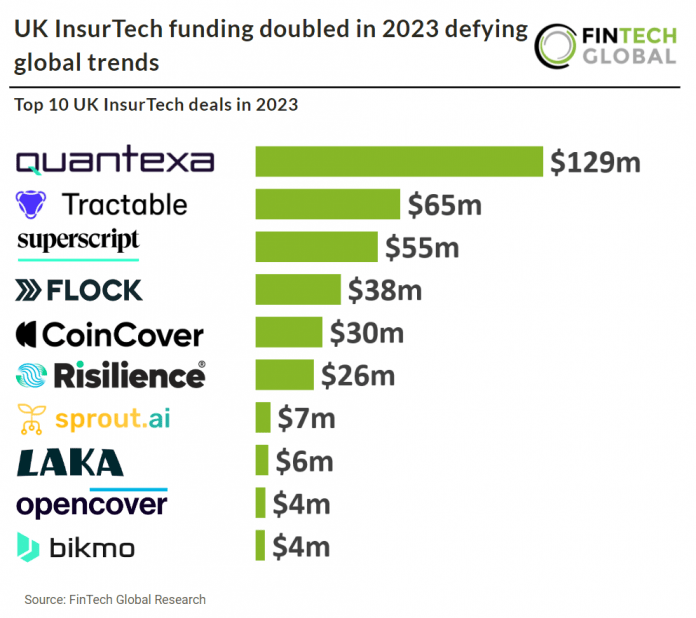

UK InsurTech investment stats in 2023:

• UK InsurTech companies raised a combined $395m in 2023, a 43% increase from 2022

• UK InsurTech deal activity in 2023 reached 40 deals, a 35% reduction YoY

• The average UK InsurTech deal size in 2023 was $9.9m, a two-fold increase from 2022

In 2023, UK InsurTech companies experienced significant financial growth, successfully raising a combined total of $395m, marking a substantial 43% increase from the previous year. However, this financial success was not mirrored in deal activity, as the sector witnessed a downturn, with the number of deals dropping to 40, a 35% decrease YoY. Despite this drop in deal frequency, the value of individual deals surged, with the average deal size in the UK InsurTech sector increasing to $9.9m, more than doubling from the figures recorded in 2022.

Quantexa, which provides data analytics for anti-money laundering, had the largest European InsurTech deal in 2023, raising $129m in their latest Series E funding round, led by GIC. In what has been a difficult period for many tech companies, Quantexa continues to post impressive growth, having grown their ARR over 100% since closing their Series D round. In the same time period, Quantexa has seen robust growth in all regions, including a breakout performance in North America, with an increase in ARR of over 180%. This new capital will ensure that Quantexa continues to grow its global presence and invest in its world-class engineering talent. Quantexa also plans to use the funding to boost technology innovation efforts and strengthen its Decision Intelligence Platform capabilities in low-code data fusion, graph analytics, machine learning (ML), natural language processing (NLP) and artificial intelligence (AI). Additionally, Quantexa will increase focus on accelerating joint go-to-market efforts with its flagship partners which include Google, Moody’s, Accenture, KPMG, Deloitte, and EY.

The 2024 update from the Bank of England, specifically from the Prudential Regulation Authority’s insurance supervision division, emphasizes the insurance sector’s significant role and outlines the priorities and supervisory activities for the coming year. Amidst a challenging environment, the sector continues to grow in both impact and complexity, notably with an increase in liability transfers from pension schemes to life insurers and rapid expansion in cyber risk underwriting. Key areas of focus include ensuring financial and operational resilience in face of credit and liquidity risks, fostering a robust regulatory landscape through the implementation of Solvency UK, and reinforcing the sector’s contribution to the UK’s medium-to-long term economic growth. The authority is actively engaging in several supervisory activities, including developing liquidity reporting requirements, preparing for stress tests in both life and general insurance sectors, and consulting on orderly solvent exit plans for insurers. Additionally, attention is being paid to the insurance sector’s expansion, particularly life insurers’ investment strategies and the prudent management of funded reinsurance and credit risky assets. The Authority also highlights the importance of addressing financial risks from climate change, with an emphasis on enhancing scenario analysis and risk management capabilities. The document reflects a comprehensive approach towards ensuring the safety, soundness, and operational resilience of the insurance sector, while also adapting to changing market conditions and regulatory landscapes.