Lloyds Bank, a renowned British financial institution, has unveiled its groundbreaking solution aimed at transforming the trade finance landscape.

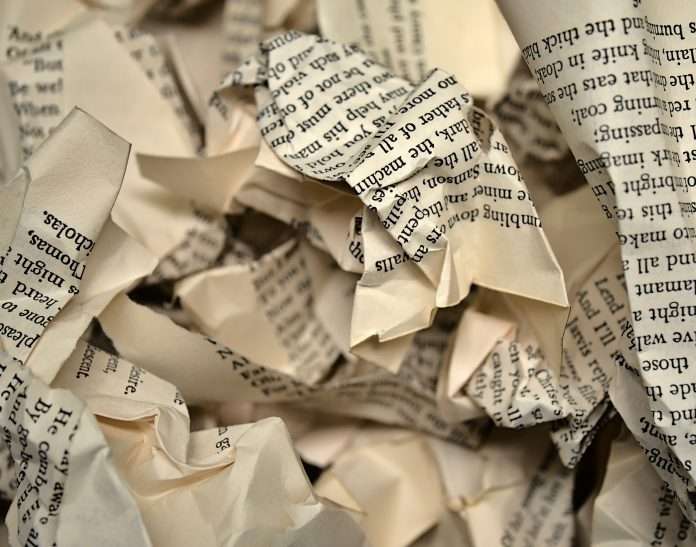

In response to the growing need for streamlined trade operations and sustainability concerns, Lloyds Bank has introduced its paperless guarantee initiative.

This innovative solution caters to businesses with substantial transaction volumes, offering them digital Direct Guarantees and Standby Letters of Credit. The primary objective is to facilitate efficient, secure, and eco-friendly trade practices.

The Paperless Guarantee initiative by Lloyds Bank aims to revolutionise the trade finance industry. Recognising the excessive use of paper in the sector, estimated at a staggering 28.5bn pieces annually, the move seeks to address this issue comprehensively. It offers clients the ability to request digital Direct Guarantees and Standby Letters of Credit, ensuring instant and secure delivery while significantly reducing their carbon footprint.

By transitioning to a paperless approach, Lloyds Bank intends to support clients in securing new business opportunities, meeting contractual obligations, and slashing both time and logistics costs. Moreover, the announcement aligns with the bank’s commitment to sustainability by substantially cutting carbon emissions, eliminating the necessity for couriering paper documents.

Gwynne Master, Head of Lending, Trade & Working Capital at Lloyds Bank said, “By working closely with our clients and their buyers and their sellers, we have a deep understanding of the nuances and challenges of trading internationally. Our latest development, the Paperless Guarantee initiative, offers clients a solution to some of those challenges. It is much more efficient, saves time, and removes costs. Removing the need for the physical delivery of paper is the future of trade and we are proud to be supporting our clients to achieve this with our new initiative.”

ABTA, the largest travel trade body in the UK, has joined forces with Lloyds Bank to embrace the paperless format, aiming to extend this innovative process to other approved bond providers.

Rachel Jordan, Director of Membership and Financial Protection at ABTA, said, “We’re always looking for new ways to deliver sustainable, efficient, and cost-effective services to our members, so we’re really excited about our new paperless arrangement with Lloyds Bank. As one of ABTA’s approved bond providers, this initiative will not only speed up the bond renewal process for ABTA members who are Lloyds Bank clients, it will also result in operational efficiencies and cost savings.”

Keep up with all the latest FinTech news here.

Copyright © 2023 FinTech Global