This week in FinTech proved to be a strong week for credit and financial technology-focused companies, with 36 investments being recorded.

Leading the way for investments this week was financial super-app Curve, who were able to fund its first $1bn in loans with a facility provided by Credit Suisse.

Elsewhere, credit-first FinTech Avant was able to lock in $250m in corporate debt and redeemable preferred equity.

As 2022 winds to a close, it has been a mixed year for the industry. While more eyes are on the FinTech sector than ever before, performances are proving to be poorer in certain markets.

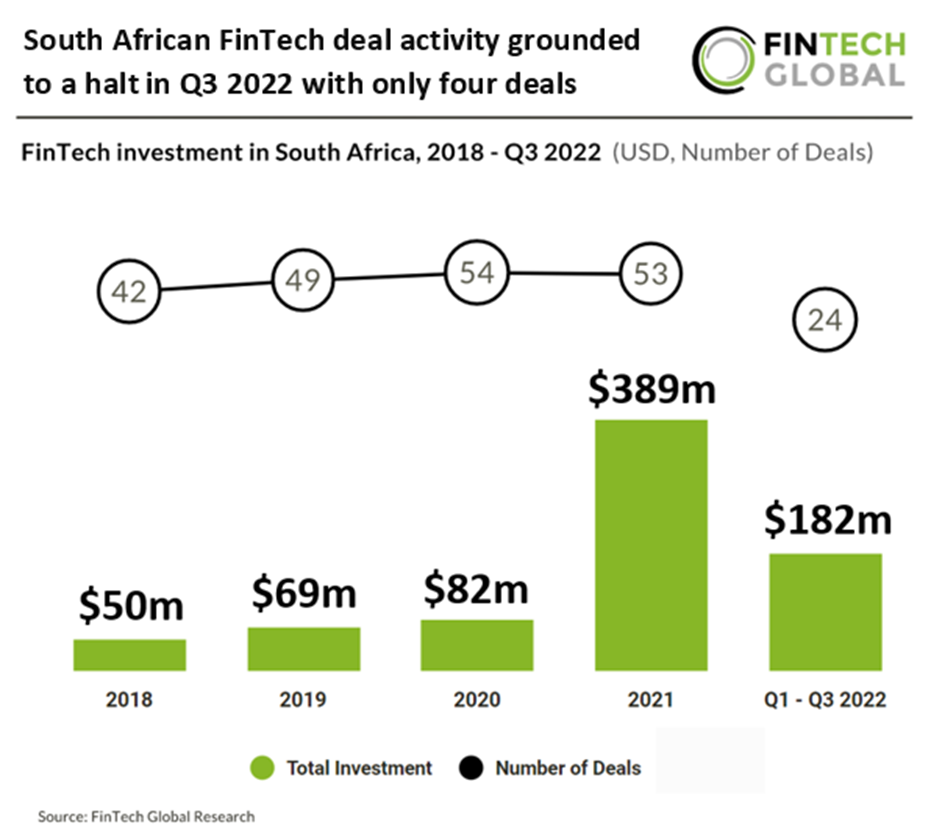

For example, research by FinTech Global this week found that South African deal activity reached four deals in total during the third quarter of 2022, a 55% reduction from Q2 2022.

Overall deal activity from Q1-Q3 2022 reached 24 deals in total which puts deal activity on track to reach 32 deals in 2022, a 40% drop from the previous year.

Here are this week’s deals.

All-in-one FinTech app Curve locks in $1bn credit facility

Financial super-app Curve has closed a deal to fund its first $1bn in loans with a facility provided by Credit Suisse.

According to Curve, the facility will enable Curve to scale its lending business – Curve Flex – across the UK, the EU and the US.

Curve claims the Flex product will allow customers to split any transaction they’ve made with Curve, at any merchant, using any card, anywhere in the world, into monthly instalments.

Avant secures $250m corporate debt from Ares

Avant, a credit-first FinTech company, has received $250m in corporate debt and redeemable preferred equity from Ares Management Alternative Credit funds.

The FinTech company provides access to personal loans and credit cards. It combines technology, analytics and superior customer service to help customers meet their financial goals.

This fresh funding follows a $250m securitisation in September. This brought the total amount of asset-backed debt financing commitments secured by Avant in 2022 to $1.1bn and Avant’s total commitments to over $1.6bn to support its consumer credit portfolios.

Sunbit bags $250m to make everyday expenses easier

Sunbit, a company building financial technology for everyday expenses, has closed a $250m revolving debt facility.

Sunbit describes itself as a company that builds financial technology for real life.

The company’s technology aims to ease the stress of paying for life’s expenses by giving people more options on how and when they pay.

The company offers the Sunbit Card, a next-generation, no-fee credit card that can be managed through a powerful mobile app, as well as a point-of-sale payment option available at more than 16,000 service locations, including auto dealership service centers, optical practices, dentist offices, veterinary clinics, and specialty healthcare services.

Security automation firm Drata scores $200m

Drata, a continuous security and compliance automation platform, has netted $200m in a Series C funding round.

The round was led by GGV Capital and ICONIQ Growth and also saw participation from Salesforce Ventures, Cowboy Ventures, Silicon Valley CISO Investments, FOG Ventures and S Ventures. Several angel investors also took part in the round.

In 2021, Drata raised $100m in a Series B raise that lifted its valuation to $1bn. Following this recent round, the company is now valued at $2bn.

Allica Bank lands £100m Series C

Allica Bank, a FinTech SME challenger bank, has scored £100m in a Series C funding round headed by TCV.

Allica claims it is the UK’s only digitally-native challenger bank committed to providing a full-service banking relationship to established SMEs and entrepreneurs, providing them with lending, savings and payments.

The firm said it has built ‘exceptional’ momentum in the three years since being granted a banking licence, delivering continuous growth and demonstrating its potential to transform the UK’s traditional SME banking market in the decade ahead.

Investment firm reAlpha nets $100m capital commitment

reAlpha Asset Management, an AI-powered real estate technology and investment company, has scored $100m in a capital commitment.

The company claims it has a goal to empower everyone with the ability to invest in the global short-term rental market – which has a valuation of $1.2trn.

reAlpha has signed an agreement with GEM Global Yield, a Luxembourg-based private alternative investment group, for the capital commitment.

Per the terms of the agreement, GGY commits to providing reAlpha with a share subscription facility of up to $100 million for a 36-month term following the public listing of reAlpha’s shares.

reAlpha will remain in control of the timing and, within certain limits, the maximum amount of each individual drawdown under this facility and has no minimum drawdown obligation.

Younited hits €1.1bn valuation with $60m raise

Younited, which offers instant credit in Europe, has raised €60m in a fresh funding round, bringing its valuation to €1.1bn.

The capital was supplied by Eurazeo, Crédit Mutuel Arkéa, Bpifrance via its Large Venture fund and Goldman Sachs.

With the funds, Younited will further the deployment of its ‘instant credit’ and open banking solutions. It also plans to deepen its partnership activity around the world.

This solution empowers them to provide customers with financing on Loans of up to €50,000 are available, with repayment terms of 84 months.

MarginEdge lands $45m in Series C funding

Restaurant management and bill payment platform MarginEdge has scored $45m in a round of Series C funding.

Founded in 2015, MarginEdge offers a platform that offers invoice processing, inventory management, budgeting, recipe analysis, supplier bill payment capabilities and performance tracking.

The company is integrated with over 50 POS and accounting platforms. According to FinSME, during 2022, the company entered into strategic collaboration and integrations with partners such as Intuit, Gordon Food Service, 7shifts, and SpotOn.

BeeHero bags $42m to mitigate pollination risk

BeeHero, an insurer-investor backed data-driven technology company mitigating pollination risk to address global food security, has raised $42m in Series B funding.

As the global population increased, more food will need to be produced. BeeHero said that to accomplish this will require a 70% increase in the global food supply. Already nearing the limits of available arable land, this increase in productivity must come from improved yield.

Bee Hero added that, as noted by the UN, the demands of feeding a growing global population are compounded by the increasing bee mortality rates that threaten the production of 75% of the world’s food crops, including most fruit, vegetable, seed, nut, and oil crops, that are vital for nutritional security.

Tapline secures $31.7m pre-seed as it rises out of stealth

Digital finance platform Tapline has scored pre-seed funding of €31.7m in both equity and debt funding.

Founded in 2021, Tapline offers a digital finance platform that allows SaaS companies to trade their future revenues for upfront and non-dilutive cash.

Tapline has built a platform that allows for swift onboarding, provides clients with a proprietary tech-enabled credit score, and a free financial dashboard to monitor various metrics of users’ business daily.

HYPR lands $25m in Series C1

HYPR, a firm that specialises in passwordless technology, has scored $25m in a Series C1 round headed by Advent International.

The round also saw participation from .406 Ventures, RRE Ventures, Comcast Ventures and Top Tier Capital. Following the raise, HYPR has raised a total of $97m.

HYPR claims it is a pioneer in passwordless authentication and has demonstrated ‘tremendous momentum’ over the past 24 months.

The firm’s solution offers a consistent passwordless authentication experience regardless of the heterogeneity of a customer’s infrastructure.

Osome lands $25m to empower entrepreneurs

Osome, a Singapore-headquartered financial admin startup, has raised $25m in a Series B round on a mission to empower entrepreneurs.

According to a report from Deal Street Asia, the round was by Illuminate Financial, AFG Partners and Winter Capital.

Founded in 2017, Osome believes that entrepreneurs are society’s problem solvers. The company said such individuals see opportunities in complexities and drive society towards progress. By providing solutions to handle routine tasks, Osome aims to empower entrepreneurs to focus on driving their business forward.

Analytics platform for debt capital 9fin nets $23m

9fin, an analytics platform for debt capital markets, has secured $23m in its Series A+ funding round, which was led by Spark Capital.

With the funds, the company plans to hire more staff, bolster its presence in the US and expand its product into new asset classes.

Headquartered in London, 9fin is on a mission to organise the world’s leveraged finance information and make it accessible and useful through its data, news and predictive analytics platform.

Digital asset finance platform Bitwave secures $15m

Bitwave, a digital asset finance platform created to manage the intersection of crypto tax, accounting and compliance, has bagged $15m from a Series A.

Bitwave Institutional is a set of processes, controls, and technology designed to bring trust into the new digital asset financial system.

The company’s platform addresses the complex process, audit, accounting, tax, and reporting needs of sophisticated financial organizations that custody, trade, and use digital assets.

Israel-based bondIT secures $14m

Israel-based bondIT is an investment technology developer for investment firms and has secured a $14m investment led by BNY Mellon.

bondIT leverages advanced technologies, machine learning and explainable-AI to automate and optimise fixed income portfolio construction, management, and research. Its technology allows fixed income investors to create credit and yield-optimized portfolios based on data-driven analytics.

Its solution is data agnostic and can either be API or cloud-based. This allows seamless onboarding of internal models and connectivity with existing portfolio management and trading systems.

Brazil-based RegTech senhasegura bags $13m

Brazil-based Senhasegura, a privileged access management (PAM) solution provider, has raised $13m in its Series A investment round.

The capital injection was supplied by Graphene Ventures, a Palo Alto-based investor focused on the enterprise software and SaaS sectors.

With the funds, the RegTech company plans to expand its global footprint and accelerate product innovation in its flagship 360º Privilege Platform. The company is looking to expand its presence in LATAM and is also prioritising North America and the Middle East.

Vaultree lands $12.8m in Series A raise

CyberTech firm Vaultree has secured $12.8m in a Series A growth investment round co-led by Molten Ventures and Ten Eleven Ventures.

Also taking part in the round was Sentinel One, Elkstone Partners, Cyber Club London, CircleRock Capital and a number of cyber experts.

Vaultree claims its end-to-end encryption makes it possible to work with fully encrypted data without the need to decrypt the information or surrender security keys. The solution enables Searchable and Fully Homomorphic Encryption at close to plaintext speed – a major leap forward in the secure, scalable processing of data.

Carputty lands $12.3m to modernise auto financing

Carputty, a FinTech company modernising auto financing and ownership, has raised $12.3m in a Series A funding round.

This raise, co-led by Fontinalis Partners and TTV Capital, brings Carputty’s total funding amount to $21.9m.

Additional investors include Porsche Ventures and Grand Ventures, as well as Kickstart Fund, who led the Company’s seed round.

Founded in 2020, Carputty reengineers auto financing by leveraging data based on the consumer and not directly tied to a transaction.

Cacheflow nets $10m

Cacheflow, a no-code SaaS sales platform, has netted $10m in a fresh funding round, as it looks to bolster sales and marketing initiatives.

GV served as the lead investor, with commitments also coming from existing investors GGV and Pelion Ventures.

This equity will enable Cacheflow to accelerate its sales and marketing efforts, enabling the company to reach sellers in need of its SaaS deal-closing platform.

Founded in 2021, Cacheflow targets businesses in every stage of growth with an end-to-end sales solution to manage and grow the revenue lifecycle of the customer. Its technology simplifies the SaaS sales flow, integrating into a single, no-code platform.

Open finance platform Syncfy nabs $10m seed

Latin American open finance platform Syncfy has raised $10m in seed funding, as it prepares to grow across the region.

Point72 Ventures served as the lead investor, with commitments also coming from JAM Fund, Ausum Ventures, Avalancha Ventures, FJ Labs, MANTIS Venture Capital and XBTO Humla Ventures.

Notable angel investors also joined the round, including Tether co-founder Brock Pierce and Quantum Artificial Intelligence engineer Hartmut Neven.

Syncfy enables single API access to financial data from 125+ different banks, digital wallets, tax authorities, utility providers, crypto exchanges, and blockchains across 15+ countries in Latin America, as well as internationally.

Paywatch lands $9m to empower employees

Paywatch, a Maylasian earned wage access service provider, has raised $9m in a pre-Series A funding round to empower employees.

According to a report from Technode Global, the round was led by returning investor Third Prime.

The round also saw participation from Hana Ventures (the venture arm of Hana Financial Group in Korea), Parkwood Corp. and notably, the endowments of Vanderbilt University and University of Illinois Foundation.

Founded in 2020, Paywatch enables employees to access their earnings instantly, rather than waiting until payday.

Rezonate launches from stealth with $8.7m

Israel-based Rezonate is a new identity protection that has launched from stealth following the close of an $8.7m funding round.

Commitments to the investment came from State of Mind Ventures, Flybridge, toDay Ventures, Merlin Ventures seed fund and others. Unnamed angel investors also joined the round.

With the capital, the RegTech company is planning to bolster its go-to-market efforts and explore new innovations and partnerships.

Rezonate was co-founded by Roy Akerman and Ori Amiga. The team claims to have created the industry’s first cloud identity protection platform (CIPP).

Pylon nets $8.5m

Pylon is a startup that is helping lenders and FinTechs embed end-to-end mortgage tools, and it has reportedly raised $8.5m in its seed round.

The investment was led by Conversion Capital who served as the lead investor. Other commitments came from Peter Thiel, Fifth Wall, Montage Ventures, QED Ventures and Village Global.

Additional funds were supplied by angel investors from Zillow, SoFi, Ramp, Figure and Blend.

Pylon was founded in 2022 by Trent Hedge and Marco Monteiro, with the aim of making credit services easier to implement.

MoveEasy bags $7m

MoveEasy, a home management platform and concierge service, has raised $7m in Series A funding.

The round was led by Moderne Ventures with a strategic investment by The Travelers Companies.

MoveEasy is a fully integrated white labelled home management platform, on a mission to empower real estate brokerages, agents and mortgage partners to deliver “unmatched value” to clients.

The company’s platform and app provide clients with a holistic view of every decision that they make as homeowners, whether they are buying, selling, moving or managing their existing home.

Axiom is a new cybersecurity launching out of stealth

Axiom is a new cloud security solution that has launched out of stealth following the close of its seed round on $7m.

Axiom claims that identity and access management (IAM) is hindering engineering productivity and posing cybersecurity risks. It stated that engineering teams are stuck waiting to get access to software.

Additionally, the sprawl of developer platforms across a multitude of clouds has created a meandering landscape. This means the IAM best practice of least privilege is impossible to scale.

Get Covered bags an extra $6m

Get Covered, an InsurTech that builds software solutions for the property insurance sector, has raised $6m in Series A-2 funding.

The round was backed by RET Ventures, State Farm Ventures, WISE Ventures and LeFrak.

Founded by Brandon Tobman, Dylan Gaines and Ryan Solomon in 2018, GetCovered was built with the aim of bridging the gap between the insurance and real estate sectors.

Get Covered provides insurance technology products and services for the multifamily industry designed to make buying, selling and tracking insurance as simple and seamless as possible.

German compliance firm secjur lands €5.5m

secjur, a Hamburg-based provider of an AI-powered compliance automation platform, has scored €5.5m in seed financing.

The round was led by Visionaries Club with participation from Mario Götze, Nico Rosberg, Cocoa Ventures, SB21, Estelle Merle, Charlotte Pallua, Ignaz Forstmeier, and other angel investors.

According to FinSMEs, secjur provides an automated platform for compliance enabling anti-money laundering, data protection and information security.

The company has already established partnerships with companies such as Mercedes Benz, Samsung, Pantaflix, and Tomorrow Bank, among others.

CyberTech Saporo locks in €4m seed funding

Swiss cybersecurity firm Saporo has landed €4m in a seed funding round headed by XAnge.

Earlier this year, Saporo raised €2.6m in pre-seed funding. Following this, the company claims it saw a surge in customer requirements from businesses looking to incorporate its technology.

Saporo claims its unique approach using graph theory helps companies build and maintain secure systems by design. Their product enables organizations to model, measure, and increase their resistance to cyberattacks.

Seeds Investor bags $2.7m

Seeds Investor, which provides financial advisors with the tools to offer personalised and engaging investing experiences, has raised $2.7m in seed funding.

The investment was led by Social Leverage, with commitments also coming from DuContra Ventures and The Compound Capital Fund I, which is the affiliated venture capital fund of Ritholtz Wealth Management.

Several angel investors also joined the round, including FA Match CEO Ryan Shanks and former Goldman Sachs co-head of technology Paul Walker.

Cybersecurity education company SafeStack nabs $2.5m

New Zealand-based cybersecurity education company SafeStack has raised NZD 4m ($2.5m), as it looks to hire more staff.

The investment was led by Blackbird, an Australasian investment firm. Other commitments to the round came from Jelix Ventures, Carthona Capital, NAB Ventures, K1W1, and New Zealand Growth Capital Partners’ Aspire NZ Seed Fund.

With the funds, the CyberTech company plans to hire more staff as it hopes to build a team of 30 million security-minded software developers around the world.

SafeStack aims to help unlock the potential of a company’s software development team’s cybersecurity capabilities.

Insurance startup Starfish Specialty bags $2.5m

Starfish Specialty, a managing general agent (MGA), has raised $2.5m in its second funding round in addition to £500,000 in debt.

According to a report from Insurance Business Mag, the round was led by Starfish Specialty’s founders and supported by others including industry veteran Brad Emmons, who has been named a senior advisor to the company.

Starfish was launched last year by Jeremy Hitzig, Tom Lane, Margaret McBurney, Michael Thabet, Brooks Chase and James Flynn.

The company’s goal is to protect the bottom line for carriers and provide the right solutions for brokers by listening closely, responding quickly and putting the needs of its partners first.

Membrane Finance nets €2m in seed financing

Finnish FinTech Membrane Finance, a company building a European alternative to the USD stablecoin, has secured its e-money licence and raised €2m.

The seed funding round was led by Finnish seed stage venture capital company Maki.vc.

According to Finextra, with the Electronic Money licence secured, EUROe – Membrane’s product – will become the first regulated EUR-based, full-reserve stablecoin in the EU.

Planned to launch early next year, EUROe is a fully reserved, Euro-nominated stablecoin that brings fiat Euro liquidity on-chain, bridging the traditional financial systems to the world’s leading blockchains.

Insurance risk management startup Intelligent AI secures £2m

Intelligent AI, which claims to be disrupting insurance risk management with AI and data analytics, has reportedly raised £2m in seed funding.

SuperSeed served as the lead investor, with commitments also coming from the Cornwall and Isles of Scilly Investment Funds, according to a report from Insurance Times. Unnamed UK-based angel investors also joined the round.

This seed funding will enable Intelligent AI to further the development of its underwriting platform. The InsurTech company is also looking to hire more staff, drive global partnerships and expand beyond the UK and US.

AI-powered Koble collects $1.2m to enhance investment decisions

Koble, an AI-powered platform that improves investment decisions, has reportedly secured $1.2m in pre-seed funding.

With the capital, the company plans to enhance its algorithms and technology.

Koble claims its AI technology can identify early-stage investments that outperform the market. The company structured massive volumes of publicly available information into a unique dataset, which its algorithms use to source, evaluate and invest.

Insiber raises €100,000

Insiber, which is focused on helping SMEs with their cybersecurity risks, has reportedly collected €100,000 in funding.

The capital was supplied by Singaporean venture capital fund Antler, according to a report from Tech Razzle.

Insiber was founded by Guido van Nispen and Vitaly Shtyrkin, who met during Antler’s residency in 2022. The duo wanted to create a solution to help SMEs easily interact with cyber insurance and cybersecurity tools.

Since that initial idea, Insiber has established itself as a one-stop platform for cybersecurity and cyber insurance.

Texas FinTech Save snares funding

Save, a Texas-based FinTech firm, has raised an undisclosed amount of funding from a round led by BNP Paribas.

Also taking part in the investment round was Webster Bank.

Founded in 2019, Save claims it is the world’s first savings platform. The firm states it is team of ‘market-leading investment professionals’ who believe that the current equity markets contain significant draw-down risks.

Last week, there were 24 funding rounds in FinTech, with a total of $648m raised.

Copyright © 2022 FinTech Global