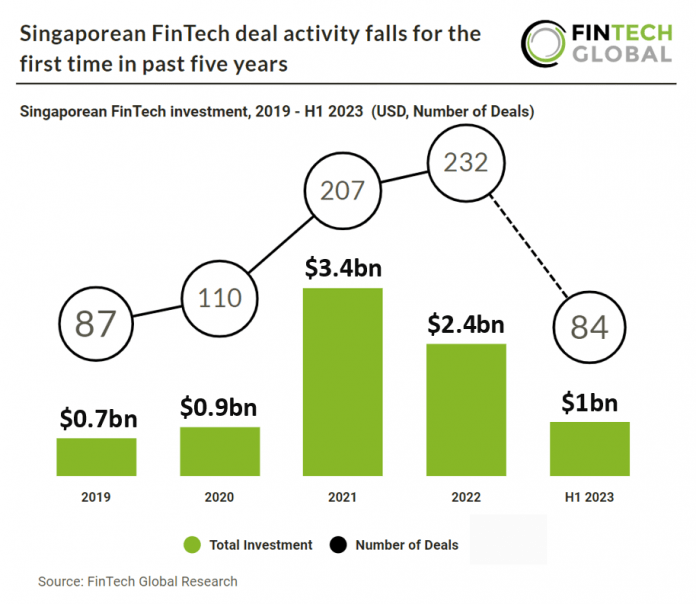

Key Singaporean FinTech investment stats in H1 2023:

• Singaporean FinTech companies raised a combined investment of $1034m in H1 2023, a 14% drop YoY

• Singaporean FinTech deal activity reached 84 deals in H1 2023, a 27% decrease from H1 2022

• Singaporean FinTech deal activity is expected to reach 168 deals in 2023

Singaporean FinTech deal activity is on track to reduce for the first time in the past five years. Based on deal activity in H1 2023, deal activity in 2023 is expected to reach 168 deals in total, a 28% drop from 2022. In H1 2023, FinTech companies based in Singapore secured a total investment of $1034m, indicating a 14% decline compared to the previous year. Singaporean FinTech deal activity reached 84 deals in H1 2023, a 27% decrease from H1 2022.

Kredivo Holdings, which provide a wide range of financial services including BNPL and loans, was the largest FinTech deal in Singapore during the first half of 2023 raising $270m in their latest Series D funding round, led by Mizuho Financial Group. The company says the new capital will be deployed to support its existing ecosystem of digital payments and credit service and to finance the upcoming launch of its neobank Kroo. Akshay Garg, CEO of Kredivo Holdings, says: “Despite challenging market conditions, investors continue to recognize the scale and strength of our business, and our innovation potential. The upcoming expansion into digital banking is deeply synergistic with the existing Kredivo product and also opens up a very promising channel for us to become the digital financial services platform of choice for tens of millions of consumers in Southeast Asia.”

In response to the increasing relevance of ESG issues, the Monetary Authority of Singapore (MAS) launched its ESG Impact Hub on 5 October 2022, to foster co-location and collaboration between ESG fintech startups and solution providers, financial institutions and real economy stakeholders. This Hub seeks to capitalise on the strong industry interest in Project Greenprint launched in 2020 and accelerate the growth of Singapore’s ESG ecosystem. MAS has also introduced disclosure and reporting requirements for ESG funds. As of 1 January 2023, the funds will now be required to disclose information on an ongoing basis, and investors will receive yearly updates on the progress of the ESG goals that the funds have specifically set.

Singaporean FinTech deal activity falls for the first time in past five years

Investors

The following investor(s) were tagged in this article.