The UK FinTech community has welcomed Ron Kalifa’s review, but stakeholders argue the government must do more to take the sector seriously and protect the nation’s position as an industry leader.

Kalifa FinTech review is designed to present a roadmap for how the government can support the growth of the UK’s FinTech industry.

The recommendations in the review include the introduction of a new visa route enabling FinTechs to more easily source talent from around the world, something that has long been desired by the community, particularly following Brexit.

Recognising the importance of regulatory sandboxes, Kalifa’s review also recommended the implementation of a scale box to provide regulatory support for growing firms.

Other recommendations include improving UK listings rules with free float reduction and dual class shares, creating a £1bn FinTech growth fund to help firms grow independently, and establishing a private sector-led Centre for Finance, Innovation and Technology to support national coordination and the growth of the industry.

“FinTech has the power to change lives, both in terms of job creation and better wages that are so essential to our recovery, and making financial services more accessible and relevant to people’s lives,” Kalifa said.

“Britain has a proud record of starting up and scaling up some of the best known FinTech products, but we cannot rest on our laurels. The next powerhouses will not be created by accident.

“We must continue to nurture our startup culture, but crucially we must also give our high growth firms the support to become global giants. With the right reforms that encourage entrepreneurialism, investment and make it easy to attract and invest in talent, Britain can usher in a period of dominance that can help us build back better from Covid-19.”

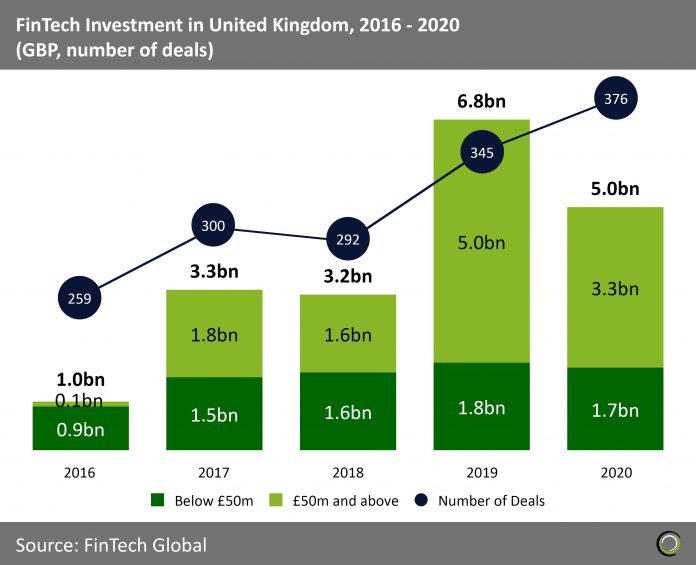

The news comes as funding into the UK FinTech sector declined in 2020 despite an increase in deal activity. Last year the sector raised £5bn across 376 investment deals, compared to a total of £6.8bn across 345 deals in 2019, according to FinTech Global’s research.

“FinTech is one of the UK’s great success stories and will help us seize new opportunities around the world,” said Rishi Sunak, chancellor of the Exchequer. “We must now build on our global reputation for fostering innovative startups and ensure firms can access the talent, finance and support they need to scale up here in the UK.

“FinTech is one of the UK’s great success stories and will help us seize new opportunities around the world,” said Rishi Sunak, chancellor of the Exchequer. “We must now build on our global reputation for fostering innovative startups and ensure firms can access the talent, finance and support they need to scale up here in the UK.

“This review will make an important contribution to our plan to retain the UK’s FinTech crown, create more skilled jobs, and deliver better financial services for people and businesses.”

Even though most FinTech entrepreneurs eagerly lined up to demonstrate their support of the review, several of them said the initiatives in it would be for nought unless the government started to take the industry seriously and not just pay lip service to the idea.

“FinTech companies have often considered their efforts to be under-appreciated by the government,” said Adam Holden, CEO of compliance software provider NorthRow. “As an example, when CBILS and BBLS were first launched, many FinTech companies were excluded, in favour of the traditional banks.

“I recognise that some of this was for liquidity reasons, but they were arguably better placed to effectively and efficiently police the processes when speed was of the essence. The outcome was a potential multi-million pound bill to the government for fraudulent cases.”

Simon Cureton, CEO of Funding Options, shared a similar opinion. “Despite the UK’s rise in FinTech being feted in the wake of the last financial crisis, these businesses were left on the bench as the impact of Covid-19 began to be felt,” he said.

Saying it was understandable for the government to turn to tried and tested incumbents when the coronavirus crisis hit, he argued that old and big firms rarely represent “the vanguard of this revolution”

“FinTech has rapidly achieved maturity and should no longer be viewed as a cool kid on the block,” Cureton said. “It must be trusted to deliver on its promise, pressing from the front to refine the increasingly robust technology stacks that perform crucial due diligence at great speed, under severe stress.”

Charles Delingpole, founder and CEO of RegTech firm ComplyAdvantage, suggested that more should’ve been done to protect the industry in a post-Brexit era.

“The loss of passporting and the denial of equivalence for financial services is deeply problematic for UK FinTech after Brexit,” he said. “Therefore, economically it is absolutely crucial for anything that can be done to resolve the situation.”

One of the biggest Brexit worries for the FinTech community has been how the UK’s divorce from the EU would affect the access to talent. The review’s visa recommendations, which was hinted earlier this week, could help alleviate some of that stress.

“At present, hiring the best talent can be a costly and [time-consuming] process, so any additional simplification and cost reduction is enormously welcome,” said Delingpole. “Similarly, improving access to a much deeper pool of talented engineers is also welcome.”

Tom Graham, managing director in banking at Accenture UK, echoed the sentiment. “Empowering a diverse domestic and international talent base, enabled with the skillset needed to deliver on the promise, will future-proof our unique ecosystem and ensure the UK’s leading position in financial services is not compromised,” Graham said.

Virraj Jatania, CEO and founder of Pockit, was another industry stakeholder welcoming the news, but implored the government to not allow the momentum to slip between its fingers.

“The FinTech sector is a key growth engine of the UK economy, and can be a centrepiece of our Covid-19 recovery,” Jatania said. “But for the sector to achieve its potential we need to roll out the welcome mat to FinTech talent from across the globe and to improve access to investment. This needs to happen now. Today’s proposals must not become lodged in the machinery of government.”

Similarly, Tom Shave, partner and head of FinTechs at Smith & Williamson, welcomed the review’s “bold ambitions to position the UK as the leading market for FinTech”, but feared that the government would avoid the “hard decisions in pushing through Mr Kalifa’s recommendations, leaving the market to fend for itself once again in a very competitive global market.”

Despite the nation having birthed FinTech unicorns like Revolut and Checkout.com, Shave worried that their journeys often end before their time.

“[Much] more must be done to translate large, privately-backed firms into global, multinational listed businesses,” he said “Too often in the past fast-rising UK tech companies have sold out early in their journey and not emulated their more successful US peers.

“In that context, while many of the recommendations in today’s review are welcome, the real litmus test will be how many are actually implemented in practice and the extent to which wider UK government policy decisions are coordinated to maximise impact.”

The review’s focus on supporting regional hubs around the country also caused contentions. While some welcomed the initiatives aimed at bolstering the industry across the UK, others believed it was a waste of time.

One of the industry stakeholders supporting the push was Louise Brett, head of FinTech at Deloitte.

“With a third of all FinTechs now sitting outside of London, providing the right support to enable regional clusters to thrive is vital,” she said. “This is best achieved through collaboration, access to information, investment, skills and talent, and policy and regulation expertise.

“It is important to recognise that this isn’t about regional hubs competing with London. Instead, it is a global opportunity that, if nurtured, will ensure growth across the UK and future FinTech competitiveness on an international stage.”

Delingpole, on the other hand, seemingly hinted that the initiative was more about drumming up political support than about strengthening the industry.

“Whilst regional FinTech clusters might be an attractive aspiration for politicians seeking to democratise access to financial services jobs, in reality, given that London is a global financial centre its gravitational pull eclipses all other cities in the UK,” he said. “Therefore, any specialisation is limited to servicing the needs of London rather than being a specialist cluster in its own right.”

Delingpole was also sceptical about the review’s recommendations regarding dual class shares.

“This is a bit of a storm in a teacup, and instead of allowing dual class structures to pull focus, we should instead be looking at change of control rules, which are a prohibitive force when it comes to going public companies in the UK,” he said.

While recognising that dual structures have received a lot of media attention, Delingpole suggested that the cases of companies using them in practice are “few and far between.”

“Probably far more relevant is the take-over code rules on change of control, which makes special-purpose acquisition companies (SPACs) difficult to list in the UK,” he said.

“When a reverse takeover occurs in the UK, trading is automatically suspended in stock, which prevents SPACs from being a viable vehicle for promoters in the UK. This is a very real prohibitive factor when it comes to listing companies in the UK, and needs to change.”

Oliver Prill, CEO of Tide, said he hoped that the review’s recommendations would help UK companies grow across the world.

“Support for UK FinTechs scaling internationally is of particular importance,” he said. “With Tide beginning our journey in the India market and ambitions to scale beyond that in the long-term, we see that the introduction of a FinTech credential portfolio to support the credibility of UK FinTechs internationally has the scope to ease market entry significantly.”

Mark Leaver, financial services technology leader at PwC UK, added, “We are seeing technology companies increasingly performing roles that have historically been done by financial institutions themselves. Opening up the legacy platforms of financial institutions, letting in more agile technology-led organisations and enabling incumbents and new entrants to collaborate will help the industry to better serve customer needs and become more efficient.”

Copyright © 2021 FinTech Global