Tag: Banking

US banks are surpassing European counterparts in AI talent growth

In the past six months, the world's foremost banks have expanded their AI talent by 9%, a rate that doubles their overall headcount growth, according to a survey from Evident.

Unit21 unleashes cutting-edge ACH features to combat financial fraud

Unit21, a leading player in the FinTech space, has announced the rollout of its latest innovations aimed at revolutionising ACH (Automated Clearing House) transactions and bolstering fraud prevention measures.

Standard Chartered partners with Visa B2B Connect for streamlined cross-border payments

Standard Chartered has joined forces with Visa B2B Connect to expand its existing suite of payment solutions.

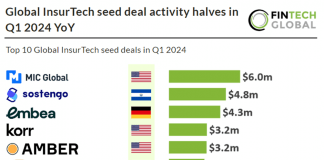

Global InsurTech seed deal activity halves in Q1 2024 YoY

Key Global InsurTech seed deal investment stats in Q1 2024:

• InsurTech seed deal activity reached 25 deals in Q1 2024, a 52% reduction from...

Frost Bank improves customer experience with Atomic direct deposit switch

Frost Bank, a San Antonio-based firm, is set to incorporate Atomic into its operations to enable it to improve its customer satisfaction rates and make banking more accessible for all.

The role of LLMs in enhancing BFSI operational efficiency and customer...

The advent of generative AI is not just a futuristic vision but a present reality transforming how businesses communicate with customers. This cutting-edge technology, underpinned by large language models (LLMs) like GPT-4, BERT, ELECTRA, and RoBERTa, is setting new standards for customer interaction and service delivery. It enables systems that not only manage communications but also predict and adapt to customer needs with unprecedented personalization and efficiency.

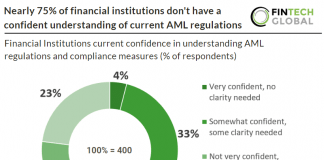

Nearly 75% of financial institutions don’t have a confident understanding of...

Sanction Scanner conducted a comprehensive survey, gathering insights from over 400 respondents across more than 50 countries and various industries. The findings shed light...

How HCL BigFix streamlines IT compliance for the banking sector

In the banking industry, adhering to IT compliance standards is crucial for maintaining data security, safeguarding customer privacy, and ensuring financial stability. The sector is governed by an intricate web of standards, ranging from global benchmarks to protect against cyber threats and secure sensitive information. HCL BigFix stands out as a vital tool in helping financial institutions navigate these stringent compliance requirements.

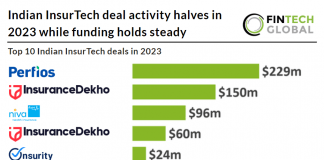

Indian InsurTech deal activity halves in 2023 while funding holds steady

Key Indian InsurTech investment stats in 2023:

• Indian InsurTech deal activity reached 21 transaction in 2023, a 52% drop from 2022

• Indian InsurTech companies...

Revolutionising finance: The rise of embedded finance in 2024

As we delve deeper into 2024, the embedded finance phenomenon continues to reshape the financial services sector. A Capgemini survey from 2021 revealed that over 70% of banking executives view embedded finance as a catalyst for innovation, customer base expansion, and cost reduction, predicting its market value to soar to $588bn by 2030 from $22bn in 2020. This trend positions embedded finance as a key strategic channel for banks.