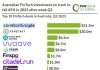

Canadian Incumbent banks have a firm grip on the Canadian banking market with only a small number of Canadians choosing neobanks as of April 2024. This is in stark contrast when compared to other countries such as the UK where the neobank Monzo is the most popular banking app. Incumbent banks have a total of 46m downloads, a 87% share of total downloads whilst neobanks have a combined 6.6m, a 13% share. EQ Bank, the direct banking operation of Equitable Bank, had the largest growth over the last 12 months at 46%.

TD Bank, a Canadian retail bank, overtook CIBC in 2019 to be the most downloaded banking app as of Apr 2024 with 10.4m downloads in total. The TD Canada app has an average rating of 4.1 stars over the play store and app store and its recent reviews are generally negative. Reviews of the TD Bank Group’s app highlight various usability issues and frustrations. Users report difficulty in navigating transactions, lack of transaction detail, and inconvenience in accessing bill payment history. Some express dissatisfaction with customer service and the inability to resolve simple issues like updating contact information. Despite attempts by the bank to provide solutions, such as accessing bill payment history through the Move Money link, users remain dissatisfied with the overall experience, leading some to consider switching to other banking institutions for a smoother experience.

Koho, A no-fee spending account, was the most downloaded neobank in Canada with 2.2m downloads in total. Koho’s app has an average rating of 4.5 stars over the play store and app store and its recent reviews are mixed. While some express satisfaction with services like cashback and efficiency, others report significant issues. Complaints include poor customer service, account locking without notice, unresponsiveness to inquiries, and failure to report to credit bureaus, resulting in lowered credit scores. Instances of funds being withheld without explanation or inadequate resolution further contribute to dissatisfaction. However, long-term users commend Koho’s overall service and efficiency, especially for frequent travellers and those utilizing premium memberships.