The PropTech sector saw a sharp slowdown in funding from the second half of last year as social distancing brought real estate transactions to a halt.

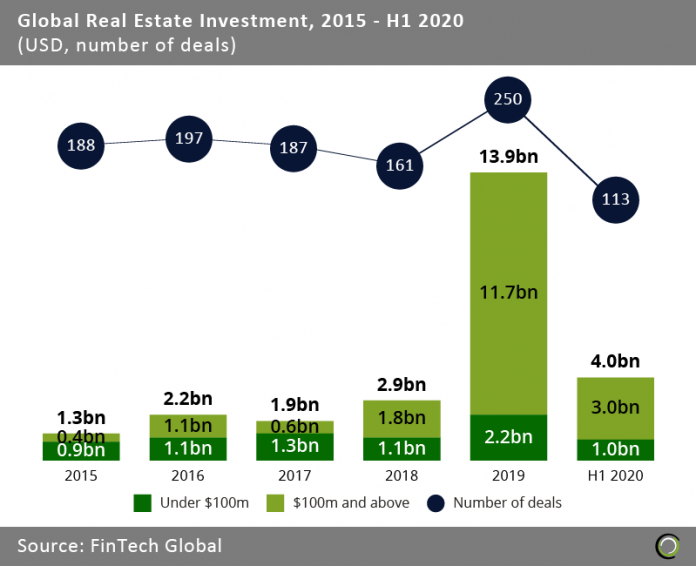

- Global PropTech funding decreased from $12.7bn in H2 2019 to $4.0bn in H1 2020. According to MarketWatch, there were almost 20% fewer existing homes for sale in May 2020 than the same month in 2019, as sellers have been reluctant to allow prospective buyers into their properties due to the health risks that they would be facing. Similarly, many buyers have been unwilling to purchase properties amid increasing unemployment rates, wage cuts and job uncertainty. This caused a reduction in deal flow and transactions this year, negatively affecting revenue projections for PropTech companies.

- Despite experiencing a decline over the past year due to Covid-19, funding from deals under $100m in 2019 was double of that in 2016, suggesting that investors were becoming progressively keen on investing capital in new and innovative PropTech firms that disrupt the traditional processes of property transaction, mortgage lending and real estate investing. For example, as of today, some countries already have a few different property transaction companies competing with each other; such is the case for the United States, with real estate transaction platforms like Zillow, Redfin, Opendoor, Knock and Offerpad trying to expand their market share.

- Although the amount of funding exhibited a steep drop at the start of this year from the highs recorded at the end of 2019, the number of deals rose from 61 in H1 2019 to 113 in H1 2020. Thus, we can expect a strong interest from investors in the PropTech sector over the next 12 to 24 months as the market recovers and emerging companies are redefining the transaction process amid social distancing, enabling investors to purchase real estate assets without going through agents, buyers and sellers to transact with minimal hassle, and properties to be priced in a transparent manner. For instance, at the beginning of this year, digital real estate platform Loft raised $175m in Series C funding. The company aims to use this capital to increase liquidity and transparency for buyers and sellers by combining real transaction data with machine learning to price apartments.

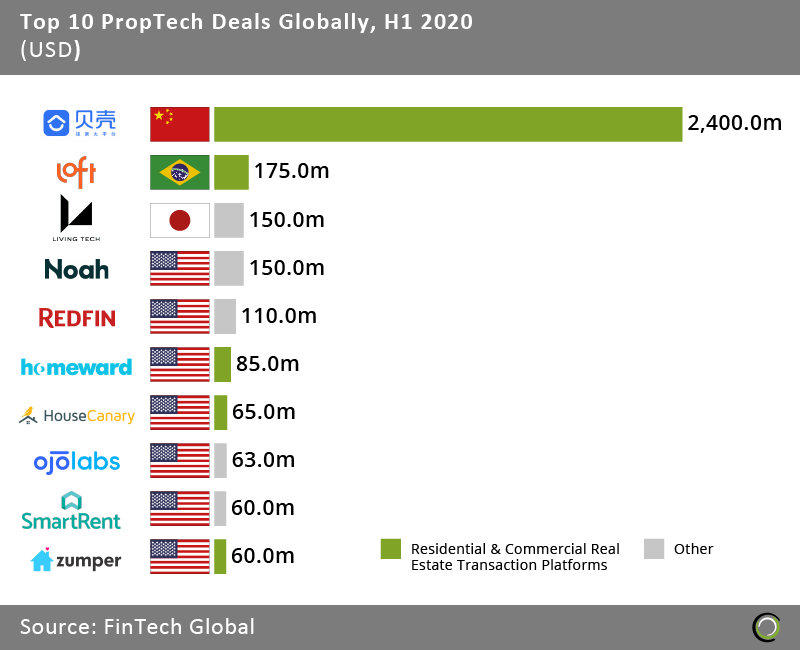

US?PropTech companies dominate the top 10 deals list in the first half of 2020

- Among the companies that completed the top ten PropTech deals in H1 2020, seven of them (Noah, Redfin, Homeward, HouseCanary, OJO Labs, SmartRent and Zumper) are headquartered in the United States. Many real estate companies in the United States are employing AI for pricing, projecting returns and property maintenance. For instance, SmartRent recently closed a $60m Series C funding round led by Spark Capital to expand its smart home solutions, enabling residents to live in their properties with more security, convenience and efficiency.

- Five of the top ten companies (Ke.com, Loft, Homeward, HouseCanary, Zumper) provide residential and commercial real estate transaction platforms as part of their core operations. As an increasing proportion of the global population is able to afford a home, these companies allow their customers to buy and sell properties without worrying about realtors, viewings and other obstacles during the purchasing process.

- Ke.com was the PropTech firm that raised the largest amount of capital in a single funding round this year, and it will use the recently raised funding of $2.4bn to accelerate the digitization of the residential industry, making property listings and transactions quicker and more transparent in China.

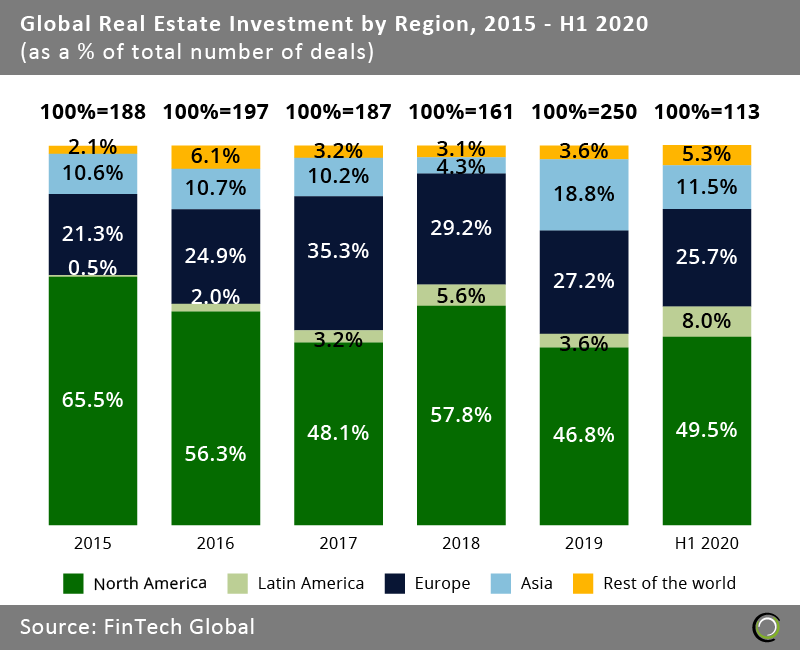

Europe and Latin America share of PropTech investment has grown since 2015, as investors moved away from the established market in?North America

- Asia PropTech investment share grew from 10.6% in 2015 to 18.8% in 2019, then dropped to 11.5% in H1 2020 due to the early negative impact of Covid-19. Despite this, real estate markets in developed Asian cities like Singapore and Tokyo continue to attract PropTech funding, boasting benefits such as low tax rates and attractive returns respectively. Meanwhile, emerging markets are becoming increasingly popular. For instance, Vietnam is observing an increase in the application of smart technologies in its real estate industry. This has paved way for many innovative PropTech startups like Propzy and Rever, which facilitate the process of leasing and improve the efficiency of project management for residential and commercial properties.

- Although Europe share has fallen from 35.3% in 2017 to 25.7% in H1 2020 because of rising construction costs and political uncertainty, we can still anticipate an active European PropTech market in the next few years, especially in countries with unfavorable legislation changes like Germany where real estate agents now have to be paid by their mandating clients rather than by tenants. This change has given rise to a large number of PropTech firms, helping these clients legally bypass the newly introduced obligation.

- North America experienced a decrease in share from 65.4% in 2015 to 46.8% at the end of 2019, as European and Latin American real estate markets became more attractive. However, the share of the region saw a small increase at the start of this year and PropTech funding in the United States is expected to grow in the short-term, as investors seek predictable cash flows in the midst of volatile financial markets and geopolitical instability.

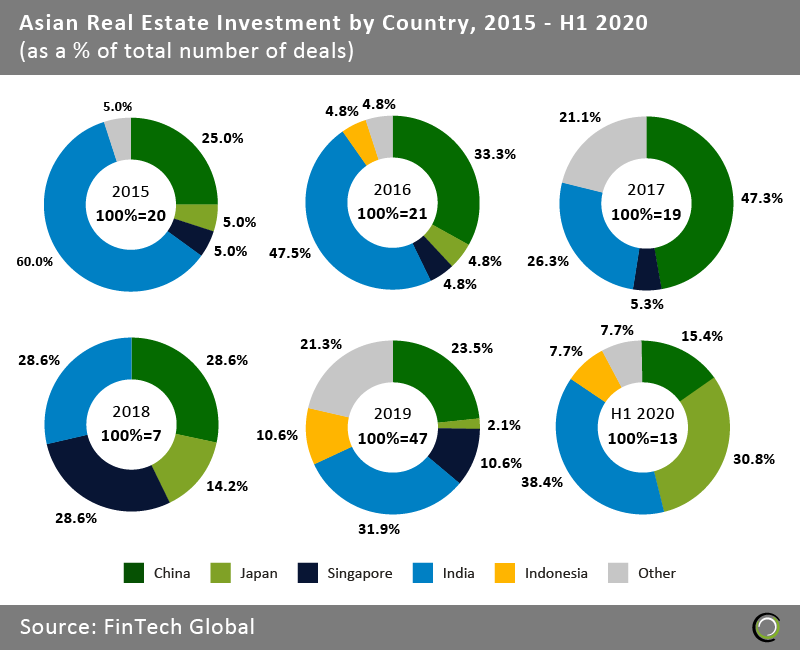

Japanese and Indian companies completed over two-thirds of Asia PropTech deals in H1 2020

- China PropTech investment share in Asia fell from 47.4% in 2017 to 15.4% in H1 2020, while Japan rose to 30.8% during that period. A possible reason behind this is the Japanese government growing focus on enhancing entrepreneurship to bring down the rising number of unemployed youths. Part of this initiative includes expanding the country property market by making use of its advanced technology. Meanwhile, although China experienced a massive increase in its property prices over the past decades, price rises are starting to slow in the country largest cities. In fact, most of the price gains were felt in its second and third-tier cities last year, based on a study by the Global Property Guide.

- India share decreased from 60.0% in 2015 to 28.6% in 2018, then rose to 38.5% in H1 2020. According to India Brand Equity Foundation, the real estate sector in India is expected to reach a market size of $1 tn by 2030, from $120 bn in 2017, and contribute 13% to the country GDP by 2025. While early PropTech startups in India focused on providing digital marketplaces for residential and commercial properties, more recent startups are offering more advanced features, like real estate market data services, as the rise in real estate transactions is driving the need for organized market information.

- Indonesia occupied 10.6% of the total share of Asian PropTech deals in 2019 and 7.7% of the total share in H1 2020. As the country economy grew and poverty rate declined, property portals like Rumah.com and Lamudi increased in prominence. Recently, however, greater exposure to the global market has given rise to PropTech companies providing more advanced functions such as but not limited to co-working space and real estate investment platforms. Despite this, Indonesia economic growth is slowing down, and this may have an adverse effect on the demand for its residential properties and the health of its PropTech companies.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global.??2020 FinTech Global