Tag: BNPL

Klarna become first bank to deploy ChatGPT Enterprise

Klarna has revealed that it is the first bank to adopt Open AI's Chat GPT Enterprise platform, as it continues to lead the race for AI implementation into online banking.

Sileon and Zorrz team up to revolutionise UK credit payments

Sileon, a state-of-the-art software-as-a-service (SaaS) provider, has inked a partnership with ZorrzTM Finance, a pioneering FinTech entity focused on democratising credit access through artificial intelligence.

Koverly unveils unique “Pay in 30” platform, eyes $70m in new...

Koverly, a global B2B payments solution providing payment flexibility alongside reduced foreign exchange rates, has introduced KoverlyPay, a novel buy now, pay later (BNPL) service.

BNPL Splitit to delist after landing $50m investment

BNPL Splitit has revealed it is planning to delist from the ASX after securing up to $50 million from Motive Partners.

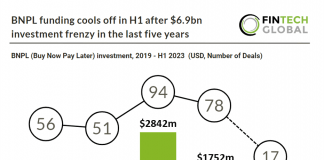

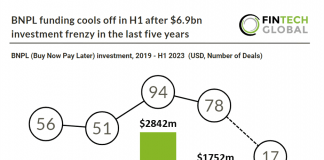

BNPL funding cools off in H1 after $6.9bn investment frenzy in...

Funding for Buy Now Pay Later (BNPL) has dropped significantly in 2023 and the sector is on track to report its lowest deal activity...

BNPL funding cools off in H1 after $6.9bn investment frenzy in...

Funding for Buy Now Pay Later (BNPL) has dropped significantly in 2023 and the sector is on track to report its lowest deal activity...

Klarna continues strong growth in Canada

Swedish BNPL giant Klarna has revealed that its service is now experiencing rapid growth across Canada.

Klarna axes open banking brand Klarna Kosma after 18 months

Klarna has scrapped its own eponymous banking brand Klarna Kosma after just under 18 months of operation.

The digital race – How automation can improve efficiency and customer...

Improving the customer experience has become one of the biggest priorities for financial services. In fact, 63% of firms place customer experience as their number one focus as they try to meet the evolving demands of their customers. Lending is one area of finance where the fight to provide the best customer experience is really heating up. Many have even dubbed it as the next major battlefield.

16 million UK residents unaware of debt risk with BNPL

Approximately 16 million UK residents remain oblivious to the financial risks associated with 'Buy Now Pay Later' (BNPL) services, says research from responsible lender,...