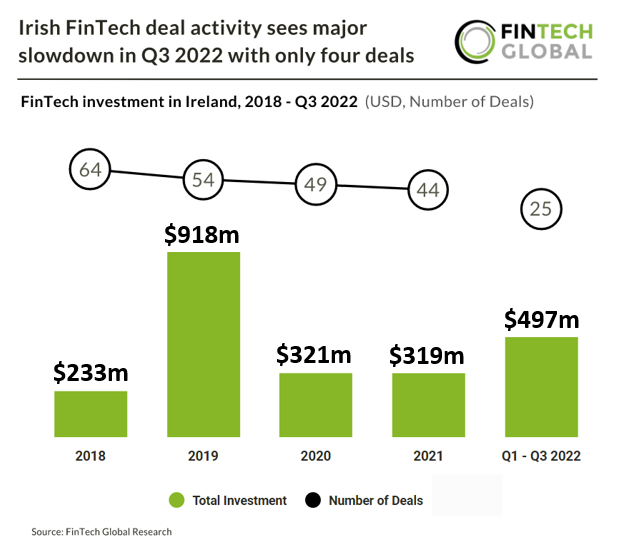

• Irish FinTech companies announced only four new funding rounds in Q3 2022, a 69% drop from the previous quarter. Irish deal activity is expected to decline for the fourth consecutive year and reach 33 deals in total for 2022, a 24% drop from 2021 levels. FinTech Investment is on track to double in 2022 from the previous year with projections reaching $663m based on investment in Q1-Q3 2022.

• Ireland has had great success in the FinTech sector, mainly due to its low rate of corporation tax rate, the R&D tax credit regime, and the intellectual property profits tax incentive scheme. There are also incentives for non-domiciled people to relocate to the country. According to assistant professor Richard McGee, academic director of the MSc in financial data science in the UCD School of Business, the nature of the financial services sector here has lent itself to the sector’s development. “A lot of back-office stuff is done here in the admin and compliance areas,” he says. “That’s where the RegTech companies come in. There are at least 50 different Irish RegTech companies now. There is a lot of institutional knowledge here. A lot of back-office work can be automated and we have people here who understand the work and the technology and how to automate it.”

• Fonoa, which automates taxes via an API, was the largest FinTech deal in Ireland during Q3 2022 raising $60m in their latest Series B funding round led by Coatue. Sturman, Co-founder and Chief Product Officer, said that the additional raise, which comes around nine months.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2022 FinTech Global