The Global RegTech Buyer’s Guide for 2021Â reveals the industry has grown to over 1,000Â companies globally offering a variety of innovative solutions.

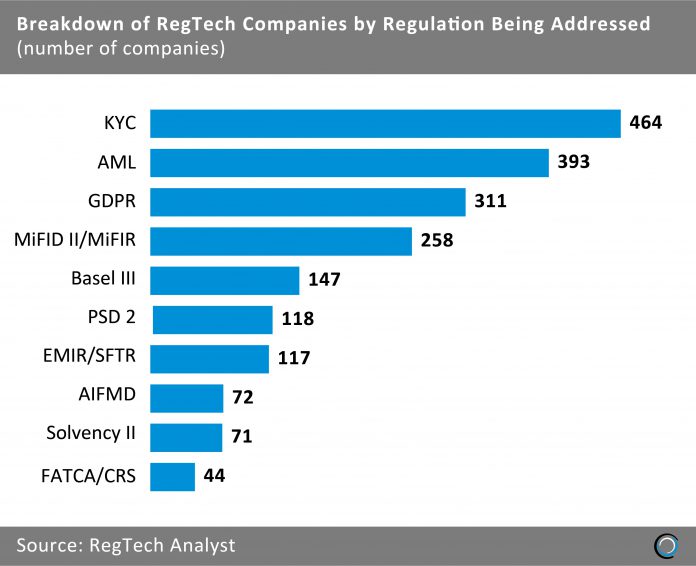

The RegTech industry has grown to the point where companies in the space offer solutions to solve many of the regulatory issues in financial services. By taking a look at the number of companies addressing each legislation, insights can be obtained about which rules have given financial institutions the biggest headaches in recent times.

Given the increasingly complex requirements placed by regulatory authorities on AML and KYC procedures, along with the increase use of digital onboarding channels, it is no surprise that a majority of RegTech solutions address these particular areas of legislation. Over 450 companies around the world provide offerings that make compliance with KYC regulation more effective or more efficient, while for AML rules that figure stands at 393.

The third most common regulatory framework addressed is GDPR, which 311 RegTechs have built solutions for. The top fine that can be imposed for failing to comply with the regulation is the higher figure of $20m or 4% of annual global revenue, putting pressure on financial institutions to update their data retention strategies and ensure customer information is well protected.

More than 250 companies offer solutions to address MiFID II/MiFIR regulatory framework, which is the EU-wide set of legislation designed to improve transparency and investor protection. As part of the rules financial institutions need to record and store all communications related to financial transactions for at least five years and in some cases for seven years. It covers all communications channels such as voice, video, instant messaging, website and social media. And with the increase of remote communication, due to the pandemic, having a cloud-based technology solution is often the most cost-effective option to comply with the rules.

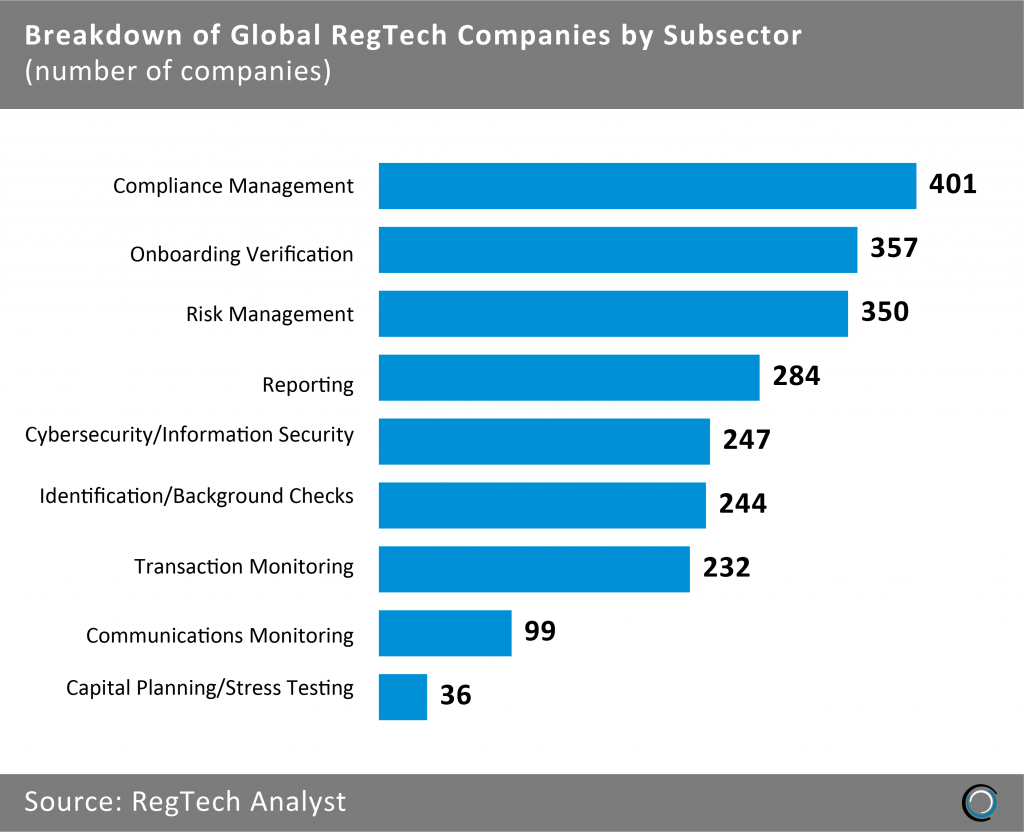

A third of RegTech companies offer solutions for compliance or regulatory change management

RegTech companies operate across all the stages of the value chain in different numbers. There is clearly room for improvement in every phase of the compliance process and innovative RegTech companies are providing solutions to enhance efficiency and effectiveness throughout. Note the total in the chart above adds up to 2,250 as the subsectors are not mutually exclusive with many of the 1,183 companies tracked by RegTech Analyst offering solutions that address more than one part of the value chain or can be assigned to more than one subsector.

Although at first it appears that more RegTech companies operate in compliance management than in any other area, not all have it as their primary focus. Many RegTech companies that are focused on other areas of operations also provide tools to integrate with compliance management in terms of monitoring adherence to internal policies and keeping up to date with regulatory changes.

Nearly a third of all RegTech companies operate in the onboarding verification or risk management subsectors. The data-heavy nature and the risk of big fines associated with AML and KYC processes as well as the growing pressure to assess customers digitally has driven the proliferation of onboarding solution providers in recent years. At the same time financial institutions increasingly need to construct more complicated risk models to incorporate the additional data points collected from online interactions. To address those challenges financial services firms are relying on technology solution providers leveraging machine learning and big data analytics.

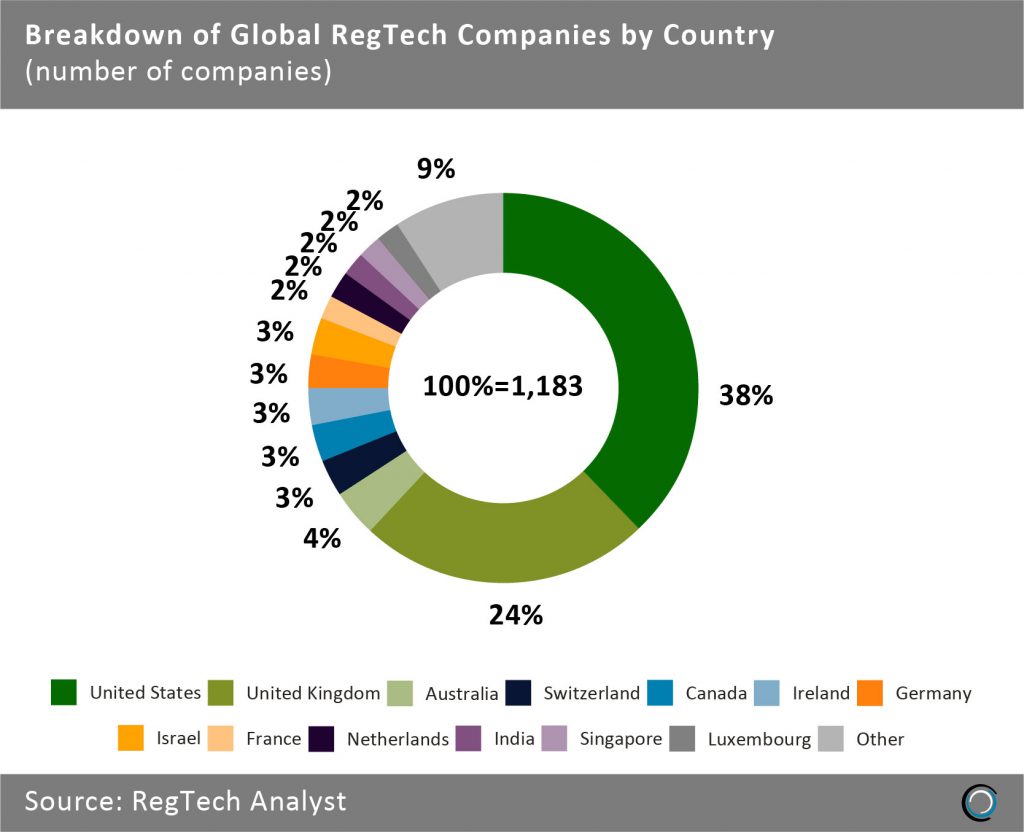

Despite US and UK domination, countries around the world are building RegTech solutions

Companies based in the United States and United Kingdom make up nearly two-thirds of the world’s RegTech universe. This is unsurprising given the strong FinTech innovation hubs established in San Francisco, New York and London.

However, financial executives would be ill-prepared were they to look only in these established markets for potential partners as another 43 countries have representatives among the 1,183 RegTech companies FinTech Global and RegTech Analyst track globally. Australia, Singapore, Canada and the Nordics have developed vibrant RegTech ecosystems from which leading RegTech companies have emerged such as Arctic Intelligence (provider of financial crime audit, risk assessment and AML compliance solutions), Cognitive View (conduct risk monitoring solution), Tookitaki (advanced, machine learning-powered, end-to-end AML/CFT analytics platform), Trulioo (leading global identity and business verification provider) and Tink (cloud-based open banking platform).

More countries are expected to burst onto the global RegTech landscape as incubators and regulatory sandboxes are setup in other parts of the world, such as the Middle East and Latin America. For instance, the Global Financial Innovation Network (GFIN), an international group of financial regulators and related organisations, opened applications in November 2020 for the first cohort of businesses to use its sandbox. Regulators which are part of the organisation include Australian Securities & Investments Commission (ASIC), Financial Conduct Authority (FCA), Hong Kong Monetary Authority (HKMA), Monetary Authority of Singapore (MAS), Consumer Financial Protection Bureau (CFPB) and other supervisors from Bahrain, Abu Dhabi, Israel, Mexico, Nigeria, Lithuania and others.

The insights above were taken from the newly released Global RegTech Buyer’s Guide for 2021. To read more get your copy today!

©2021 FinTech Global