Key UK InsurTech investment stats in Q1 2023:

• UK InsurTech deal activity reached 14 deals during Q1 2023, a 39% drop from Q1 2022

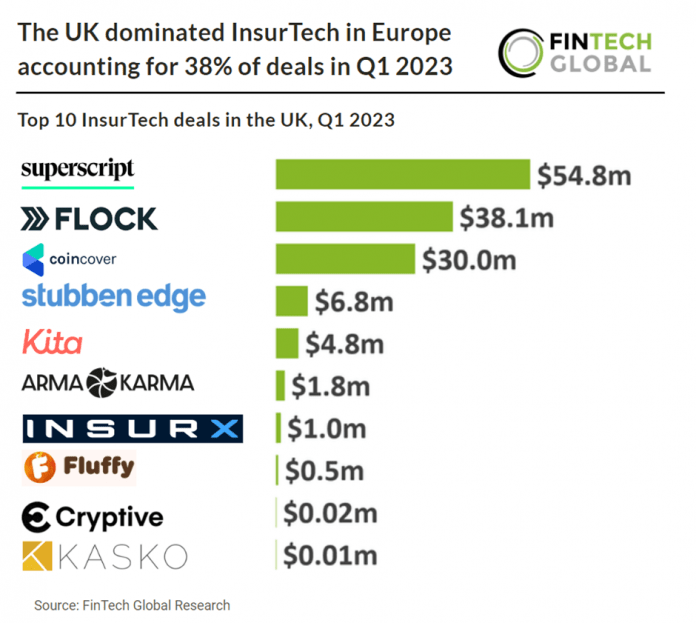

• UK InsurTech companies raised $138m in Q1 2023, a slight 9% drop YoY

• The UK was the most active InsurTech country in Europe during Q1 2023 with 14 deals out of 38 announced in the region

During the first quarter of 2023, 14 new InsurTech deals were completed in the UK, marking a 39% decrease compared to the same period in 2022. In Q1 2023, InsurTech companies in the UK secured a combined total funding of $138m, representing a minor 9% decline compared to the previous year.

Superscript, a business insurance provider, had the largest European InsurTech deal in Q1 2023 after raising $55m (£45m) in their latest Series B funding round, led by BHL Holdings. Superscript plans to use the funds to further develop its underwriting and broking capabilities, enhanced by machine learning. The company has a fully “self-serve” online platform that allows customers to buy and manage insurance online with the help of machine learning technology. It will also expand its range of insurance and products and services for “international distribution” following the opening of its office in Rotterdam last year to support its growth plans in Europe. Having seen more than a fivefold increase in its customer base since its £8.5m Series A raise in 2020, the company now counts Amazon Business and Virgin Money Bank among its partners.

The UK was the most active InsurTech country in Europe with 14 deals, a 38% share of total deals. France was the second most active with six deals, a 16% share of deals and Germany was third with four deals, a 11% share of total deals.

In Jan 2023, The Prudential Regulation Authority (PRA) updated insurers on its priorities for the supervision of life and general insurers in 2023. The PRA aims to ensure that the insurance sector can consistently provide financial protection and security to policyholders, even in challenging circumstances. Insurers are expected to adapt to disruptive changes while maintaining strong governance, risk management, and resilience to continue offering essential insurance services to the economy. The main areas of focus for 2023 include financial resilience, risk management, implementing financial reforms, reinsurance risk, operational resilience, and facilitating an orderly exit for insurers. These priorities are part of the PRA’s ongoing efforts to ensure the stability and reliability of the insurance industry. The letter is addressed to all insurers, including those with operations in other countries, under the supervision of the PRA.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2023 FinTech Global