Key Global FinTech acquisition stats in H1 2023

• FinTech acquisition activity halved in H1 2023 YoY reaching 174 acquisitions in total

• FinTech acquisition activity dropped 20 percentage points more than the general market

• The average FinTech acquisition size was $844m in H1 2023 up three-fold from H1 2022

The number of FinTech acquisitions in H1 2023 decreased by 50% compared to the previous year, totalling at 174 acquisitions. FinTech acquisition activity experienced a 20 percentage point decline compared to the overall market. Reasons for this can be attributed to uncertainty around declining valuations. According to Sifted, the average early-stage valuations (Series A to C) are down 23% from Q1 of last year while late-stage valuations (Series C+) have fared substantially worse, registering a year-on-year decline of 77%. The average FinTech acquisition size was $844m in H1 2023 up three-fold from H1 2022.

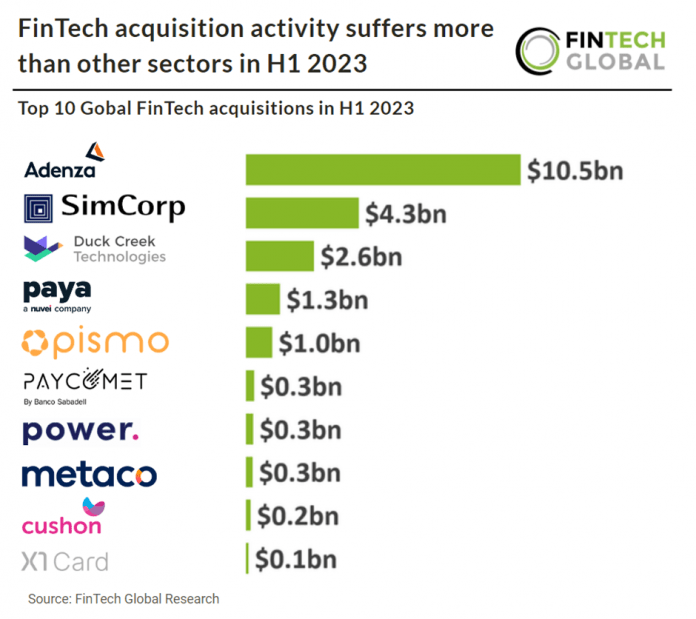

Adenza, which offer end-to-end trading, treasury, risk management and regulatory compliance solutions, was the largest FinTech acquisition in H1 2023 after being acquired by Nasdaq, an online global marketplace for buying and trading securities, for $10.5bn. The acquisition of Adenza brings together two world-class franchises steeped in market infrastructure, regulatory, and risk management expertise at a time when financial institutions are navigating some of the most complex market dynamics in history said Adena Friedman, Chair and Chief Executive Officer of Nasdaq. Nasdaq have said Adenza complements Nasdaq’s trusted brand and platform of mission-critical solutions, across Marketplace Technology and Anti-Financial Crime solutions, with a broader spectrum of offerings in areas such as regulatory technology, compliance, and risk management solutions. Adenza serves a $10 billion SAM growing 8% per year, increasing Nasdaq’s SAM by approximately 40% to $34 billion. Adenza acquisition increases Solutions Businesses to 77% of 2023E total revenue, up from 71% today. Adenza acquisition will boost Nasdaq ARR* as a percentage of total revenues to 60% in 2023E, up from 56% today.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2023 FinTech Global