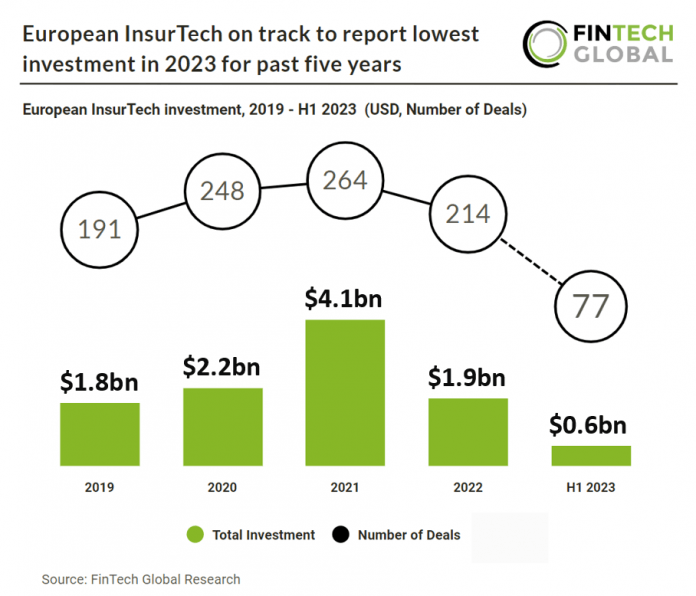

Key European InsurTech investment stats in H1 2023:

• European InsurTech deal activity is on track to reach 154 transactions in 2023, a 28% reduction from last year’s levels

• European InsurTech investment in H1 2023 reached $595m, a 46% drop from H1 2022

• The UK remains the most active InsurTech country in Europe with 26 deals in H1 2023

European InsurTech has seen a correction in 2023 with both deal activity and investment on track to drop to their lowest levels in the past five years. Based on the investment pace in the first six months, InsurTech deal activity in Europe is projected to hit 154 funding rounds in 2023, a 28% decrease compared to the levels seen in 2022. In the first half of 2023, European InsurTech investment totalled at $595m, reflecting a 46% decline compared to the same period in 2022.

Quantexa, which provide data analytics for anti-money laundering, had the largest European InsurTech deal in H1 2023, raising $129m in their latest Series E funding round, led by GIC. In what has been a difficult period for many tech companies, Quantexa continues to post impressive growth, having grown their ARR over 100% since closing their Series D round. In the same time period, Quantexa has seen robust growth in all regions, including a breakout performance in North America, with an increase in ARR of over 180%. This new capital will ensure that Quantexa continues to grow its global presence and invest in its world-class engineering talent. Quantexa also plans to use the funding to boost technology innovation efforts and strengthen its Decision Intelligence Platform capabilities in low-code data fusion, graph analytics, machine learning (ML), natural language processing (NLP) and artificial intelligence (AI). Additionally, Quantexa will increase focus on accelerating joint go-to-market efforts with its flagship partners which include Google, Moody’s, Accenture, KPMG, Deloitte, and EY.

The UK continued to be the most active InsurTech country in Europe with 26 new capital raises in H1 2023, a 34% share of all transactions. France and Germany were the joint second most active InsurTech countries with nine deals each a 11.6% share of deals.

The Retained EU Law (Revocation and Reform) Act 2023 makes significant changes to the framework of REUL. The Treasury will repeal the firm-facing requirements in retained EU law (REUL), and we will replace those provisions, where appropriate, with our rules. There is a significant amount of REUL, and the repeal and replacement work will have an impact on our Handbook. This includes the Insurance Distribution Directive (IDD). With the next steps being an FCA Consultation Paper in September 2023. The IDD was designed to establish standards and transparency measures for insurance distributors, ensuring fair treatment and clear information for consumers when purchasing insurance. It covered aspects like business conduct standards and transparency requirements, such as providing comprehensive information to consumers. Efforts were underway to replace certain regulations related to the IDD, in collaboration with the Treasury, for regulatory consistency.