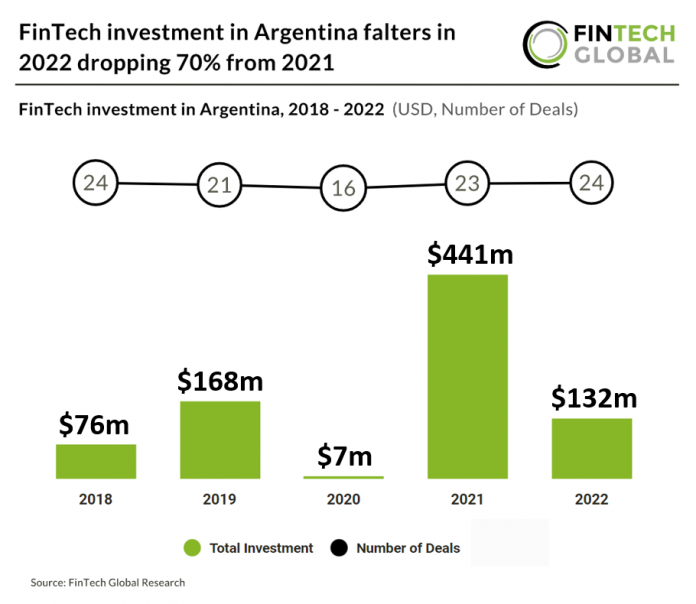

Key FinTech Investment stats in Argentina from 2022:

• FinTech investment in Argentina reached $132m in 2022, a 70% drop from 2021’s levels

• FinTech Deal activity in 2022 increased by one deal, totalling at 24

• Q4 2022 was the most active quarter defying global trends with eight deals announced

FinTech in Argentina has had a rocky 2022 with investment in the country dropping significantly from 2021 levels. This being said, Ualá, a mobile app used to manage paid debit cards, raised $350m in 2021 and $150m in 2019. By removing these deals, 2022 broke a new record for FinTech investment. Deal activity has remained strong in the past five years with a small drop during 2020 which can be attributed to Covid-19. Last year also saw the most deals raised by Argentinian FinTech companies and Q4 was the most active quarter indicating a strong 2023.

Geopagos, an embedded PayTech solution, was the largest FinTech deal in Argentina during 2022, raising $35m in their latest venture round led by Riverwood Capital. Geopagos plans to use the fresh capital to strengthen its Latin American presence and make new investments in its digital portfolio. The company also aims to ramp up its efforts to develop innovative solutions such as boosting its omnichannel products and facilitating the development of new payment acceptance systems. Geopagos has a presence in 15 Latin American countries and says it facilitates more than 150 million transactions with a processed volume of $5 billion per year.

In May 2022, the Banco Central de la República Argentina, the central bank of the country, adopted new regulations for digital wallets. The board’s mandate requires financial institutions, including banks, FinTechs, payment services providers, and digital wallet administrators, to give their customers the option to link other accounts. This allows customers to make payments and transfers through one digital wallet while utilizing funds from another account. The central bank has mandated that banks provide account information to payment services providers to enable this feature. Participants in the industry have until September 30, 2022 to comply and implement the necessary changes, according to the central bank.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2023 FinTech Global