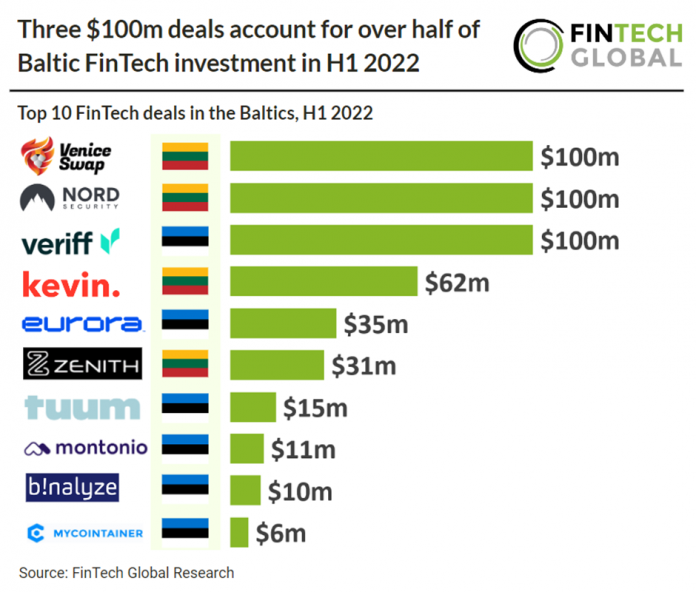

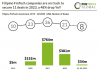

• The three $100m deals in H1 2022 came from Venice Swap, a crypto exchange platform, Nord Security, which offers a comprehensive cybersecurity package against online hazards, and Veriff, an online identity verification company, which in aggregate accounted for 54% of the total $558m raised by FinTech companies in the Baltics in the first half of 2022. FinTech investment in the Baltics is expected to increase more than six-fold in 2022 based on funding activity so far this year.

• Estonia was the most active FinTech country in the Baltics, accounting for 83% of the deals in the first half of 2022 although investment in the region was dominated by Lithuania which accounted for 53% of total capital invested in the Baltics. The Blockchain & Crypto sector was the most active Baltic FinTech sector accounting for 28% of deals, with 11 in total.

• Brussels lawmakers are in the final stages of introducing the new MiCA legislation, a Blockchain & Crypto framework to reduce money laundering, protect investors and preserve financial stability and will likely be ready in late 2022. Lithuania however have jumped the gun, Mindaugas Liutvinskas, vice minister in the Lithuanian ministry of finance said “What we decided to do is take practice steps, do all our homework, to strengthen our regulatory framework,” he called the proposed law a “quick fix” that MiCA can then take “to the next level.” Estonia have also created similar legislation although their intention is to promote sound companies, not empty shells that merely register in the country but operate from elsewhere, and will incorporate a MiCA-style requirement to hold €125k in capital and to have anti-money-laundering staff physically based in the country. The Blockchain & Crypto sector in Estonia, meanwhile, is hoping that measures will be brought in on a slower timeline. Latvia also plan to incorporate MiCA when the EU finalise the legislation.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2022 FinTech Global