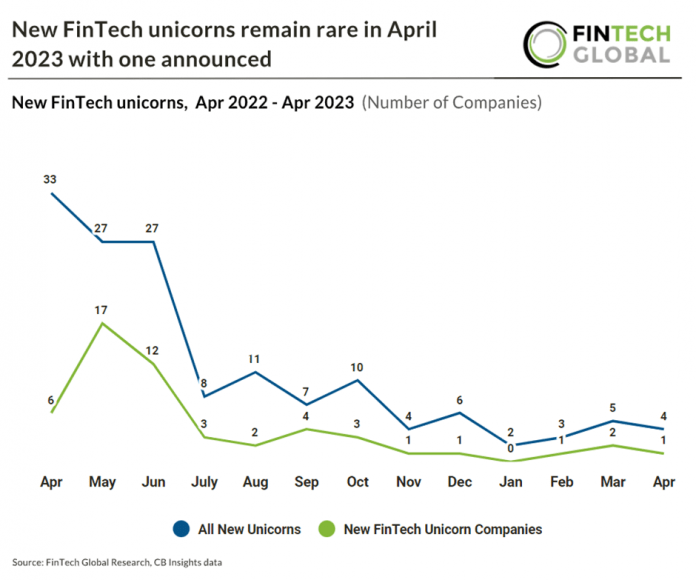

New FinTech unicorn announcements remain low in April 2023 with only one announced. Quantexa, a UK based anti financial crime platform, was the only FinTech unicorn in April 2023 after raising $129m in their latest series E funding round, propelling Quantexa’s valuation to $1.8bn. The round was led by GIC, a global institutional investor, and existing investors also participated, including Warburg Pincus, Dawn Capital, British Patient Capital, Evolution Equity Partners, HSBC, BNY Mellon, ABN AMRO, and AlbionVC. Quantexa has achieved impressive growth, with their annual recurring revenue (ARR) increasing by over 100% since the completion of their Series D funding round. In addition, Quantexa has experienced strong growth in all regions, including a 180% rise in ARR in North America. Over the past year, Quantexa has expanded its geographic reach, resulting in an increase in its workforce from 500 to 650 employees. The company has opened new offices in New York City, the UAE, Amsterdam, and established a new Technology and Analytics Hub in Malaga Tech Park, Spain, in November 2022. With the additional funding, Quantexa will continue to expand its global presence and invest in its top-tier engineering talent.

Looking forward in 2023, Who are the FinTech Soonicorns to watch?

Deepki, A SaaS platform for the real estate industry to measure sustainability metrics, raised €150M in March 2022, setting their post-money valuation between $660m-990m. aims to assist the real estate sector in mitigating its ecological footprint. The company supports enterprises in gathering and consolidating sustainability-related data, encompassing metrics such as carbon emissions, water and energy consumption, waste production, and other ESG (Environmental, Social and Governance) indicators. The startup endeavors to automate this process to the greatest extent possible, leveraging APIs and web-scraping tools.

TIFIN, a personalised investment platform utilising AI, raised $109m in a Series D financing round which brings TIFIN’s valuation to $842m. TIFIN leverages AI to enable personalised wealth management and digital distribution for investment managers. Its ultimate goal is to enhance financial well-being through investing. TIFIN operates multiple specialised divisions that include Magnifi, a search-based investment marketplace; Financial Answers, a platform for generating investment advice and demand; TIFIN Wealth, a collection of personalisation components for wealth managers, advisors, and other intermediaries; and Distill, an AI-driven analytics and intelligence platform for asset managers and wealth enterprises. With the infusion of fresh capital, TIFIN plans to continue expanding its operations, with a particular focus on enhancing Magnifi’s consumer platform, expanding Distill’s reach among asset and wealth enterprises, expanding outside the US, and driving additional fintech innovation initiatives. This funding will supplement TIFIN’s existing funds from prior capital raises.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2023 FinTech Global