Tag: Neobanks

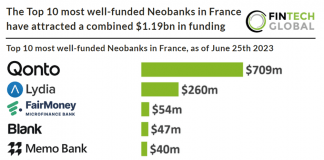

The Top 10 most well-funded Neobanks in France have attracted a...

French neobanks may face challenges in staying competitive due to their close association with incumbent banks like Boursorama Banque and Société Générale. While these...

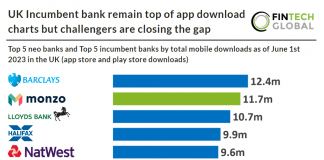

UK Incumbent bank remain top of app download charts but challengers...

Key mobile banking download stats as of June 1st 2023:

• Revolut was the most downloaded mobile banking app in 2022 with 3.31m downloads

• Combined...

Why sanctions screening is crucial for FinTechs

Following the invasion of Ukraine, financial institutions have seen a tidal wave of sanctions. Implementing strong sanctions screening tools enables FinTechs and neobanks to bolster their market reputation.

FinTech Farm herds $7.4m in seed funding raise

London-based firm FinTech Farm has secured $7.4m from a seed funding round co-led by Flyer One Ventures and Solid.

Zeta secures unicorn label following $250m Series C

Indian neobank startup Zeta has received unicorn status after a $250m Series C funding round took it to a $1.45bn valuation.

Neobank Nemo reportedly nabs funding from Mumbai Angels to empower Indian...

Early-stage investors’ platform Mumbai Angels Network has reportedly invested an undisclosed amount in cloud-based neobank Nemo.

Bunq, Volt partner to bolster open payment technology

Dutch challenger bank Bunq has partnered with London-based payments company Volt to provide a faster way for Bunq customers to transfer money from other accounts.

UK banks top the global list for boardroom technology experience, new...

British banks lead in boardroom technology experience compared to global competitors, Accenture research revealed.

Can banks beat neobanks at their own game?

Challenger banks have spent the better part of the last decade turning the banking world on its head, but is there a way for incumbents to bridge the technology divide?

Monzo and Starling Bank lead service quality league

Challenger banks Monzo and Starling Bank led the list that provided the best service among the UK's 19 largest personal account providers, according to new research from British regulators.