India-based personal finance app INDwealth has reportedly raised $30m in its newest equity financing.

The company received the new line of equity from Steadview Capital, a London-based alternative investing firm, a number of reports in the media state. A scheduled launch for the platform is set for early next year, according to the articles.

INDwealth offers an online platform to help consumers manage their financial goals and set saving plans. The solution provides users with personalised recommendations for investment opportunities via an AI-based advisory engine.

Alongside this, users can access tax analytics and tax-saving strategies, lending, expense management, portfolio management and micro-savings, according to its LinkedIn profile.

There have been a number of India-based FinTech companies to close deals over the past month. Earlier this week, ClearTax closed a $50m investment to accelerate the growth of its technology and product. Its investors included Composite Capital, Sequoia Capital and SAIF Partners.

Other deals to close recently in the country include a undisclosed round of digital lending app RevFin, a $3m round of personal loan provider Qbera and the $30m Series C of POS financing solution Kissht.

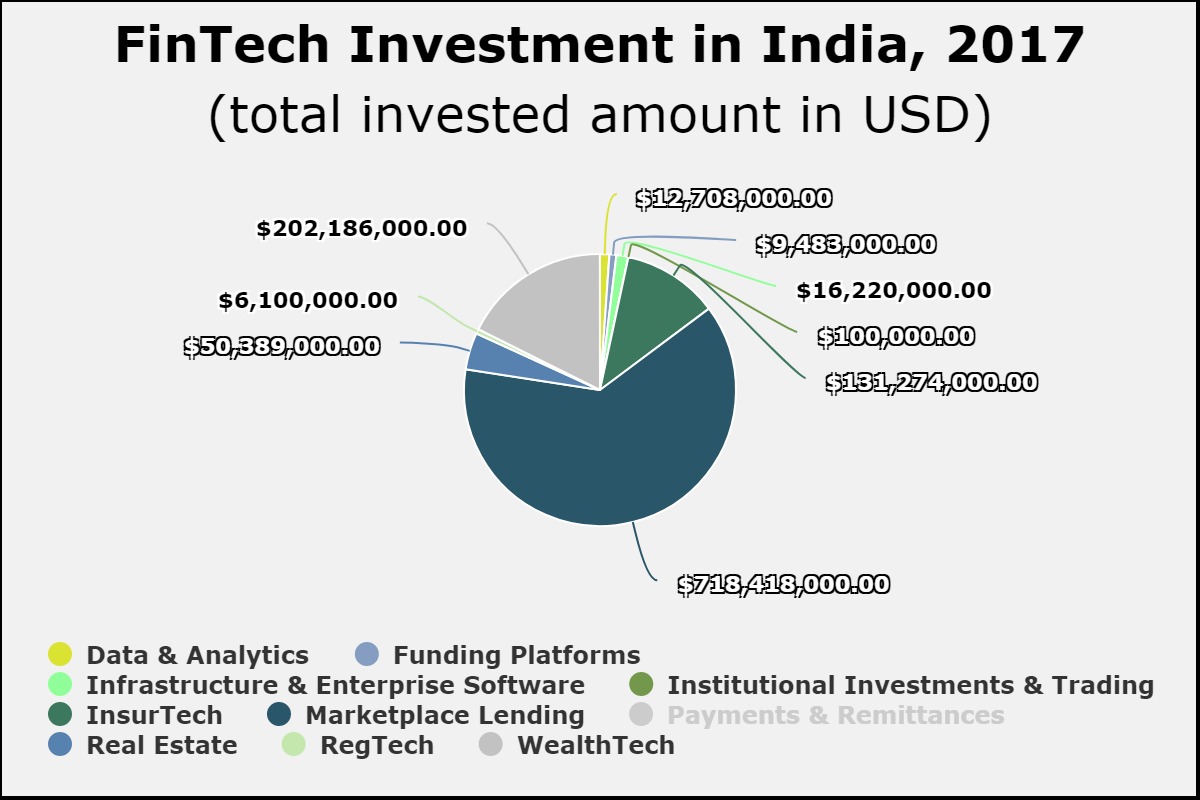

Last year, India’s FinTech sector was dominated by the payments and remittance space, according to data by FinTech Global. WealthTech companies represented to third biggest share of funding, with a 3 per cent share of the $7.3bn deployed overall.

While this seems like a small percentage, if funding to payments companies is removed, there was only $1.1bn invested in the country, with WealthTechs accounting for 20 per cent of this figure.

Copyright © 2018 FinTech Global

Copyright © 2018 FinTech Global