the WealthTech sector was heading towards its worst results in years. The sector only managed to attract $3.3bn in investment in the first six months of 2020. For you who haven’t kept score, that represents a 41% decline compared to the capital raised in the last six months of 2019 when $5.6bn was injected into the sector, according to FinTech Global’s research.

Now it may seem as if the WealthTech industry could be turning a page, having raised $2.8bn in the third quarter of 2020 across 111 transactions, representing a five-quarter high for deal activity.

It’s hardly a secret what is behind the slump. The Covid-19 pandemic has wreaked havoc on the world economy. And if there is one thing investors dislike, it’s uncertainty.

So what can businesses in the WealthTech sector do to change the tide? For starters, they may want to start thinking about adopting a more holistic approach.

“I think when institutions are building siloed solutions with no ability to bring them together in a 360-holistic sense down the road,” says Fredrik Davéus, the CEO and co-founder of WealthTech provider Kidbrooke. “This means they will lose out on all the strategic benefits of consistent guidance [and] advice across channels; vastly reduced time to market for additional applications – business area or channel wise.”

He adds, “The WealthTech sector should go the b2b route and help incumbents improve customer-centricity. That is the weak spot of the incumbents and thus should be the one you try to disrupt.”

Kidbrooke has been named one of the 100 most innovative companies in the industry by bagging spot on the coveted WealthTech100 list earlier this year.

While investment into the WealthTech sector did increase in the third quarter of 2020, what the end result of the year is going to look like is still, like many other things this year, uncertain.

Copyright © 2020 FinTech Global