From: RegTech Analyst

As demand for compliance solutions is shooting through the roof, RegTech Analyst has revealed the 100 most innovative companies in the world on its fourth annual RegTech100 list.

The prestigious list recognises the world’s most innovative technology solution providers that address the challenges of ever-increasing regulatory pressures within financial services.

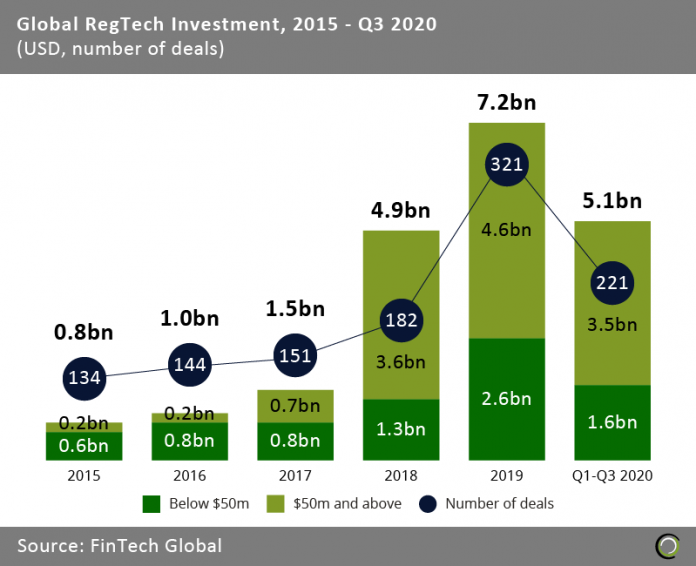

The RegTech industry has scaled massively since 2010 as banks and other financial institutions grapple with the unrelenting pace of regulatory change across all jurisdictions. Over $5.1bn has been invested in RegTech companies so far in 2020, according to data published by RegTech Analyst.

Part of the reason why is that the Covid-19 pandemic has seen demand for compliance solutions skyrocket.

Part of the reason why is that the Covid-19 pandemic has seen demand for compliance solutions skyrocket.

But as demand for these services has skyrocketed, so has the number of tech ventures able to fulfil businesses’ compliance obligations.

Consequently, this year’s process to identify the 100 RegTech innovation leaders was more competitive than ever. A panel of analysts and industry experts voted from a longlist of over 1,000 companies produced by RegTech Analyst.

Sixty-two new companies entered the RegTech100 for 2021 and the finalists were recognised for their innovative use of technology to solve a significant industry problem, or to generate efficiency improvements across the compliance function.

“Banks and other financial institutions need to be aware of the latest RegTech innovation in the market to avoid new compliance risks and stay competitive despite new regulations around customer onboarding and remote communication post Covid-19,” said Mariyan Dimitrov, director of research at RegTech Analyst.

“The RegTech100 list helps senior management filter through all the vendors in the market by highlighting the leading companies in sectors such as identity verification, risk management, communications monitoring, information security and reporting.â€

Among the 100 companies selected for a spot on the coveted RegTech100 list were ACTICO, leading international provider of software for intelligent automation and digital decisioning to manage risk, fulfil regulatory obligations and prevent fraud; Apiax, which is building digital solutions that enable financial institutions to comply with regulations worldwide; and Armadillo, which provides reports on 380 million companies and five billion individuals plus PEPs, sanctions, adverse media and ID verification for KYC/EDD.

Some of the companies on the list have understandably been in the news recently too. For instance, BearingPoint RegTech, an international provider of innovative regulatory, risk, and supervisory technology solutions, recently made headlines after it was revealed that it was under new ownership. In November, the company had announced that Nordic Capital had bought the business.

Similarly, Bureau van Dijk (BvD) also made few headlines earlier this year when it bought the risk assessment platform RDC. Of course, BvD has had no problem making a name for itself, as it is able to scan information on nearly 400 million companies to capture and treat entity data for better decision-making and increased efficiency.

Capnovum is another noteworthy company on the list as this marks the fourth time it has successfully secured a spot. The company delivers a global, industry agnostic, regulatory change management platform with fully automated horizon scanning and real-time impact assessments.

Compliance.ai made a few headlines in November when it closed a $3m Series A round to fuel its international growth. The company helps BFSI firms transform RCM, thereby reducing compliance risk for compliance officers, risk officers, and general counsel.

Other worthy mentions are Df2020, which offers dialogue-driven technology that can digitise complex rule-based knowledge such as regulations and procedures; Fourthline, a provider of end-to-end solution for bank-grade KYC and fraud detection; KYC Global, which has developed provider of best-of-breed RiskScreen AML software and leading compliance portal KYC360; and Red Oak Compliance, the advertising compliance review software of choice in the financial services industry.

Moreover, RegCentric secured a spot thanks to it being able to deliver innovative services and solutions that take a holistic approach across risk management, regulatory reporting, and data management.

Sphonic is a provider of a ‘low-code’ identity orchestration solution allowing organisations to automate KYC, KYB, AML and fraud transaction monitoring processes via a single API.

The Technancial Company provides real-time risk management and trade surveillance tools to and for global markets.

Singapore has long reputation of nurturing innovative RegTech and FinTech companies. Tookitaki is a case in point. The company is a globally recognised RegTech company providing proven, scalable, easily implementable and explainable AI-powered smart solutions in the AML/CFT and Reconciliation spaces. And it has just claimed a spot on the RegTech100.

So has Trulioo, a leading provider of real-time identity and business verification for five billion people and 330 million companies worldwide through a single API, and Veratad Technologies, which provides online/real-time identity verification, age verification, fraud prevention and compliance solutions.

The complete RegTech100 list and research report are available for FREE at www.RegTech100.com.

Copyright © 2020 FinTech Global