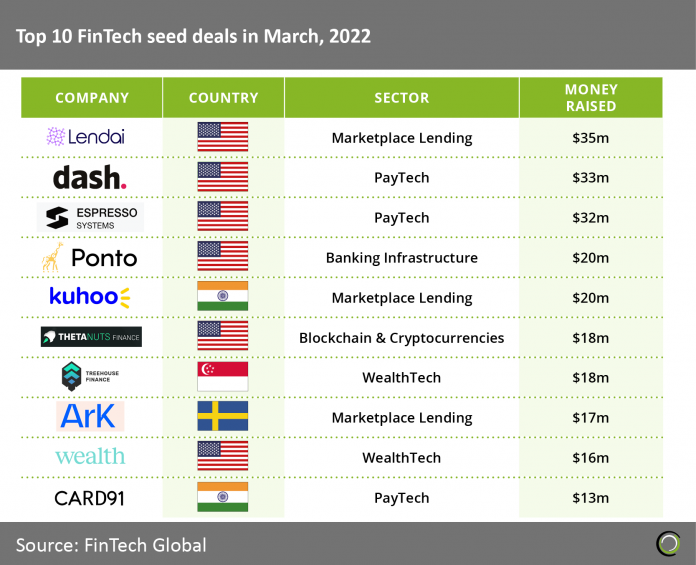

- The US accounted for 44% of total seed deals in March which further cements the country’s position as the leading FinTech innovation hub globally. Seed funding rounds are a good predictor of future growth in particular sector as companies look to scale up in the coming years. The higher the value of the seed round the higher market potential that venture capitalists (VCs) see in companies, which in this case shows that investors are bullish on the US market as well as PayTech and Marketplace Lending sectors.

- Lendai, a direct lender financing US real estate properties for foreign investors, was the largest seed deal in March 2022 raising $35m. Lendai will use the seed funding to expand its services to more US states and launch new financing loan programs.

- The most dominant sectors on the list are PayTech and Marketplace Lending which in aggregate account for 60% of the deals on the list. This indicates that investors still see growth and disruption opportunities in these markets.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2021 FinTech Global