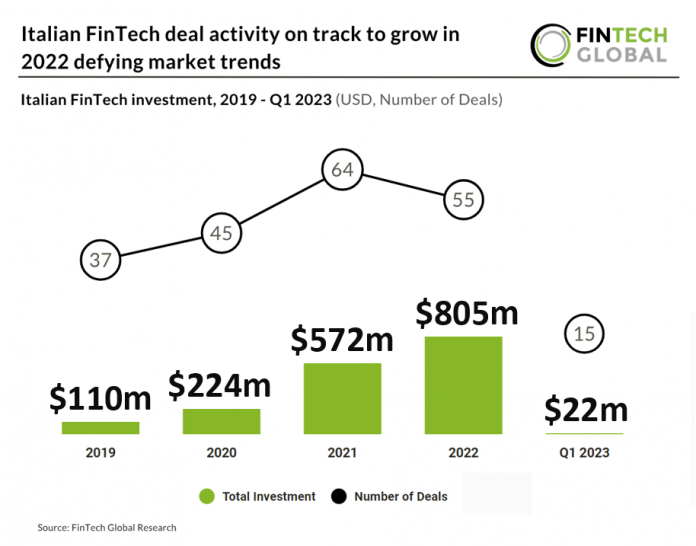

Key Italian FinTech investment stats in Q1 2023

• Italian FinTech deal activity reached 15 deals in Q1 2023, 15% higher than the first quarter last year

• However, Italian FinTech companies raised a combined $21.9m in during the first three months of 2023, a 90% drop YoY

• PayTech was the most active Italian FinTech subsector with four deals, a 27% share of total deals

Italian FinTech deal activity witnessed a surge in Q1 2023, as it recorded a total of 15 deals. This represents promising growth of 15% compared to the corresponding quarter of the previous year, Q1 2022. Based on Q1 2023’s deal activity, Italian FinTech is on track to reach 60 deals in 2023, a 9% increase from 2022. In Q1 2023, Italian FinTech companies collectively raised a total of $21.9m. This reflects a substantial decline of 90% compared to the previous year as private market valuation broadly decline.

UNGUESS (formerly AppQuality), a crowd testing platform, was the largest Italian FinTech deal in Q1 2023, raising $10.9m in their latest Series B funding round, led by FITEC. The company intends to use the funds to consolidate its position in the crowdtesting sector in the Italian market, to strengthen the expansion in other strategic European countries, and support the development of the platform, with a view to integrating it with new solutions, content and services. Over time, the range of services offered to businesses has expanded to include different types of tests on any digital product or physical device, services and solutions for the optimisation of user and customer experience (UNGUESS Experience), for the verification of the presence of functional defects and bugs in software quality (UNGUESS Quality), and finally to embrace the cyber security sector with a solution based on a crowd of 500 certified Italian Ethical Hackers (UNGUESS Security).

PayTech was the most active Italian FinTech subsector with four deals, a 27% share of total deals. In comparison to other European countries, Italy displays a higher reliance on cash transactions. Prime Minister Giorgia Meloni introduced two measures in December 2022 aimed at promoting cash usage and reducing commission costs paid to banks and digital payment providers. The first measure proposed allowed merchants to reject digital transactions below 60 euros, while the second measure aimed to raise the legal limit for cash payments from 1,000 euros to 5,000 euros. These initiatives received criticism from the Italian parliament, the central bank, and the European Commission, as they were seen as potentially facilitating Italy’s shadow economy. As of April 2023 no deal has been brokered. Rome is pushing for an agreement to lower fees on electronic transactions, specifically for businesses with annual revenues up to 400,000 euros. If no deal is reached, Prime Minister Meloni has stated her willingness to impose a “solidarity contribution” equal to 50% of the net proceeds from these transactions. The proposed scheme involves eliminating fees for payments up to 10 euros, with progressively reduced fee cuts for transactions ranging from 11 to 30 euros. However, some financial firms are reportedly hesitant about adopting this solution.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2023 FinTech Global