The past week has given cybersecurity, PayTech and even InsurTech aficionados a host of reasons to perk up their ears.

While we reported on a slew of investment rounds in everything from online banking to cybersecurity last week, two segments of the industry that stood out are cybersecurity and PayTech.

Last week was also all about mortgage lender Better.com’s gigantic $500m round as well as the CyberTech industry, which raked in millions. So, before we delve into the 30 funding rounds from last week, let’s talk a bit about why that is.

Better.com landed $500m, led by SoftBank, taking the US digital mortgage lender’s valuation to $6bn. This is up from $4bn last November when it raised $200m in a Series D round. Better.com offers proprietary mortgages via a fully digital and commission-free loan process. It also integrates its offering into the platforms of partners like Ally Bank to improve their mortgage processes.

The ongoing pandemic causing low mortgage rates coupled with the rising consumer demand for an end-to-end digital mortgage application process, fuelled acceleration in the online lending space.

In fact, as the lending space continues to evolve, more people are now open to purchasing homes. A KPMG study, which surveyed over 2,250 professionals in Australia, Canada and the UK, showed that more than half already have a mortgage while 55% who do not have a mortgage are looking to buy within two years. This is testament to the strength of the digital lending sector. To add on, the global lending market is expected to reach $8,871.2bn in 2025 and $11,604.7bn in 2030 according to ResearchAndMarkets.com proving that more investors will seemingly pump in more money in lending firms.

Better.com was hardly the only lending platform to secure funding. London’s consumer loans provider Fintern raised £32m in equity and debt financing.

With the ubiquity of digital lending and online banking comes the threat of cyber risks, which brings us to the sector that added the most millions last week – cybersecurity. The global CyberTech industry experienced tremendous growth between 2016 and 2019 as investors injected money into companies combating cyberattacks and data leaks in financial services. The total funding grew at a CAGR of 91.6% from nearly $666.1m to nearly $4.7bn at the end of last year.

Fittingly, cybersecurity and anti-money laundering companies, including Tines, Bryter, Talon Cybersecurity, Hack The Box, SafeGuard Cyber, PlexTrac, OpenEnvoy and CadoSecurity, topped their coffers last week. In fact, fraud detection firm Signifyd banked $205m – the second largest round from last week – which it plans to use to develop its e-commerce protection platform that protects merchants from fraud and abuse.

Indeed, despite the rise in the number of startups sprouting in the sector making it a crowded space, the escalation in investment in cybersecurity companies suggests that there is much room for budding entrepreneurs to make a splash in the sector. Furthermore, UK-based cybersecurity unicorn Darktrace was reportedly considering a £3bn listing on the London Stock Exchange proving that the sector is ripe for innovation.

Additionally, big tech firms as well as SMBs continue to be hit by cyberattacks making it key to ensure more security. Last week dating app Manhunt was targeted by cybercriminals where thousands of accounts’ information was leaked.

Another sector that made significant strides last week was PayTech. While online transactions are witnessing a surge, the coronavirus chaos brought into question whether payment startups would be able to raise capital this year. Global PayTech investment last year recorded its lowest funding levels since 2017 where startups in the sector raised over $11.8bn, a massive drop from 13.19% year-on-year compared to 2019.

However, defying the declining pattern, startups such as Paymob, Orum, Wage, Modulr, Yoello, Sunday, Cardlay and Routable were all the payment-focused companies whose cash injections FinTech Global reported on last week.

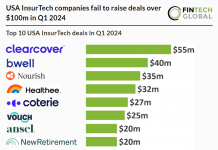

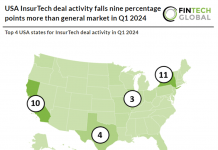

Additionally, the InsuTech sector too witnessed a few big rounds with The Zebra gaining the unicorn status thanks to its $150m funding along with Clearcover’s $200m round and Vericred which raised $23m. Given that the global InsurTech industry which raised $1.7bn in 2016, scored $6.2bn in 2020 according to FinTech Global’s research, it’s easy to say that the sector is set to go from strength to strength this year as well.

Clearly, it seems as if the InsurTech and PayTech industries have continued to grow despite the pandemic.

Now, let’s look at the different rounds raised last week in more detail.

Better.com’s ginormous $500m round

Better.com banked $500m from SoftBank that values the digital mortgage lender at about $6bn.

Better’s last funding round was in November 2020 where it was valued at $4bn. Better extended $14bn in loans in Q1 this year and $25bn in loans in 2020. The profitable company reaped $800m in revenue in 2020. Better is expected to go public later this year and SoftBank is purchasing shares from Better’s existing investors.

The reason for its growth was the rising home buying market and the surge in refinancing activity in the past year as interest rates are incredibly low.

Signifyd lands $205m in Series E funding

Digital commerce protection solutions provider Signifyd raised $205m in Series E growth equity financing.

The round, which valued the company at $1.34bn, was led by Owl Rock Capital. The company intends to use the funds to expand its Commerce Protection Platform and identity graph globally, across digital shopping and payments and accelerate its growth in Latin America and EMEA.

Clearcover collects $200m in its Series D

Car insurance provider Clearcover closed a $200m Series D funding led by Eldridge.

The round saw participation from existing investors American Family Ventures, Cox Enterprises, Omers Ventures as well as several other new investors.

The company, which has raised $329m in total funding, intends to use the funds to grow its insurance, product, and engineering teams and will double its overall headcount by next year.

The Zebra earns the horn after $150m funding round

Austin-based The Zebra, which operates an insurance comparison site, raised $150m in Series D funding, led by an unnamed investor.

Joining the round were a group of investors, including Weatherford Capital, as well as Accel, which led the company’s $38.5m Series C last year. The investment brings The Zebra’s total raised to $251.5m since its 2012 inception.

The Zebra intends to leverage more customer data to create personalised experiences and create more products. The company also plans to add rental, life and pet insurance, as well as enabling better communication between agents and customers.

TipRanks inks $77m

Israeli company offering financial analytics services TipRanks secured a $77m investment led by technology company Prytek.

TipRanks offers a stock research platform that makes alternative databases available to retail traders. It uses natural language processing to analyse the performance of the professional analysts for its services.

Veriff banks $69m in Series B

NYC-based global identity verification provider Veriff secured $69m in Series B financing.

The round, which brought Veriff’s total secured funding to date to $92.8m, was led by IVP and Accel. In conjunction with the funding, Jules Maltz of IVP and Matt Weigand of Accel will also join Veriff’s Board of Directors. The company intends to use the funds to continue its growth in the US.

JP Morgan, Mastercard, UBS pump in $65m in ConsenSys

Ethereum development house ConsenSys raised $65m from JP Morgan, Mastercard, UBS as well as several blockchain companies such as Protocol Labs, Maker, Fenbushi, Alameda Research and others.

The company is known for its three million user MetaMask wallet, which since last October has a business model taking 0.875% of transactions where users can make token swaps.

Its goal is for DeFi and traditional finance to converge on the public blockchain.

SafeGuard Cyber reels in $45m led by NightDragon

SaaS-based platform dedicated to managing digital risk protection SafeGuard Cyber raised $45m of equity and debt led by NightDragon with participation from Cisco Investments and previous investor, Allegis Cyber.

SafeGuard Cyber enables people to interact securely on any cloud application, including social apps, mobile chat, collaboration platforms, CRM and service clouds. The new funding will enable SafeGuard Cyber to expand its business and technology capabilities to meet global demand for this rapidly accelerating market.

Fintern hauls in £32m in equity and debt financing

London-based consumer loans provider Fintern raised £32m in equity and debt financing by Hamburg-based financier Varengold Bank.

This round of funding comes fresh off the back of Fintern’s public launch just last month and is slated to propel the company’s goal of providing £1bn in consumer loans by 2025.

Fintern leverages AI to examine an applicant’s total financial situation, incoming, outgoing, current repayments and repayment history to make a potential loan decision. This enables the firm to make affordable lending available to a much wider audience when compared to traditional lending methods.

Routable snares $30m led by Altman brothers

US-based FinTech Routable raised $30m through its Series B investment round which was led by Sam Altman, CEO of Open AI and former president of Y Combinator and Jack Altman, CEO of Lattice, with participation from Flexport as well as a slew of angel investors.

Routable enables businesses to send and receive payments. Moreover, its secure payments solution helps Accounts Payable/Accounts Receivable team automate bill-pay and invoicing, find errors, request authorisation from supervisors and streamline cash flow.

Talon Cyber Security lands $26m

Talon Cyber Security secured $26m in seed funding from Lightspeed Venture Partners, Team8, serial entrepreneur Zohar Zisapel and cyber angel investors.

The company is developing a cybersecurity technology that protects from the unique threats emerging in today’s era of distributed work. Talon’s novel approach enables all employees, no matter the device they are using, to access their corporate resources in a secure way.

The seed funding will allow the company to further develop its technology and expand the development team.

Cart.com receives $25m in its Series A funding

Houston-based provider of end-to-end e-commerce services and software Cart.com raised $25m in Series A financing led by Houston-based venture capital firm Mercury Fund and Winter Park, Florida-based Arsenal Growth.

The Series A round, Cart.com’s second round in five months, follows a $20m seed round led by Bearing Ventures. To date, Cart.com has raised more than $45m. It offers a range of e-commerce software products and services, including offerings for online storefronts, digital marketing, payment processing among other services.

Sunday gets $24m to boost contactless payments for restaurateurs

Big Mamma founders teamed up with Christine de Wendel to raise $24m in seed funding from Coatue and New Wave, with further support from numerous established hospitality investors to support the launch of FintTch startup Sunday.

Sunday is designed to let customers pay in less than 10 seconds through a QR code on their smartphones. This new payment technology will benefit both the restaurants and customers and claimed that every table could save 15 minutes of wait time on average while waiters benefited from 40% more tips among other improvements.

Dublin startup Tines adds €22m to its account

Tines raised €22m valuing the company at $300m. The funding was led by Addition, a $1.4bn fund created by Lee Fixel, who previously invested in Spotify and Peloton on behalf of Tiger Global.

The startup allows other companies to automate processes such as customer service and security issues without needing technical skills. Co-founded in 2018 by Eoin Hinchy and Thomas Kinsella, the cash will allow the firm to double its 18-person workforce and open a Boston office.

Vericred nabs $23m in Series B funding

NYC-based data services platform powering digital quote-to-card experiences in health insurance and benefits Vericred closed a $23m Series B round of funding.

The round was led by Aquiline Technology Growth with participation from new investors Echo Health Ventures, MassMutual Ventures, Guardian Strategic Ventures and existing investors. The company intends to use the funds to expand its teams in New York and Omaha to further build its marketing and sales functions and grow the community of participants on its platform.

Orum gets $21m

Financial infrastructure platform Orum raised $21m in Series A funding round led by Bain Capital Ventures, with participation from previous investors Inspired Capital, Homebrew, Acrew, Primary, Clocktower and Box Group.

Orum provides embeddable financial infrastructure products bringing real-time and fully automated money movement to enterprises across verticals. The company intends to use the funds to accelerate the hiring of talent in data engineering, machine learning and data science and to expand its partnership teams.

Paymob closes $18.5m Series A

Egypt-based FinTech Paymob secured $18.5m in a Series A round led by Global Ventures. The round includes $15m in fresh capital and $3.5m that came as its first tranche in July 2020. The round, which is the largest ever Series A raised by a FinTech in Egypt, also saw participation from A15 and FMO, the Dutch entrepreneurial development bank.

Merchants can integrate Paymob’s payments APIs in their websites or mobile apps to accept payments from their customers using different payment methods including cards, mobile wallets and cash on delivery.

With the fresh capital, the company aims to accelerate its expansion to Saudi and other regional markets this year.

Aclaimant raises $15m in a Series B financing round

Chicago-based insight-driven workflow platform for safety and risk management Aclaimant raised $15m in Series B equity and debt funding.

The round, which brought total funds raised to over $20m, was led by Next Coast Ventures. The company will use the new funds for product innovation, increase hiring across all departments, accelerate client acquisition and sales as well as marketing and partnership development and add key talent across the risk management spectrum to grow and expand its in-house subject matter expertise.

Hack The Box banks $10.6m

UK-based provider of an ethical hacking community and cybersecurity training platform Hack The Box raised $10.6m in Series A funding.

The round was led by Paladin Capital Group with participation from Osage University Partners, Brighteye Ventures, and existing investors Marathon Venture Capital. The company intends to use the funds to establish its presence in the US and global market and expand its product portfolio for both individuals and organisations.

Cado Security reels in $10m

UK-based provider of a cloud-native digital forensics platform Cado Security closed a $10m Series A funding.

The round, which brought the total capital raised to $11.5m, was led by Blossom Capital with participation from existing investors including Ten Eleven Ventures. The company intends to use funds to accelerate growth through the expansion of key functions including engineering, customer support and go-to-market operations.

PlexTrac’s $10m round to help the firm expand

Boise-based cybersecurity firm PlexTrac raised $10m. The round was led by Noro-Moseley Partners and Madrona Venture Group with participation from StageDotO Ventures.

The company will use the funds to continue to build the team and grow the platform. Led by founder and CEO Dan DeCloss, PlexTrac provides a platform that enables offensive and defensive security teams to collaborate in real-time on cyber-attack simulations, known as purple teaming.

Wage secures $5m in funding round led by Google

San Francisco-based Wage raised $5m in a funding round led by Google’s AI venture fund, Gradient Ventures. Follow-on investment came from 8VC, Pear Ventures, Bloomberg Beta, CoFound Partners, and executives from SoFi, Public, Zillow and Affirm.

The infrastructure software solutions provider lets users securely and easily share their payroll data with third parties without the need for document uploads or logins.

Wage currently works with payroll companies covering more than 30 million employees who work at firms such as Amazon, Delta Airlines, Best Buy, Starbucks, Dell, Hyatt Hotels among others.

Finary nabs $3.2m to help finance creators monetise content

Online community for investors Finary closed a $3.2m seed round led by Upfront Ventures, with participation from Dash Fund, Hannarae Nam, Madhi Raza, Eden Chen, Daniel Pourasghar, James Beshara and Lenny Rachitsky.

The company aims to be the first to provide a personal-finance-focused platform for the creator economy. Creators can start groups and offer their actionable insights for subscription payments or tips.

Numida raises $2.3m seed round

Ugandan FinTech Numida bagged $2.3m in a seed funding round led by MFS Africa to help it expand aggressively and launch new products.

Launched by Mina Shahid, Catherine Denis and Ben Best in 2017, Numida began life enabling traditional MFIs to provide unsecured credit to semi-formal businesses and more recently ventured into lending for micro and small businesses directly. Through the Numida mobile app, business owners can access unsecured working capital loans of up to $3,500 in less than two hours.

Thirdfort secures £1.5m funding

Digital onboarding platform Thirdfort has secured £1.5m in its latest fundraising. The Anti-Money-Laundering and Know Your Client specialist plans to ramp up product development and support its continued expansion in the legal and property markets.

The funding round was raised solely from existing investors as well as funds via a convertible loan from the Government. FCA regulated Thirdfort combines open banking, document scanning and facial recognition technology to streamline identity and source of funds checks carried out during legal and property transactions. It lets lawyers and property professionals onboard their clients quickly, securely and entirely remotely.

Monva raises over £450,000 through crowdfunding

FinTech firm Monva doubled its latest fundraising target, attracting more than 600 investors and raising £451,905 through Crowdcube. This latest funding round comes one year after its initial crowdfunding target in 2020 and comes ahead of a larger institutional round expected to take place towards the end of 2021.

Monva uses customer data and artificial intelligence to personalise and revolutionise the price comparison customer experience with the aim to help users make smart financial decisions.

Copyright © 2021 FinTech Global