Investors’ financial behaviours have manifested a palpable shift towards riskier waters in 2023, marking a noticeable increase in an aggressive approach to investments compared to the previous year.

Amidst the treacherous currents of high inflation and surging interest rates, there’s a keen focus among investors to prioritise income generation, becoming a significant driving force behind their investment decisions. Notably, the financial climate, muddled with uncertainties and numerous crises, has nudged investors towards seeking professional counsel, heralding an era where financial advisers and experts are steering the investment ship more frequently.

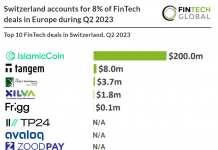

Avaloq, a noteworthy global entity in the realm of digital banking and WealthTech, provides insight into this evolving trend through its recent research. Spanning six key European and Asian markets, and encompassing the perspectives of 3,000 investors, the study sheds light on the prevailing reliance on industry professionals for investment-related decision-making.

A notable 53% of investors are drawing upon the expertise of industry professionals, a figure that has witnessed a 9 percentage point ascent since 2022. The inclination towards professional advice trumps alternative sources such as news articles and the wisdom of friends and family, emphasising a potential surge in the trust placed in financial advisers and wealth managers amidst turbulent economic times.

The underlying factors influencing this shift in investor behaviour appear rooted in the pursuit of additional income and strategic retirement planning, especially highlighted within European markets.

Fifty percent of investors have spotlighted additional income as a pivotal investing catalyst, and there’s a discernible 16 percentage point rise among European investors investing for supplementary income since 2022. Further, Avaloq’s survey underscores a transformation in investment approaches, signifying a potential burgeoning risk appetite among investors as they sail through the murky waters of the current investment environment.

Co-Chief Executive Officer of Avaloq, Martin Greweldinger, offered insights into this trend, stating, “Investors’ motivations have changed and their desire for income as well as their increased appetite for risk are reflections of the new realities of risk and return profiles in this volatile economic environment.” He continued to acknowledge the unsurprising shift towards financial advisers, advocating for the essential role they play in ensuring steady and consistent investment returns amidst the economic tumult.

Moreover, Greweldinger emphasised the lucrative opportunity that lies before wealth managers and financial advisers, necessitating an investment in technology to seamlessly anticipate and meet client needs, offering tailored investment solutions that are synchronised with evolving client preferences.

Keep up with all the latest FinTech news here.

Copyright © 2023 FinTech Global