Challenger banks and huge tech titans threaten to take traditional banks’ share of the market. Now Backbase believes it might have a solution.

The digital banking software provider has unveiled its latest cloud-based platform to help banks fight back against the growing number of players angling for a slice of the pie.

Backbase-as-a-Service covers Backbase’s entire portfolio of banking products, helping banks to innovate and reduce the cost and time dedicated to updates, security and setting up systems for the day-to-day business.

By tapping into the platform, Backbase believes banks will be able to better tackle the rising competition from both challenger banks and big tech firms entering the market, such as Apple and Uber.

It aims to do that by providing incumbent banks with the tools to be more agile through its tech infrastructure. The platform provides access to dedicated sandbox environments, scalable infrastructures, end-to-end encryption and regulatory compliance tools among other advantages. The idea is that this will enable them to develop and release new innovative products faster.

“Backbase is committed to being the leading innovation partner for global banks and credit unions,” said Jouk Pleiter, CEO of Backbase. “We believe the move to cloud is an unstoppable one and one which every financial institution needs to embrace. Our clients want the freedom to innovate and maintain their competitive edge, so launching Backbase-as-a-Service is the logical step for us. It is our duty to maximise their ROI when it comes to becoming digital-first and meeting the digital demands of their customers. Cloud is an exceptional tool for taking that leap.”

The new product comes as traditional banks face the major challenge of both digital banking startups and big tech firms taking percentages of the financial market.

While challenger banks have predominantly been a British feature over the past decade, more startups providing digital banking solutions have recently begun to spring up around the globe, competing with the incumbents as they do.

Australia provides one of the clearest examples of this trend. Four big banks – Commonwealth Bank of Australia, Westpac Banking Corporation, Australia and New Zealand Banking Group and National Australia Bank – have dominated the market for decades.

However, they are struggling to keep the trust of customers. The crisis for these banks was intensified after the Australian Royal Commission into Misconduct in the Banking, Superannuation and Financial Services Industry unveiled systemic misconduct in the sector, including negligence in preventing their systems from being used for money laundering.

A new breed of Australian digital banks has taken advantage of the situation and the support of the Australian government, which is aiming to create an environment where they can thrive.

Similar patterns can be spotted in Latin America where NuBank became a decacorn after raising a $400m Series F round in the summer of 2019, in Scandinavia where Northmill has begun to release new banking products and in the US where brands like HMBradley are moving into the market.

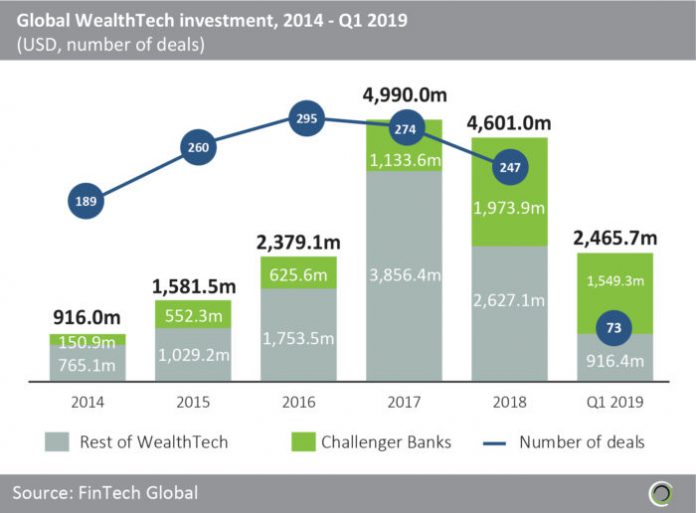

Challenger banks around the world have attracted a lot of investment, according to FinTech Global’s research. Investment in the sector rose from $150.9m in 2014 to $1.97bn in 2018.

The growth of the global challenger bank market is expected to keep growing at a compound annual growth rate of 40.4% until it is worth $301bn by 2025.

That being said, challenger banks face their fair share of teething troubles. For instance, German regulators have criticised N26 for its inadequate efforts to tackle money laundering, both Chime and Revolut have had service outages, and Monzo was forced to shut down its premium membership in September.

Moreover, some research suggest that big banks can still rely one Gen Z customers to pick them over the new startups.

But, as Backbase pointed out, challenger banks are not the only existential threat to incumbent banks as big tech titans are also angling for a slice of the FinTech space.

Uber, Facebook, Apple, Amazon and Alibaba have all launched FinTech initiatives over the past few years.

Not only are they able to leverage their scale and brands for success, but they also have huge consumer datasets that give them a huge competitive edge against the old players in the sector.

Even though big tech firms’ entry into the market will also create new opportunities, it is easy to see why banks might be worried.

Several incumbents have responded to the increased competition by upping their own digital efforts.

For instance, HSBC has announced plans to overhaul its First Direct brand. The re-thinking of the brand includes creating products like an in-app marketplace and automating savings by leveraging artificial intelligence.

The Royal Bank of Scotland (RBS) has provided another example through the launch of its online banking app Bó, which is set up to compete with challenger banks. Although, it did not get off to a good start after it was revealed that many of the positive reviews of the app was allegedly written by RBS’ own staff.

So while only time will tell whether or not Backbase’s latest product will help banks to compete on the developing market, it is clear going digital has become priority for several incumbents.

Copyright © 2020 FinTech Global