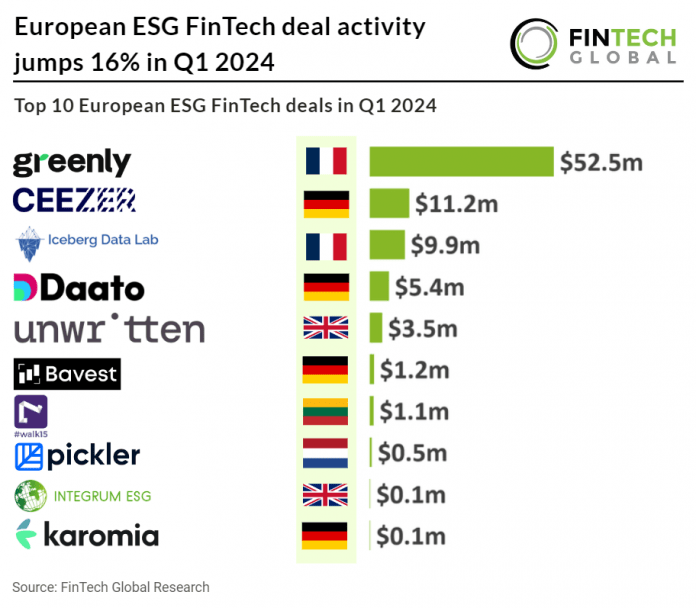

Key European ESG FinTech investment stats in Q1 2024:

• European ESG FinTech deal activity reached 14 transactions in Q1 2024, a 16% increase from the same period last year

• European ESG FinTech companies raised a combined $85m in Q1 2024, a 14% reduction YoY

• Germany was the most active European ESG FinTech country with four funding rounds

In the first quarter of 2024, European ESG FinTech saw an uptick in deal activity, totalling 14 funding rounds, marking a notable 16% rise compared to the same period in 2023. However, despite this uptick in deals, European ESG FinTech companies experienced a downturn in funding, collectively securing $85m, reflecting a 14% reduction YoY.

Greenly, a carbon management provider, had the largest European ESG FinTech deal in Q1 2204 after raising $52.5m in their latest Series B funding round, led by led by Fidelity International Strategic Ventures. The recent injection is set to catalyze Greenly’s expansion plans significantly. With ambitions to broaden their global presence, particularly in the United States and Europe, Greenly is poised to refine and enhance their suite of carbon management tools. This funding will facilitate a transition from traditional, manual carbon accounting methods to a more streamlined, technology-driven approach, ensuring businesses can easily navigate their sustainability journeys.

Germany was home to the highest number of European ESG FinTech deals with four transactions, a 29% share of deals. The UK was the second most active country with three deals, a 21% share and France was third with two deals, a 14% share of all funding rounds.

On Feb 2024, the EU Council and European Parliament have reached a provisional agreement on a regulation aimed at enhancing investor confidence in sustainable products through environmental, social, and governance (ESG) rating activities. Vincent Van Peteghem, Belgian Minister of Finance, welcomes the agreement, emphasizing its potential to drive a transition towards a socially responsible and sustainable future. The agreement focuses on improving the reliability and comparability of ESG ratings by enhancing transparency and integrity, requiring authorization and supervision by the European Securities and Markets Authority (ESMA), and ensuring compliance with transparency requirements. Key elements include clarification on the scope and exclusions of ESG ratings, disclosure requirements for financial market participants, and provisions for small ESG rating providers. Additionally, the agreement emphasizes the separation of business and activities to mitigate potential conflicts of interest, with exceptions for certain activities.

European ESG FinTech deal activity jumps 16% in Q1 2024

Investors

The following investor(s) were tagged in this article.