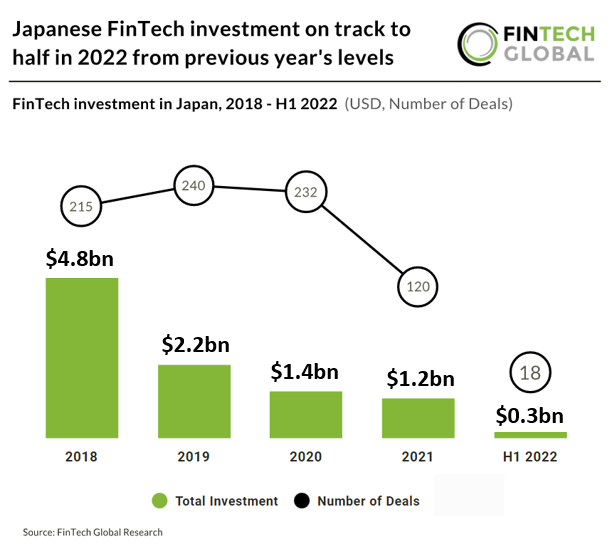

• Japan recorded a better second quarter compared to Q1 2022 with $240m in investment, which is a four-fold increase from the opening quarter. This is a massive reduction compared to previous years when funding peaked in 2018 at $4.8bn. Deal activity in the country also rose slightly from the first quarter by 25% to ten deals in total for Q2 2022.

• Opn, a financial services provider that offers a payment gateway for e-commerce businesses, was the largest FinTech deal in H1 2022 raising a large $120m in their latest Series C funding round which included investments from MUFG Bank, Mars Growth Capital and JIC Venture Growth Investments. Opn will use the funds to expand its product line-up and push further into Southeast Asia as it rides the growth of digital payments in the region.

• Blockchain & Crypto was the most active FinTech sector in Japan for H1 2022, with eight deals in total and was closely followed by the PropTech sector which had seven deals in total. Interestingly only two other sectors, PayTech and RegTech announced deals showing that Japan has a smaller ecosystem compared to other countries.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2022 FinTech Global