Neobanks are transforming finance around the world. However, some are making bigger waves than others.

It’s hardly a secret that digital lenders are some of the most successful FinTech companies driving the modern digitisation of finance. Yet, if you’re looking for proof, remember that challenger banks are raising more money than any other WealthTech sector, according to FinTech Global’s research. Seven of the ten biggest WealthTech investment deals in the first quarter of 2020 were raised by challenger banks. The success of the sector is hardly surprising, given neobanks are becoming increasingly popular among investors, millennials and younger customers.

The success of the sector is hardly surprising, given neobanks are becoming increasingly popular among investors, millennials and younger customers.

So let’s take a closer look at ten challenger banks leading the charge.

Nubank

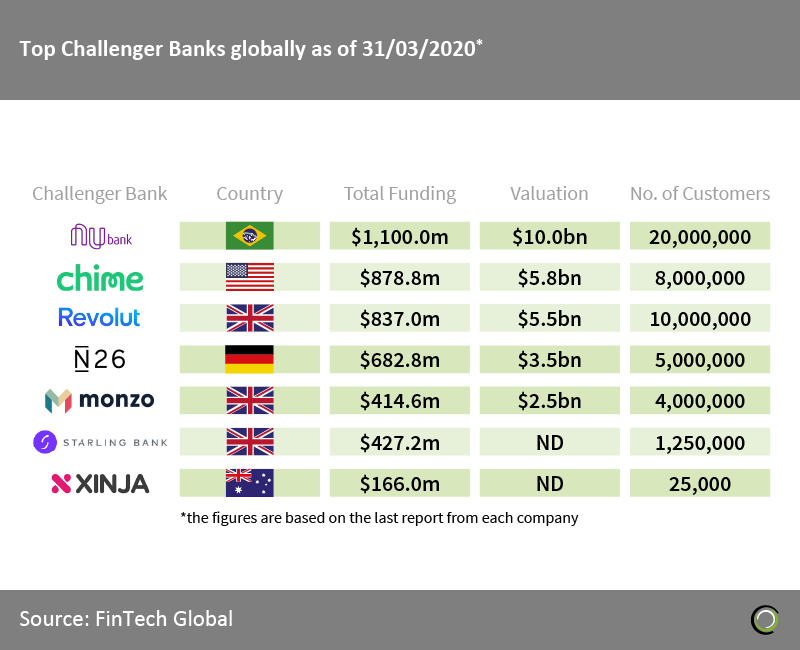

No list like this would be complete without mentioning Nubank. This Brazilian challenger bank is arguably the biggest neobank in the world, having achieved a valuation over $10bn in 2019 following a $400m Series F funding round. While there are plenty of unicorns among the companies on this lis, Nubank’s valuation makes it the only FinTech venture on this list to give it full access to the coveted decacorn club

Launched in 2013, the company has raised over $1.1bn in funding and, in January 2020 this year, it announced that it had over 20 million customers on its books. That’s more than double the number of customers most other challenger banks FinTech Global have looked into have. Even more impressively, the company has been extremely efficient in acquiring customers with amount of funding per new account of just $55.

2020 has also seen Nubank make its first acquisition. In January, the FinTech decacorn bought software engineering firm Plataformatec, to boost its internal development team as it aims to tackle several obstacles in the new year.

The company has continued to grow, having ventured into Mexico in the first quarter of 2020 in order to tap into the nation’s underbanked population.

Chime

Chime

While US challenger banks have been slower than its European counterparts to make their mark in the market, several of them are rapidly making up for lost time. Chime is chief among them. Ryan King and Chris Britt founded the neobank in 2013. Since then the bank has secured $878.8m in funding across several rounds.

Most recently, it secured $200m in a new capital injection in March 2020. That raise came just months after the challenger bank bagged $500m in a Series E round in December 2019. That valuation pushed the that pushed its valuation to $5.8bn

Chime reportedly has eight million customers.

Revolut

The UK has long been a FinTech leader and challenger banks are no exception. Britons have proven themselves as early adopters of digital banking and the neobank sector has also benefited from the UKnot having the same high saturation of banks as other nations.

Of the challenger banks in the UK, Revolut has led the way. Nikolay Storonsky and Vlad Yatsenko founded Revolut in 2015. It is one of the alumni of the Level39 FinTech incubator in London. Since the launch, the company has raised $837m in funding and attracted ten million customers to join its platform.

The most recent raise was closed in February 2020. It saw Revolut add $500m to its coffers and achieve a valuation of $5.5bn.

Revolut has also unveiled ambitions global expansion plans. In September it announced that it was going to expand into 24 new markets including Russia, Japan and Brazil, meaning it would start to compete more directly with Nubank. It also said it would grow into the US, which was a promise it finally made good on in March 2020.

N26

German N26 was founded in 2013 by Valentin Stalf and Maximilian Tayenthal, who reportedly picked the name from the number of sides of a Rubrik’s cube.

Since then, it has raised $682.8m in funding in total, including a €10m series A round led by Peter Thiel’s Valar Ventures. N26’s closed its latest round was made in July 2019 When it upped its Series D round to $470m. The capital injection also saw it achieve a valuation of $3.5bn. Like Revolut, N26 has also announced plans to open up shop in Brazil.

Monzo

Monzo is often named as Revolut’s main competitor. Although, that shouldn’t surprise anyone, given they are both UK-based FinTech ventures.

However, it only has a valuation of $2.5bn and only four million customers, both figures are half of Revolut’s. That being said, its customers have proven to be particularly loyal, which became evident when Revolut recently tried to hijack one of Monzo’s Twitter threads.

When Monzo asked its followers for what feature they would like to see, Revolut replied that it should introduce a button that would enable customers to switch immediately to Revolut. Many of the customers lashed back, with one of them saying, “Who would switch to Revolut? Perhaps someone who has metal fetish to get that card. What else is there? No customer service that’s for sure. But thanks, that made me laugh.”

Another testament to its popularity is that Monzo has been named one of the most recommended brands in Britain.

Monzo was founded in 2015 and has raised $414.6m in total. It most recently raised £113m in June 2019 in a round backed by Y Combinator, Continuity, Latitude, Accel, Stripe and Orange Digital Ventures.

Starling Bank

Starling Bank is another testament to the UK’s ability to nurture the growth of successful challenger banks. Former Allied Irish Banks COO Anne Boden launched the venture in 2014. Since then the venture has raised $427.2m in total and attracted 1.25 million customers to its solution. Most recently, the mobile-only bank bagged £60m in funding in Februrary 2020.

Xinja

Founded in 2017, Xinja is one of the new wave of digital lenders to wash over Australia in recent years. The company has raised in total $166, but is set to receive another $163m withing the next two years on the back of a deal in March 2020 with Emirates’ World Investments. It has 25,000 customers and was granted a full banking licence from the Australian Prudential Regulation Authority in 2019.

Judo Bank

Australian challenger bank Judo Bank was founded in 2016 by Alex Twigg, Chris Bayliss, David Hornery, Jacqui Colwell, Joseph Healy, Kate Keenan, Mal Hiscock and Tim Alexander. Since then, it has raised $829.6m in funding in total, most recently through a $350m credit facility from Citi Bank in March 2020.

Volt

Volt Bank is another Australian challenger bank to make the list. It has $78.5m in total since it was founded in 2017. In March 2020, the neobank experienced its latest cash injection bagged $48m in a Series C round.

Kyash

Japanese digital bank Kyash has collected $45m in its Series C round earlier in 2020, which brought the total raised by the challenger bank to $70.4m. The new capital infusion was co-led by Greenspring Associates and Goodwater Capital. Other contributors were Greyhound Capital, Altos Ventures, Partech Partners, Broadhaven Ventures, Tekton Ventures and DST Global managing partner Rahul Mehta.

Copyright © 2020 FinTech Global