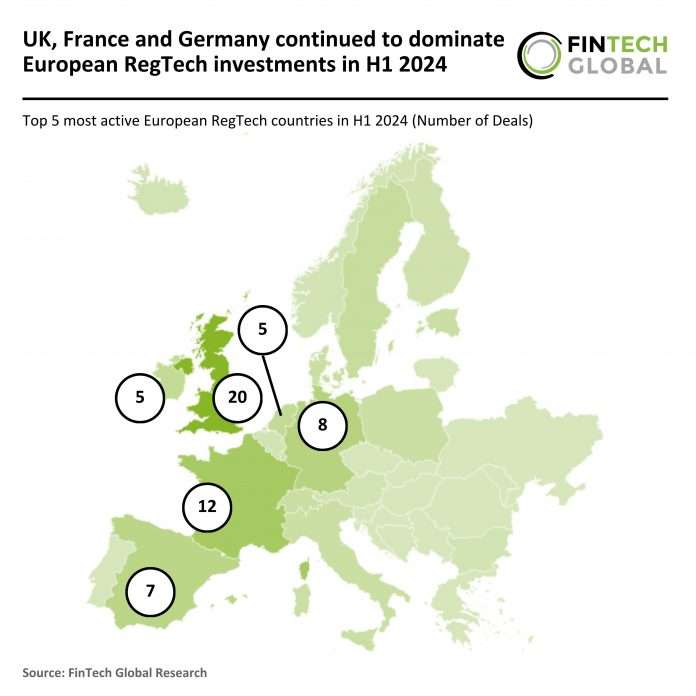

European RegTech investment stats in H1 2024:

- UK, France and Germany retained top 3 spots for the most active RegTech markets based on number of deals in H1 2024

- Average deal value remained stable which coupled with a drop-in deal activity indicates investors are taking on a more focussed approach to new dealmaking

- Global Screening Services (GSS), a London-based RegTech secured the largest deal of H1 2024 by completing a $47m A2 funding round

In the first half of 2024, the European RegTech sector recorded 86 transactions, a drop of 54% from the 189 funding rounds completed in H1 2023. The United Kingdom remained the market leader with 20 deals (23% share), followed by France with 12 deals (14%), and Germany with eight deals (9% share). Spain secured seven deals representing around 8% of the market, while Netherlands and Ireland rounded off the top 5 with five deals each (6% share). This is in contrast to H1 2023, where the United Kingdom had a more dominant lead with 58 deals (31% share), followed by France and Germany, each with 20 deals (11% share), Switzerland with 16 deals (8% share), and Spain with 10 deals (5% share). The top 5 in H1 2024 saw the entry of Netherlands and Ireland, while Switzerland dropped out of the top tier, reflecting a shift in the geographic focus of RegTech investments.

In H1 2024, the average deal value was approximately $6m, reflecting a decrease compared to the $6.1m in H1 2023. This slight decrease of around 1.6% in average deal value suggests that while the overall number of deals has dropped, the investments being made have remained relatively stable in size. This stability indicates that investors continue to be selective, focusing on companies with growth potential or more established businesses within the RegTech sector, even as the overall market activity has significantly declined.

Global Screening Services (GSS), a London-based provider of sanctions transaction screening services, has completed its Series A2 funding round, raising over $47m, making it the largest funding round in the European RegTech market for H1 2024. Notable contributors include AlixPartners, Cynosure Group, and the latest addition, Commonwealth Bank of Australia (CBA). This investment coincided with the company’s transition from the development phase to the operational phase as the cloud-native platform prepares to go live with its inaugural clients. GSS sells a sanctions-screening platform to help banks and other financial institutions comply with regulations. These institutions feed transaction data into GSS’s cloud-based platform, which returns an alert if it finds a match against a standardised set of sanctions lists from around the world—GSS also “enriches” these lists with additional data points, such as dates of birth, International Maritime Organisation (IMO) numbers for ships, and data from the local financial transfer systems of sanctioned countries such as Russia and China. With another $47m in the bank, GSS is now transitioning from “development phase” to fully operational, as it prepares to go live with its first customers.

Keep up with all the latest FinTech research here

Copyright © 2024 FinTech Global