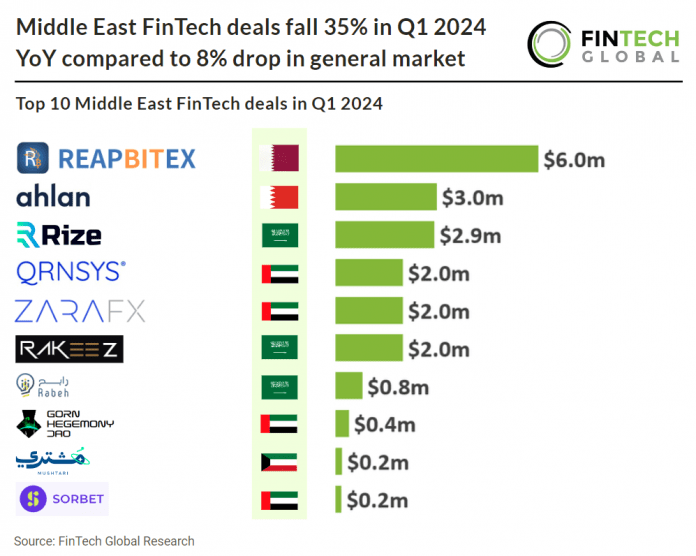

Key Middle East FinTech investment stats in Q1 2024:

• FinTech deal activity in the Middle East reached 24 funding rounds in Q1 2024, a 25% reduction from the same period in 2023

• FinTech companies in the region raised a combined $19.5m in Q1, a 85% drop YoY

• The UAE was the most active country with 14 deals, a 58% share of all transactions

In the first quarter of 2024, FinTech in the Middle East witnessed a decline in deal activity, totalling 24 deals, marking a 25% decrease from the same period in 2023. Despite the persistent efforts, there was a significant downturn in fundraising, with FinTech companies in the region collectively raising only $19.5m, indicating an 85% drop YoY.

Reapbitex, an encrypted crypto portfolio, had the largest FinTech deal in the Middle East during Q1 2024 after raising $6m in their seed round extension. Reapbitex has a MSB license, issued by the U.S. government, is widely recognized as the gold standard for crypto trading. Reapbitex’s acquisition of this license is a testament to its commitment to regulatory compliance, security, and transparency. With this license in hand, Reapbitex is poised to establish itself as a long-term player in the crypto exchange arena, assuring users of a secure and legally compliant platform. The platform is now gearing up for a groundbreaking move – the launch of its first platform coin, REAP.

The UAE was the most active country in the Middle East with 14 deals, a 58% share of deals. This was followed by Saudia Arabia and Oman with three deals each, a 12.5% share of deals.

The latest Middle East finance regulation came from The Central Bank of the UAE, which has issued the long-awaited Open Finance Regulation, establishing a comprehensive framework for the licensing, supervision, and operation of Open Finance in the country. The Regulation, published in the Official Gazette on April 15, 2024, will be implemented in phases as notified by the CBUAE. This development is significant for the UAE’s financial sector and impacts all categories of CBUAE licensees. Open Finance promises increased control and options for consumers while driving innovation and growth in the financial sector.