Key Global Lending Technology investment stats in Q2 2023

• Lending Technology deal activity reached 126 deals in Q2 2023, a 22% drop YoY

• Lending Technology companies raised a combined $554m in Q2 2023, a 67% drop from Q2 2022

• The USA was the most active Lending Technology country with 61 deals

Lending Technology companies globally completed 126 funding rounds in the second quarter, showing a 22% decrease compared to the same period in the previous year. During the second quarter of 2023, Lending Technology companies collectively raised $554m, indicating a significant 67% decline compared to the funding raised in Q2 2022. According to Allied market research the global FinTech lending market was worth $449bn in 2020 and is expected to reach $4,957bn by 2030, growing at a CAGR of 27.4% between 2021 and 2030.

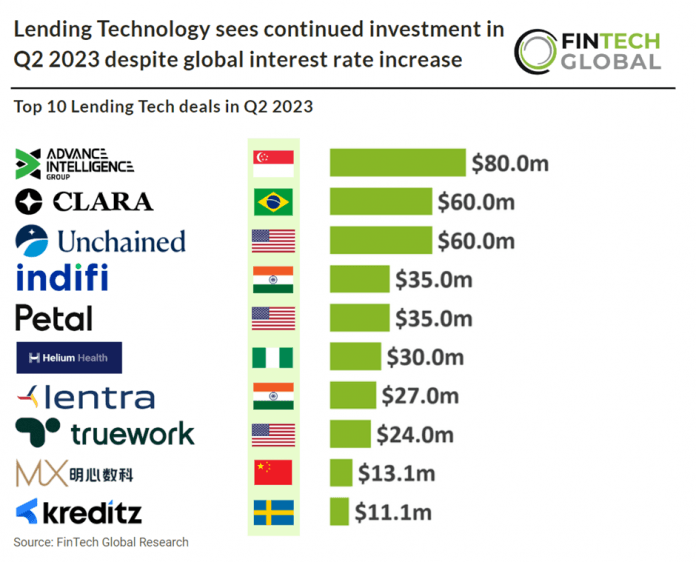

Advance Intelligence, which offers an ecosystem of AI-powered, credit-enabled products and services, had the largest Lending Technology deal in Q2 2023 after raising $80m in their latest private equity funding round, led by Northstar Group and Warburg Pincus. Jefferson Chen, Co-Founder, Group Chairman, and Chief Executive Officer of Advance Intelligence claims that this new investment will contribute to the acceleration of our program to use artificial intelligence (AI) technology to simplify consumer transactions and enable more equitable and widespread access to credit and financial products and services. The company has raised over $700 million in total and secured capital exceeding $1 billion for its credit book. Advance Intelligence Group, which operates across Asia, is one of the largest independent financial services-focused technology startups in the region.

The USA was the most active Lending Technology country with 61 deals, a 48.1% share of deals. India was the second most active Lending Technology country with 11 deals, an 8.7% share and Brazil was third with seven deals, a 5.5% share.

An increase in interest rates is a double edge sword for those offering loans as there will better margins for lenders but generally less customers as the repayments are higher. This being said higher interest rates coupled with high inflation will cause consumers to struggle with the cost of living and may turn to alternative sources of lending as banks have stricter lending criteria due to regulatory rules.